0309 NYS ST 809 Tax Ny Form

What is the NYS ST 809 Form?

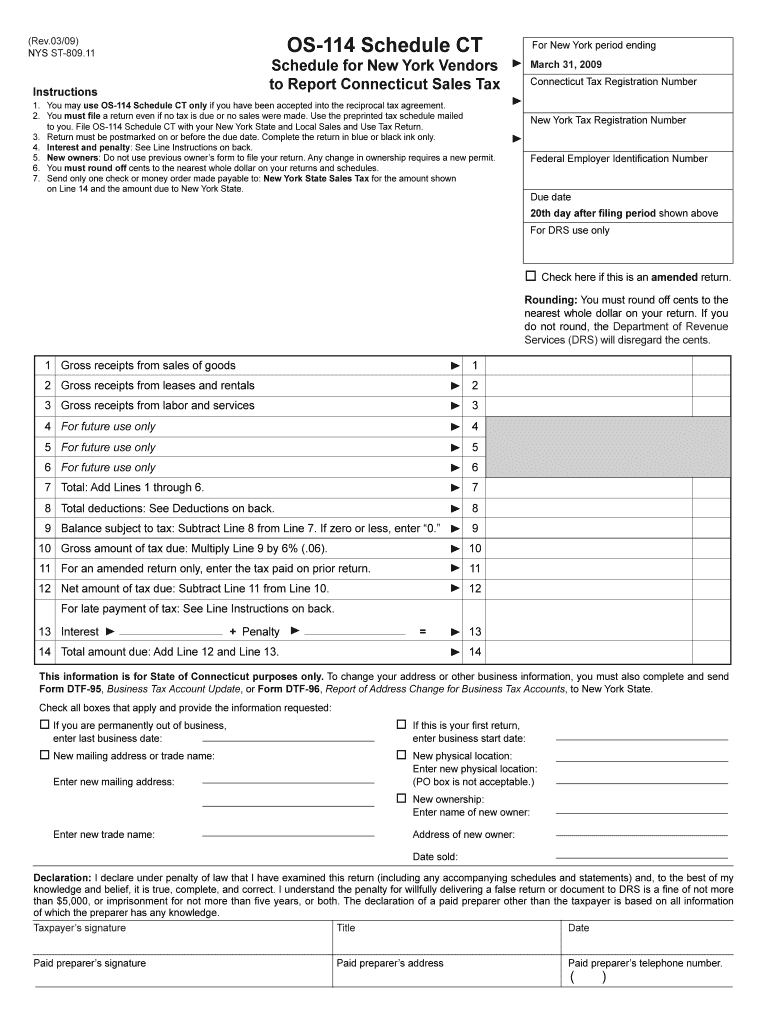

The NYS ST 809 form, also known as the 809 form, is a tax document used in New York State. It is primarily utilized for claiming an exemption from sales and use tax for certain purchases. This form is essential for businesses and individuals who qualify for tax exemptions under specific conditions, such as purchases for resale or items used in manufacturing. Understanding the purpose of the ST 809 form is crucial for ensuring compliance with New York tax regulations.

Steps to Complete the NYS ST 809 Form

Completing the NYS ST 809 form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Begin by providing your name and address at the top of the form.

- Indicate the type of exemption you are claiming by checking the appropriate box.

- Include the seller's information, including their name and address.

- Clearly describe the items being purchased and their intended use.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the NYS ST 809 Form

The NYS ST 809 form is legally binding when filled out correctly and used in accordance with New York State tax laws. It serves as proof of exemption from sales tax for qualifying purchases. To ensure its legal validity, the form must be completed in full, signed by the purchaser, and provided to the seller at the time of the transaction. Failure to adhere to these guidelines may result in penalties or denial of the exemption.

Filing Deadlines and Important Dates

While the NYS ST 809 form itself does not have a specific filing deadline, it is essential to present it at the time of purchase to avoid sales tax charges. Businesses should be aware of any changes in tax regulations or deadlines that may affect their eligibility for exemptions. Keeping updated with the New York State Department of Taxation and Finance will help ensure compliance.

Required Documents for the NYS ST 809 Form

When completing the NYS ST 809 form, certain documents may be required to substantiate your claim for exemption. These may include:

- Proof of business registration, such as a sales tax certificate.

- Invoices or receipts for the items being purchased.

- Any additional documentation that supports the claim for exemption.

Examples of Using the NYS ST 809 Form

The NYS ST 809 form can be used in various scenarios. Common examples include:

- A retailer purchasing inventory for resale.

- A manufacturer acquiring materials used in the production process.

- A nonprofit organization buying supplies for exempt purposes.

Each of these examples illustrates how the form facilitates tax-exempt purchases under New York law.

Quick guide on how to complete st 809

Complete st 809 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can retrieve the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage 809 form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest method to edit and eSign fill in st 809 seamlessly

- Obtain ny st 809 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign nys st 809 and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs st 809 vs st 810

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Related searches to 809 form

Create this form in 5 minutes!

How to create an eSignature for the fill in st 809

How to generate an eSignature for the 0309 Nys St 809 Tax Ny in the online mode

How to make an eSignature for the 0309 Nys St 809 Tax Ny in Chrome

How to generate an eSignature for putting it on the 0309 Nys St 809 Tax Ny in Gmail

How to make an eSignature for the 0309 Nys St 809 Tax Ny right from your smart phone

How to create an eSignature for the 0309 Nys St 809 Tax Ny on iOS

How to make an electronic signature for the 0309 Nys St 809 Tax Ny on Android devices

People also ask nys st 809

-

What is the 809 form, and how can airSlate SignNow help with it?

The 809 form is a specific document that often requires signatures in business processes. With airSlate SignNow, you can easily upload, send, and eSign your 809 form, streamlining the workflow and ensuring that all parties can sign digitally, saving time and resources.

-

Are there any costs associated with using airSlate SignNow for the 809 form?

airSlate SignNow offers various pricing plans to fit different business needs when working with documents like the 809 form. You can choose from monthly subscriptions to annual plans that provide cost-effective solutions while ensuring you can manage your 809 form efficiently.

-

What features does airSlate SignNow offer for managing the 809 form?

With airSlate SignNow, you can customize your 809 form, set automated reminders, and track the signing process in real-time. The platform's user-friendly interface simplifies document management, making it easy to handle the 809 form from start to finish.

-

Can I integrate airSlate SignNow with other tools while using the 809 form?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to connect your preferred tools while managing the 809 form. This means you can easily sync data and documents across platforms, enhancing your workflow.

-

Is it secure to send and eSign the 809 form with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that your 809 form and all documents are protected throughout the signing process. Your data privacy is a top priority at airSlate SignNow.

-

What are the benefits of using airSlate SignNow for my 809 form?

Using airSlate SignNow for your 809 form provides numerous benefits, including faster processing times and improved accuracy. The platform minimizes the chances of errors and delays, ultimately enhancing your business operations and client satisfaction.

-

Can multiple users collaborate on the 809 form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 809 form, making it easy for teams to add signatures and comments. This collaborative feature ensures that all necessary input is captured efficiently, leading to a smooth signing process.

Get more for st 809

Find out other st 809 fill in form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT