Form 100s

What is the Form 100s

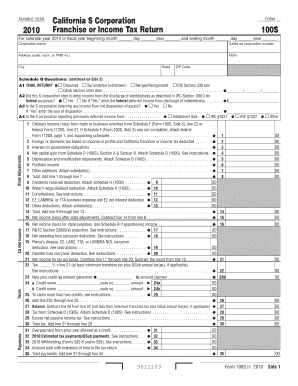

The Form 100s is a specific tax document utilized primarily by businesses in the United States. It is essential for reporting income, deductions, and credits to the Internal Revenue Service (IRS). This form is particularly relevant for corporations that operate in multiple states, as it allows them to report their income accurately and comply with state tax regulations. Understanding the purpose and requirements of the Form 100s is crucial for ensuring compliance and avoiding potential penalties.

How to use the Form 100s

Using the Form 100s involves several key steps. First, businesses must gather all necessary financial information, including income statements, balance sheets, and any relevant deductions. Next, the form must be filled out accurately, ensuring that all sections are completed according to IRS guidelines. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements of the state and the IRS. Utilizing electronic filing methods can streamline the process and reduce the likelihood of errors.

Steps to complete the Form 100s

Completing the Form 100s requires careful attention to detail. Follow these steps for accurate submission:

- Gather financial documents, including income statements and receipts for deductions.

- Fill out the identification section, including the business name, address, and Employer Identification Number (EIN).

- Report total income and calculate any allowable deductions.

- Complete the tax computation section, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 100s

The legal use of the Form 100s is governed by IRS regulations and state tax laws. To ensure the form is legally binding, businesses must comply with all relevant tax laws and filing requirements. This includes submitting the form by the designated deadline and providing accurate information. Failure to comply can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional to ensure that all legal obligations are met.

Filing Deadlines / Important Dates

Filing deadlines for the Form 100s can vary based on the business's tax year and state regulations. Generally, corporations must file their tax returns by the 15th day of the fourth month following the end of their fiscal year. For businesses operating on a calendar year, this typically means the deadline is April 15. It is essential to stay informed about any changes to deadlines and to plan accordingly to avoid late filing penalties.

Required Documents

To complete the Form 100s accurately, several documents are required. These typically include:

- Financial statements, such as income statements and balance sheets.

- Receipts and records for all deductions claimed.

- Previous year’s tax return for reference.

- Any supporting documentation required by state tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Form 100s can be submitted through various methods. Businesses can choose to file electronically, which is often the fastest and most efficient option. Alternatively, forms can be mailed to the appropriate tax authority or submitted in person at designated offices. Each method has its own set of requirements and processing times, so it is important to choose the one that best fits the business's needs.

Quick guide on how to complete form 100s 6112641

Effortlessly Prepare Form 100s on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 100s on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Form 100s with Ease

- Find Form 100s and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that function.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 100s and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 100s 6112641

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are form 100s and how can airSlate SignNow help?

Form 100s are essential documents used for various business processes, and airSlate SignNow simplifies their management. With our platform, you can easily create, send, and eSign form 100s, ensuring a seamless workflow. This saves time and reduces errors, making it an ideal solution for businesses of all sizes.

-

How much does airSlate SignNow cost for managing form 100s?

airSlate SignNow offers a range of pricing plans designed to fit different budgets and needs. Our plans allow businesses to efficiently manage form 100s without breaking the bank, with features scaling according to your requirements. You can start with a free trial to see how it works for your team before committing.

-

What features does airSlate SignNow offer for form 100s?

Our platform provides a variety of features for managing form 100s, including customizable templates, easy eSigning, and document tracking. Additional options allow for team collaboration and automated workflows, making it easier to handle form 100s efficiently. All these features contribute to increased productivity and streamlined processes.

-

Can I integrate airSlate SignNow with other tools for form 100s?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage form 100s. Integration options include popular services like Google Drive, Salesforce, and Microsoft Office, allowing you to connect your existing workflow. This makes it easier to manage and send form 100s alongside other essential tools.

-

Is airSlate SignNow secure for handling form 100s?

Absolutely! airSlate SignNow prioritizes the security of your documents, including form 100s. We employ advanced encryption, secure cloud storage, and strict compliance with data protection regulations, ensuring that your information remains safe and confidential during the eSigning process.

-

How can I track the status of my form 100s in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your form 100s through our user-friendly dashboard. It provides real-time updates on whether your documents have been sent, viewed, and signed. This transparency helps you manage deadlines and follow up promptly, enhancing your overall efficiency.

-

Can I create custom templates for form 100s?

Yes, airSlate SignNow allows you to create custom templates for your form 100s, streamlining the document creation process. You can personalize templates with logos, predefined fields, and specific formatting to match your branding. This means you spend less time recreating forms and more time focusing on your core business activities.

Get more for Form 100s

- Dss form 2924

- Complies with the virginia form

- Wvha health card form

- Conditional enrollment form for children attending

- If you have a court order for child support please attach proof form

- Fillable online lakewood city of lakewood comprehensive form

- About medical assistance virginia department of social form

- Application checklist for facilities amerihealth caritas vip care plus form

Find out other Form 100s

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free