4506a Form

What is the 4506a

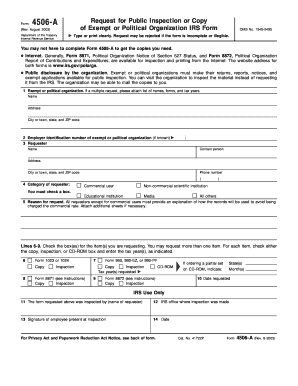

The 4506a form, officially known as the "Request for Transcript of Tax Return," is a document used by taxpayers to request a copy of their tax return information from the Internal Revenue Service (IRS). This form is particularly useful for individuals and businesses that need to verify their tax history for various purposes, such as applying for loans or financial aid. The 4506a allows taxpayers to obtain transcripts of their tax returns, which can include details about income, deductions, and tax liabilities.

How to use the 4506a

Using the 4506a form involves a straightforward process. First, taxpayers must fill out the form with their personal information, including name, address, and Social Security number. Next, they specify the type of transcript they need and the tax years for which they are requesting information. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the taxpayer's preference. It is essential to ensure that all information is accurate to avoid delays in processing.

Steps to complete the 4506a

Completing the 4506a form requires careful attention to detail. Here are the steps to follow:

- Download the 4506a form from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of transcript you are requesting, such as a tax return transcript or an account transcript.

- Specify the tax years for which you need the transcripts.

- Provide your signature and date at the bottom of the form.

- Submit the completed form to the IRS by mail or electronically, based on your preference.

Legal use of the 4506a

The 4506a form is legally recognized as a valid request for tax information under U.S. tax law. It is essential for taxpayers to understand that the information obtained through this form is confidential and should only be used for legitimate purposes, such as securing loans or verifying income. Misuse of the information obtained can lead to legal repercussions, including fines or other penalties. Therefore, it is crucial to handle the data responsibly and in compliance with applicable laws.

IRS Guidelines

The IRS has established specific guidelines for the use of the 4506a form. Taxpayers must ensure that they are eligible to request the transcripts and that they provide accurate information. The IRS typically processes requests within a few weeks, but processing times may vary based on the volume of requests. It is advisable to check the IRS website for any updates or changes to the guidelines that may affect the completion and submission of the form.

Form Submission Methods

Taxpayers have several options for submitting the 4506a form. The primary methods include:

- By Mail: Complete the form and send it to the appropriate IRS address based on your state of residence.

- Electronically: For those who prefer a quicker method, the form can be submitted electronically through the IRS e-Services platform, provided the taxpayer has registered for access.

Required Documents

When submitting the 4506a form, taxpayers may need to provide additional documentation to verify their identity. This can include a copy of a government-issued ID, such as a driver's license or passport, and any relevant tax documents for the years requested. Ensuring that all required documents are included will help expedite the processing of the request and reduce the likelihood of delays.

Quick guide on how to complete 4506a

Manage 4506a effortlessly on any device

Web-based document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents quickly without delays. Handle 4506a on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 4506a effortlessly

- Locate 4506a and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you want to share your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Wave goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 4506a and guarantee seamless communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506a form and how is it used?

The 4506a form is a request for a transcript of tax return information from the IRS, primarily used by lenders when verifying a borrower's income. It is crucial for ensuring that all financial information is accurate and up to date for mortgage applications and other loan processes.

-

How can airSlate SignNow help with 4506a document management?

airSlate SignNow simplifies the entire process of managing the 4506a form by enabling users to send, sign, and store documents securely. This platform eliminates the hassle of paperwork while ensuring compliance with all necessary regulations, making it a valuable tool for businesses.

-

Is there a cost associated with using airSlate SignNow for 4506a forms?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs. By investing in this cost-effective solution, users can streamline the handling of 4506a forms and other documents, providing great value for comprehensive eSignature services.

-

What features does airSlate SignNow offer for 4506a processing?

AirSlate SignNow offers features like document templates, real-time tracking, and automated workflows specifically designed for handling 4506a forms. These tools enhance efficiency, reduce errors, and save time in the document signing process.

-

Can airSlate SignNow integrate with other software for handling 4506a forms?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems, allowing users to efficiently handle 4506a forms within their existing workflows. This integration enhances productivity and ensures a smooth documentation process.

-

What are the benefits of using airSlate SignNow for 4506a document signing?

Using airSlate SignNow for 4506a documents offers numerous benefits including ease of use, enhanced security, and faster turnaround times. The platform ensures that your signed documents are legally binding and securely stored, giving you peace of mind.

-

How secure is airSlate SignNow when handling 4506a forms?

AirSlate SignNow employs advanced security measures including encryption and secure data storage to protect your sensitive information, such as 4506a forms. This ensures that all transactions are handled with the utmost care and privacy.

Get more for 4506a

- Wwwirsgovforms pubsabout form 8879 cabout form 8879 c irs e file signature authorization for

- 2021 form 5498 ira contribution information

- Updated internal revenue service irs contact information

- 2020 schedule a form 940 irs tax formsabout schedule a form 940 multi state employer and futa credit reductioninternal revenue

- 2021 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

- Fillable online rental form northeast passage fax email

- 2021 form 8853 archer msas and long term care insurance contracts

- Schedule d schedule dform 1120 department of the

Find out other 4506a

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT