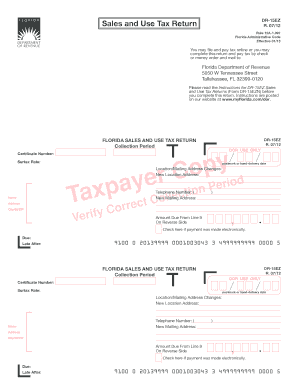

Sales and Use Tax Return Fl Form

What is the Sales And Use Tax Return Fl Form

The Sales And Use Tax Return Fl Form is a crucial document used by businesses and individuals in Florida to report sales and use tax liabilities. This form is designed to ensure compliance with state tax laws. It captures essential information about taxable sales, exempt sales, and the total amount of tax due. Understanding this form is vital for accurate tax reporting and avoiding potential penalties.

How to use the Sales And Use Tax Return Fl Form

Using the Sales And Use Tax Return Fl Form involves several steps to ensure accurate completion. First, gather all necessary financial records, including sales receipts and invoices. Next, accurately fill out the form by entering your business details, total sales, and applicable tax rates. It is important to review the form for accuracy before submission. Once completed, the form can be submitted online, by mail, or in person, depending on your preference.

Steps to complete the Sales And Use Tax Return Fl Form

Completing the Sales And Use Tax Return Fl Form requires careful attention to detail. Follow these steps:

- Gather all relevant sales data for the reporting period.

- Fill in your business information, including name and address.

- Report total sales, including taxable and exempt sales.

- Calculate the total tax due based on applicable rates.

- Review the completed form for any errors or omissions.

- Submit the form by your chosen method: online, by mail, or in person.

Legal use of the Sales And Use Tax Return Fl Form

The legal use of the Sales And Use Tax Return Fl Form is governed by Florida state tax laws. This form must be completed accurately to fulfill legal obligations and avoid penalties. Submitting false information can lead to fines and legal repercussions. It is essential to ensure that all reported figures are truthful and that the form is submitted by the required deadlines to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Sales And Use Tax Return Fl Form vary based on the reporting period. Typically, forms are due on the first day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form is due by February first. Staying aware of these deadlines is crucial to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Sales And Use Tax Return Fl Form can be submitted through various methods to accommodate different preferences. Businesses can choose to file online via the Florida Department of Revenue's website, which offers a streamlined process. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own benefits, so selecting the one that best fits your needs is important.

Quick guide on how to complete sales and use tax return fl form

Prepare Sales And Use Tax Return Fl Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delay. Manage Sales And Use Tax Return Fl Form on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to change and eSign Sales And Use Tax Return Fl Form with ease

- Find Sales And Use Tax Return Fl Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Sales And Use Tax Return Fl Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax return fl form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales And Use Tax Return Fl Form?

The Sales And Use Tax Return Fl Form is a tax form used by businesses in Florida to report and pay sales and use tax. This form is essential for compliance with state tax regulations, ensuring that you accurately report taxable transactions during the reporting period.

-

How can airSlate SignNow help with the Sales And Use Tax Return Fl Form?

airSlate SignNow streamlines the process of completing and submitting the Sales And Use Tax Return Fl Form by allowing users to eSign documents digitally. With our user-friendly interface, businesses can easily prepare their tax documents, ensuring they meet deadlines without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers competitive pricing options that cater to businesses of all sizes, making it cost-effective for managing the Sales And Use Tax Return Fl Form. Our subscription plans provide various features, allowing you to choose a package that best fits your business needs and budget.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow employs advanced security measures to ensure that all documents, including the Sales And Use Tax Return Fl Form, are protected. We utilize encryption and secure cloud storage to keep your sensitive information safe from unauthorized access.

-

Does airSlate SignNow integrate with accounting software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your Sales And Use Tax Return Fl Form alongside other financial documents. This integration enhances workflow efficiency and helps keep your records organized.

-

Can I track the status of my Sales And Use Tax Return Fl Form submission?

Yes, airSlate SignNow provides features that allow you to track the status of your submitted Sales And Use Tax Return Fl Form. You will receive notifications as your document goes through the signing process and confirmation once it has been successfully submitted.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your Sales And Use Tax Return Fl Form offers multiple benefits, including reduced processing time, increased accuracy, and improved compliance with state regulations. Users can complete their forms faster and receive reminders for upcoming deadlines.

Get more for Sales And Use Tax Return Fl Form

Find out other Sales And Use Tax Return Fl Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document