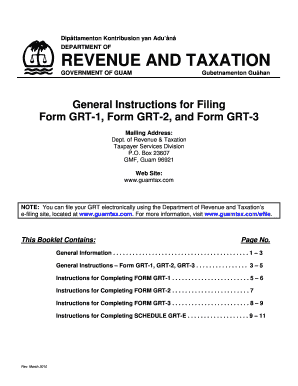

Guam Grt Instructions Form

What are the Guam GRT Instructions?

The Guam Gross Receipts Tax (GRT) Instructions provide guidance for businesses and individuals on how to correctly file the GRT form. This form is essential for reporting gross receipts generated from business activities in Guam. It outlines the necessary steps, required information, and compliance requirements to ensure accurate reporting and payment of taxes owed. Understanding these instructions is crucial for maintaining compliance with local tax laws and avoiding penalties.

Steps to Complete the Guam GRT Instructions

Completing the Guam GRT Instructions involves several key steps:

- Gather necessary documentation, such as sales records and previous tax filings.

- Access the appropriate GRT form, ensuring it is the current version.

- Follow the instructions carefully, filling out each section with accurate information.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the Guam GRT Instructions

The Guam GRT Instructions are legally binding documents that outline the obligations of taxpayers in Guam. Compliance with these instructions ensures that businesses fulfill their tax responsibilities, which is essential for legal operation within the territory. Failure to adhere to these guidelines can result in penalties, including fines or legal action by the Guam Department of Revenue and Taxation.

Required Documents for Guam GRT Filing

When preparing to file the Guam GRT form, several documents are typically required:

- Sales records detailing gross receipts.

- Previous GRT filings for reference.

- Any supporting documentation that validates reported income.

- Identification information for the business entity.

Form Submission Methods

The Guam GRT form can be submitted through various methods, providing flexibility for taxpayers:

- Online submission via the Guam Department of Revenue and Taxation's website.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated government offices, if applicable.

Penalties for Non-Compliance

Non-compliance with the Guam GRT Instructions can lead to significant penalties. Common consequences include:

- Fines based on the amount of tax owed.

- Interest on late payments, accruing over time.

- Potential legal action for continued non-compliance.

Eligibility Criteria for Filing Guam GRT

Eligibility to file the Guam GRT form generally includes:

- Businesses operating within Guam that generate gross receipts.

- Individuals engaged in activities that require GRT reporting.

- Entities registered with the Guam Department of Revenue and Taxation.

Quick guide on how to complete guam grt instructions

Organize Guam Grt Instructions effortlessly on any device

Web-based document management has become a favorite among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Guam Grt Instructions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Guam Grt Instructions with ease

- Locate Guam Grt Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Guam Grt Instructions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the guam grt instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of using airSlate SignNow for businesses in GRT Guam?

The pricing for airSlate SignNow in GRT Guam is designed to be cost-effective and offers various plans to suit different business needs. You can choose from monthly or annual subscriptions, allowing for flexibility as your business grows. signNow out to our sales team for a tailored quote that fits your specific requirements.

-

What features does airSlate SignNow offer that are beneficial for users in GRT Guam?

airSlate SignNow provides a range of features that cater to businesses in GRT Guam, including eSigning, document templates, and automated workflows. These tools help streamline the document signing process, making it faster and more efficient for teams. Additionally, the platform is user-friendly, ensuring that your team can easily adopt it.

-

How can airSlate SignNow help improve my document workflow in GRT Guam?

By utilizing airSlate SignNow, businesses in GRT Guam can signNowly improve their document workflow through automation. The platform allows for real-time tracking of document statuses, collaboration capabilities, and reduces the turnaround time for getting signatures. These enhancements lead to increased productivity and streamlined operations.

-

What industries in GRT Guam can benefit from using airSlate SignNow?

AirSlate SignNow is versatile and can benefit a wide range of industries in GRT Guam, including education, healthcare, and real estate. Whether you require contracts, agreements, or consent forms, our solution adapts to various use cases. This makes it an ideal choice for any business looking to enhance its document management.

-

Is there a free trial available for airSlate SignNow for users in GRT Guam?

Yes, airSlate SignNow offers a free trial for all potential users in GRT Guam. This allows businesses to explore the platform’s features and functionalities before committing to a paid plan. The trial period helps you assess how well the solution meets your needs.

-

Can airSlate SignNow integrate with other software commonly used in GRT Guam?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of software applications widely used in GRT Guam, including CRM systems, project management tools, and cloud storage solutions. This compatibility enhances the overall functionality and allows for a more efficient document management process.

-

What are the security measures in place for airSlate SignNow users in GRT Guam?

Security is a top priority for airSlate SignNow, especially for businesses in GRT Guam. The platform employs industry-standard encryption and compliance with regulations such as GDPR and HIPAA, ensuring that your documents are safe and secure. Regular audits and updates are conducted to maintain high security standards.

Get more for Guam Grt Instructions

Find out other Guam Grt Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors