CT 1041 , Connecticut Income Tax Return for Trusts and Estates Form

What is the CT 1041, Connecticut Income Tax Return For Trusts And Estates

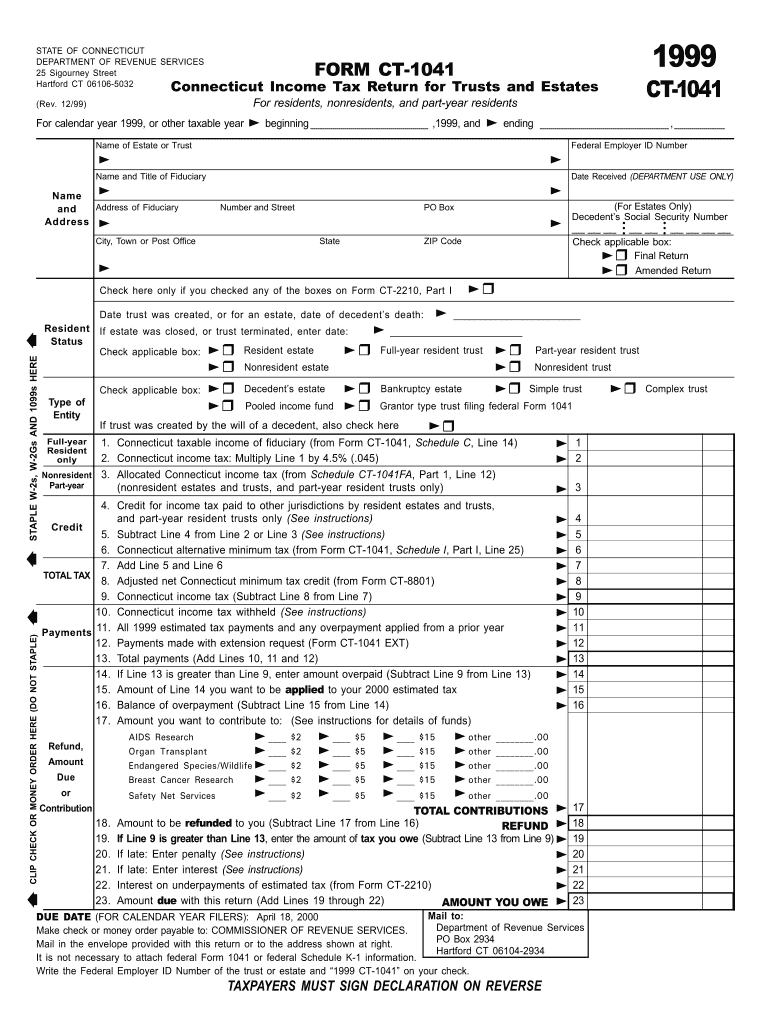

The CT 1041 is a tax form specifically designed for trusts and estates in Connecticut. It serves as the official income tax return that these entities must file with the state. The form is essential for reporting income, deductions, and credits associated with the trust or estate. It ensures compliance with Connecticut tax laws and helps determine the tax liability of the trust or estate, allowing for accurate financial reporting.

Steps to complete the CT 1041, Connecticut Income Tax Return For Trusts And Estates

Completing the CT 1041 involves several key steps:

- Gather necessary financial documents, including income statements and expense records for the trust or estate.

- Fill out the form accurately, ensuring all income sources and deductions are reported.

- Calculate the total tax liability based on the provided information.

- Review the completed form for accuracy and completeness.

- Sign and date the form, ensuring that all required signatures are obtained.

Form Submission Methods (Online / Mail / In-Person)

The CT 1041 can be submitted through various methods, providing flexibility for filers:

- Mail: Print and send the completed form to the appropriate state tax office address.

- Online: Use the Connecticut Department of Revenue Services' e-filing system for electronic submission.

- In-Person: Deliver the form directly to a local tax office if preferred.

Filing Deadlines / Important Dates

Timely filing of the CT 1041 is crucial to avoid penalties. The typical deadline for submitting the form is the fifteenth day of the fourth month following the end of the tax year. For most trusts and estates, this aligns with the April tax deadline. It is important to stay informed about any changes to deadlines that may occur due to state regulations or other factors.

Required Documents

When preparing to file the CT 1041, certain documents are essential:

- Income statements for the trust or estate, including interest, dividends, and capital gains.

- Records of expenses that can be deducted, such as administrative costs and legal fees.

- Previous year’s tax return for reference, if applicable.

Legal use of the CT 1041, Connecticut Income Tax Return For Trusts And Estates

The CT 1041 is legally binding when completed and submitted according to state regulations. It must be signed by the fiduciary of the trust or the executor of the estate. Compliance with the legal requirements ensures that the information provided is accurate and can be used in legal proceedings if necessary. Filing this form correctly protects the interests of beneficiaries and maintains transparency in financial reporting.

Quick guide on how to complete where do i mail ct 1041

Complete where do i mail ct 1041 easily on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage where do i mail ct 1041 on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign where do i mail ct 1041 effortlessly

- Locate where do i mail ct 1041 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign where do i mail ct 1041 and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs where do i mail ct 1041

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How much do tax firms charge to file form 8, 11, and income tax return for an early stage LLP?

My Principal charged Rs 5000/- for the same but it depends on turnover of the LLP and status of tax firms. Where the turnover of LLP was 22,00,000/- and audit firm is mediocre firm.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Related searches to where do i mail ct 1041

Create this form in 5 minutes!

How to create an eSignature for the where do i mail ct 1041

How to create an electronic signature for your Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates in the online mode

How to create an electronic signature for your Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates in Chrome

How to generate an electronic signature for putting it on the Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates in Gmail

How to make an eSignature for the Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates straight from your mobile device

How to create an eSignature for the Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates on iOS

How to generate an eSignature for the Ct 1041 1999 Connecticut Income Tax Return For Trusts And Estates on Android devices

People also ask where do i mail ct 1041

-

Where do I mail CT 1041 forms after completing them?

Once you have filled out your CT 1041 forms, you can mail them to the Connecticut Department of Revenue Services at the address specified in the form instructions. It's essential to ensure that you've signed the forms before mailing them. Properly completing this step will help avoid delays or issues with your filing.

-

What features does airSlate SignNow offer for submitting CT 1041 forms?

airSlate SignNow provides easy document creation and eSigning functionalities. You can fill out your CT 1041 forms digitally, ensuring accuracy and efficiency. After completing the paperwork, the platform allows you to securely send and store your documents, making it easier to mail your CT 1041 forms.

-

Is there a cost associated with using airSlate SignNow to process CT 1041 forms?

Yes, there is a nominal fee for using airSlate SignNow, offering various pricing plans to meet different business needs. The cost is well worth the time saved in preparing and sending your CT 1041 forms. You can choose a plan that fits your budget and requirements.

-

How can airSlate SignNow improve my workflow when mailing CT 1041 forms?

Using airSlate SignNow streamlines your document handling process, allowing you to automate repetitive tasks. This efficiency means you can complete and eSign your CT 1041 forms more quickly, reducing the time spent on paperwork. With its user-friendly interface, you'll find it easier to manage your documents before mailing.

-

What benefits does eSigning provide for my CT 1041 forms?

eSigning your CT 1041 forms using airSlate SignNow provides an extra layer of security and convenience. It ensures that your signatures are legally binding while reducing the risk of errors or missed signatures. Additionally, eSigning allows you to complete your forms faster and track their status easily.

-

Can I integrate airSlate SignNow with other platforms while processing CT 1041 forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms. This feature can enhance your ability to manage and send your CT 1041 forms while maintaining a cohesive workflow across your business operations.

-

How do I ensure that my CT 1041 forms are filed correctly?

To ensure your CT 1041 forms are filed correctly, double-check all information for accuracy before mailing. Utilizing airSlate SignNow allows you to review your forms digitally, minimizing the chance of errors. Always refer to the instruction booklet provided by the Connecticut Department of Revenue Services to verify compliance.

Get more for where do i mail ct 1041

Find out other where do i mail ct 1041

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online

- How To Fax Sign PDF