from an INDIVIDUAL RETIREMENT ACCOUNT IRA 2016

What is the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA

The FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA is a tax-advantaged savings account designed to help individuals save for retirement. This account allows for tax-deferred growth of investments, meaning that taxes on earnings are not paid until funds are withdrawn. Contributions to an IRA may be tax-deductible, depending on the individual's income and other factors. The primary goal of this account is to encourage long-term savings for retirement, providing individuals with a secure financial future.

How to use the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA

Using the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA involves several key steps. First, individuals must open an IRA with a financial institution that offers this type of account. Once the account is established, contributions can be made, typically up to a specified annual limit. Funds within the IRA can be invested in various assets, such as stocks, bonds, or mutual funds. Withdrawals can be made after reaching retirement age, although early withdrawals may incur penalties. Understanding the rules regarding contributions, withdrawals, and tax implications is essential for effective use of the account.

Steps to complete the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA

Completing the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA involves a straightforward process:

- Choose a financial institution that offers IRAs.

- Fill out the application form to open the IRA account.

- Provide necessary identification and financial information.

- Make an initial contribution to fund the account.

- Select investment options based on personal financial goals.

Once these steps are completed, individuals can manage their investments and monitor account performance over time.

IRS Guidelines

The IRS provides specific guidelines regarding the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA. These guidelines outline contribution limits, eligibility criteria, and rules for withdrawals. For example, individuals under age fifty can contribute up to six thousand dollars annually, while those fifty and older may contribute an additional one thousand dollars as a catch-up contribution. It is crucial to adhere to these guidelines to avoid penalties and ensure the account remains in good standing.

Required Documents

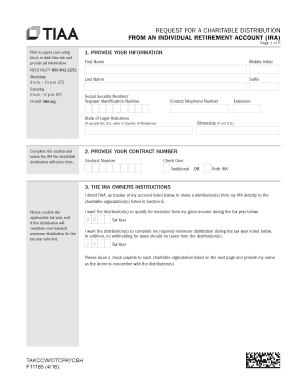

To open a FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA, certain documents are typically required. These may include:

- Identification, such as a driver's license or passport.

- Social Security number.

- Proof of income or employment.

- Completed application form from the financial institution.

Having these documents ready can streamline the account opening process and help ensure compliance with regulatory requirements.

Eligibility Criteria

Eligibility to contribute to the FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA generally depends on several factors, including income level and tax filing status. Individuals must have earned income to contribute to an IRA, and there are income limits that may affect the deductibility of contributions. Additionally, individuals must be under the age of seventy and a half to make contributions. Understanding these criteria is essential for effective retirement planning.

Quick guide on how to complete from an individual retirement account ira

Effortlessly prepare FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Handle FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA on any device using airSlate SignNow’s Android or iOS applications and enhance your document-related processes today.

How to edit and eSign FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA with ease

- Obtain FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your alterations.

- Choose your preferred way to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA and ensure exceptional communication throughout the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct from an individual retirement account ira

Create this form in 5 minutes!

How to create an eSignature for the from an individual retirement account ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Individual Retirement Account (IRA) and how does it work?

An Individual Retirement Account (IRA) is a tax-advantaged investment account designed to help individuals save for retirement. Contributions to an IRA can grow tax-deferred until withdrawal, providing a strategic way to build retirement savings. Understanding how to manage funds FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA is crucial for maximizing your retirement benefits.

-

What are the benefits of using airSlate SignNow for IRA-related documents?

Using airSlate SignNow for documents related to your Individual Retirement Account (IRA) streamlines the signing process, making it faster and more efficient. The platform offers secure eSigning, ensuring that your sensitive information is protected. Additionally, it simplifies document management, allowing you to focus on your retirement planning rather than paperwork.

-

How does airSlate SignNow ensure the security of my IRA documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your documents related to your Individual Retirement Account (IRA). This ensures that your sensitive information remains confidential and secure throughout the signing process. Trusting airSlate SignNow means you can confidently manage your IRA documentation.

-

What features does airSlate SignNow offer for managing IRA documents?

airSlate SignNow provides a range of features tailored for managing documents related to your Individual Retirement Account (IRA), including customizable templates, automated workflows, and real-time tracking. These features enhance efficiency and ensure that all necessary steps are completed for your IRA documentation. This makes it easier to stay organized and compliant.

-

Is there a cost associated with using airSlate SignNow for IRA documents?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for managing your Individual Retirement Account (IRA) documents. Pricing plans vary based on features and usage, allowing you to choose an option that fits your needs. Investing in airSlate SignNow can save you time and resources in the long run.

-

Can I integrate airSlate SignNow with other financial tools for my IRA?

Absolutely! airSlate SignNow offers integrations with various financial tools and platforms, making it easier to manage your Individual Retirement Account (IRA) alongside other financial services. This seamless integration enhances your workflow and ensures that all your financial documentation is in one place, simplifying your retirement planning.

-

How can airSlate SignNow help with compliance for IRA documents?

airSlate SignNow helps ensure compliance for your Individual Retirement Account (IRA) documents by providing features that adhere to legal standards and regulations. The platform maintains an audit trail for all signed documents, which is essential for compliance purposes. This allows you to manage your IRA documentation confidently and in accordance with the law.

Get more for FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA

Find out other FROM AN INDIVIDUAL RETIREMENT ACCOUNT IRA

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement