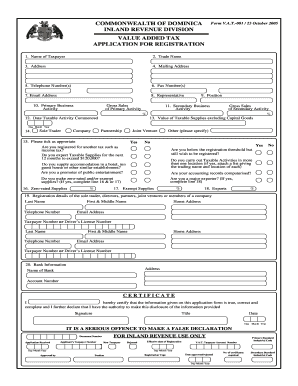

COMMONWEALTH of DOMINICA Form VAT 001 25 October Ird Gov 2005-2026

Understanding the VAT 001 Form

The VAT 001 form is an essential document used for Value Added Tax (VAT) purposes in the Commonwealth of Dominica. This form is primarily utilized by businesses to report their VAT liabilities and entitlements. It helps ensure compliance with local tax regulations, allowing businesses to accurately declare their VAT obligations to the government.

Steps to Complete the VAT 001 Form

Filling out the VAT 001 form requires careful attention to detail. Here are the steps to follow:

- Begin by gathering all necessary financial documents, including sales invoices and purchase receipts.

- Accurately calculate the total VAT collected from sales and the total VAT paid on purchases.

- Complete the form by entering the collected and paid VAT amounts in the designated fields.

- Review the information for accuracy to avoid any discrepancies.

- Sign and date the form to validate your submission.

Legal Use of the VAT 001 Form

The VAT 001 form holds legal significance as it serves as an official record of VAT transactions. To ensure its validity, the form must be completed in accordance with the regulations set forth by the tax authorities. Accurate completion of this form is crucial, as it can be subject to audits and reviews by tax officials.

How to Obtain the VAT 001 Form

The VAT 001 form can be obtained through several channels. Businesses can download it directly from the official government website or request a physical copy from local tax offices. It is advisable to ensure that you are using the most current version of the form to meet compliance requirements.

Filing Deadlines and Important Dates

Timely submission of the VAT 001 form is critical to avoid penalties. Businesses should be aware of the specific deadlines set by the tax authorities for filing this form. Typically, the VAT returns are due quarterly or annually, depending on the business's VAT registration status.

Penalties for Non-Compliance

Failure to submit the VAT 001 form on time or inaccuracies in the information provided can lead to significant penalties. These may include fines, interest on unpaid VAT, and potential legal action. It is essential for businesses to prioritize compliance to avoid these repercussions.

Quick guide on how to complete commonwealth of dominica form vat 001 25 october ird gov

Effortlessly Prepare COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov on any device utilizing airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov effortlessly

- Find COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov to guarantee remarkable communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commonwealth of dominica form vat 001 25 october ird gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT 001 form and why is it important?

The VAT 001 form is a crucial document for businesses that need to report value-added tax. This form ensures compliance with tax regulations and facilitates accurate tax filing. By using the VAT 001 form, businesses can avoid penalties and streamline their tax processes.

-

How can airSlate SignNow help with the VAT 001 form?

airSlate SignNow provides a simple platform to create, send, and eSign the VAT 001 form effortlessly. This ensures that your documents are legally binding and securely stored. With its user-friendly interface, handling the VAT 001 form becomes a streamlined process for any business.

-

What are the pricing options for using airSlate SignNow for VAT forms?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Each plan provides features designed to assist with documents like the VAT 001 form. You can choose a plan that fits your budget while ensuring compliance and efficiency in your tax documentation.

-

Is it easy to fill out the VAT 001 form using airSlate SignNow?

Yes, filling out the VAT 001 form with airSlate SignNow is remarkably straightforward. The platform allows users to fill in all necessary fields quickly and easily. Additionally, the eSigning feature enables faster approvals, ensuring you meet your tax deadlines without hassle.

-

Can I track the status of my VAT 001 form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your VAT 001 form in real time. You can see when it’s viewed, signed, or completed, giving you peace of mind about your document management and ensuring everything is on schedule.

-

Does airSlate SignNow integrate with other accounting software for managing the VAT 001 form?

Yes, airSlate SignNow offers integrations with popular accounting software that can help manage your VAT 001 form efficiently. By connecting with your preferred tools, you can streamline your workflows and ensure that your VAT filings are accurate and timely.

-

What are the benefits of eSigning the VAT 001 form through airSlate SignNow?

eSigning the VAT 001 form through airSlate SignNow offers several benefits, including increased speed and convenience. You can complete and send the form from anywhere, reducing the time spent on traditional methods. This digital approach enhances security and ensures compliance with legal requirements.

Get more for COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov

- Delivery challan format in pdf

- Ms paint worksheets for grade 3 pdf form

- Quantum mechanics by zettili 2nd edition solution manual pdf download form

- Esayidi application form

- Necedah national wildlife refuge photo contest form photo contest form

- Necedah national wildlife refuge photo contest entry form

- From an individual retirement account ira form

- Fundations alphabet picture chart form

Find out other COMMONWEALTH OF DOMINICA Form VAT 001 25 October Ird Gov

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate