New York it 2663 Fillable Form

What is the New York IT-2663 Fillable Form

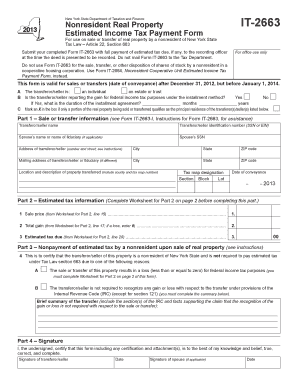

The New York IT-2663 form, also known as the Nonresident Real Property Estimated Income Tax Payment Form, is a tax document used by nonresidents who sell real property in New York State. This form is essential for ensuring that the appropriate income taxes are paid on gains from the sale of real estate. By completing the IT-2663, individuals can report their estimated tax liability and make necessary payments to the state, thereby complying with New York tax laws.

How to Use the New York IT-2663 Fillable Form

Using the New York IT-2663 fillable form involves several straightforward steps. First, you need to gather relevant information about the property being sold, including the sale price and any associated costs. Next, fill out the form with your personal details and the specifics of the transaction. It is important to calculate your estimated tax liability accurately, as this will determine the amount you need to pay. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to Complete the New York IT-2663 Fillable Form

Completing the New York IT-2663 form requires attention to detail. Follow these steps for accuracy:

- Gather necessary documents, including the property deed and sales contract.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Provide details about the property, including its location and sales price.

- Calculate your estimated tax liability based on the sale price and any deductions.

- Sign and date the form to certify its accuracy.

Legal Use of the New York IT-2663 Fillable Form

The New York IT-2663 form is legally binding when filled out correctly and submitted on time. It serves as a declaration of your estimated tax obligations to the state of New York. To ensure its legal validity, it is crucial to comply with all instructions and provide accurate information. The form must be submitted by the required deadlines to avoid penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely submission of the New York IT-2663 form is critical. The form is typically due on or before the date of the property sale. It is advisable to check the New York State Department of Taxation and Finance website for specific deadlines, as these can vary based on the tax year and any changes in legislation. Missing the deadline may result in penalties, so planning ahead is essential.

Who Issues the Form

The New York IT-2663 form is issued by the New York State Department of Taxation and Finance. This government agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for individuals completing the form, helping to clarify any questions regarding the filing process.

Quick guide on how to complete new york it 2663 fillable form

Effortlessly Prepare New York It 2663 Fillable Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage New York It 2663 Fillable Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused task today.

How to Modify and Electronically Sign New York It 2663 Fillable Form with Ease

- Find New York It 2663 Fillable Form and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow has designed for this purpose.

- Create your electronic signature with the Sign function, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your updates.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign New York It 2663 Fillable Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york it 2663 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 2663 form 2024?

The IT 2663 form 2024 is a document used for tax purposes, specifically related to the New York State estimated tax payments. It is crucial for individuals and businesses to understand its requirements and deadlines to avoid penalties. Utilizing airSlate SignNow can streamline the process of completing and submitting your IT 2663 form 2024 efficiently.

-

How can airSlate SignNow help with the IT 2663 form 2024?

airSlate SignNow provides a user-friendly platform for creating, signing, and managing the IT 2663 form 2024. With its easy eSignature functionality, you can complete required fields and get required signatures securely and quickly. This ensures you meet tax deadlines without stress.

-

What features does airSlate SignNow offer for the IT 2663 form 2024?

Key features of airSlate SignNow for handling the IT 2663 form 2024 include a customizable document editor, eSignature capabilities, and secure cloud storage. These features enhance your document management process by allowing real-time collaboration and ensuring your files are both accessible and secure.

-

Is there a cost associated with using airSlate SignNow for the IT 2663 form 2024?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, including free trials and premium subscriptions. The investment provides signNow value, streamlining your document workflow while ensuring compliance with requirements for the IT 2663 form 2024.

-

Can I integrate airSlate SignNow with other tools for the IT 2663 form 2024?

Absolutely! airSlate SignNow seamlessly integrates with various productivity and business applications, such as Google Drive and Dropbox. This integration allows you to access and manage all your documents related to the IT 2663 form 2024 in one central location.

-

What are the benefits of using airSlate SignNow for the IT 2663 form 2024?

Using airSlate SignNow for the IT 2663 form 2024 offers benefits such as time savings, enhanced accuracy, and improved workflow efficiency. You can avoid manual errors associated with paper documents and ensure that your submissions are completed swiftly and securely.

-

Is airSlate SignNow secure for submitting the IT 2663 form 2024?

Yes, airSlate SignNow prioritizes the security of your documents. With advanced encryption and strict compliance with data protection regulations, you can trust that your IT 2663 form 2024 is safe from unauthorized access or bsignNowes.

Get more for New York It 2663 Fillable Form

Find out other New York It 2663 Fillable Form

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form