Form WR, Oregon Annual WH Tax Reconciliation Report, 150 Oregon

What is the Form WR, Oregon Annual WH Tax Reconciliation Report, 150 Oregon

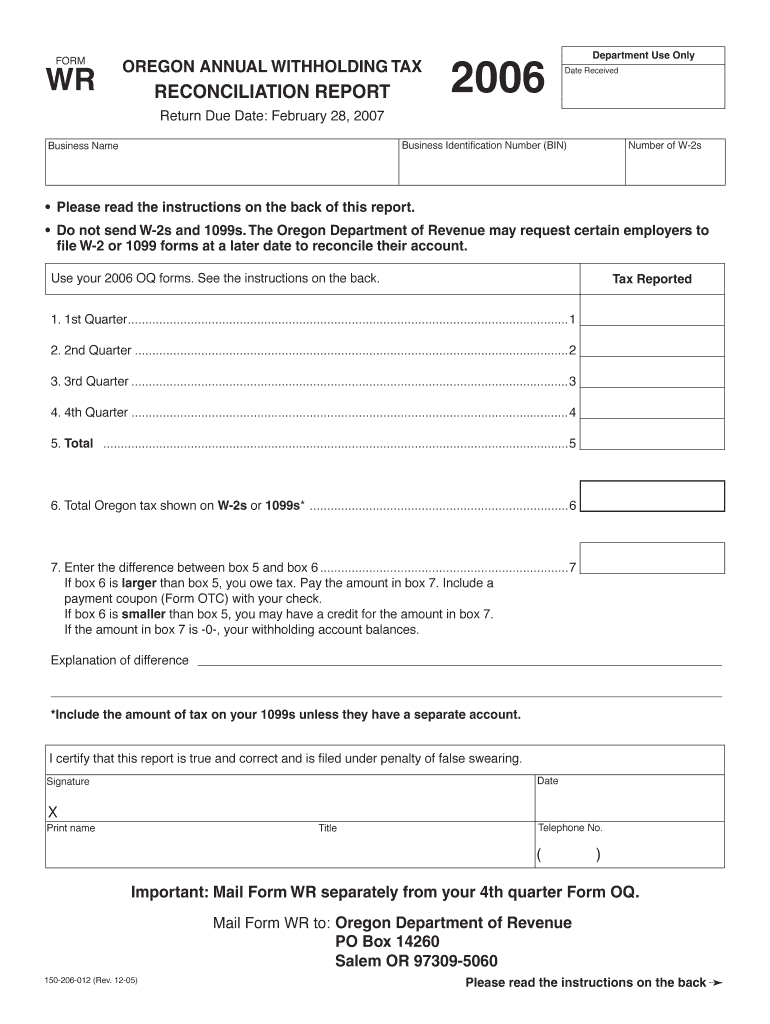

The Form WR, also known as the Oregon Annual WH Tax Reconciliation Report, 150 Oregon, is a crucial document for employers in Oregon. It is used to reconcile the state withholding tax that has been deducted from employee wages throughout the year. This form ensures that employers accurately report the total amount of state income tax withheld and remit any outstanding balances to the Oregon Department of Revenue. Understanding this form is essential for compliance with state tax laws and for maintaining good standing as an employer.

Steps to complete the Form WR, Oregon Annual WH Tax Reconciliation Report, 150 Oregon

Completing the Form WR requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect all payroll records for the year, including total wages paid and state taxes withheld.

- Fill out the form: Enter the total amount of state income tax withheld from employees, as well as the total wages paid.

- Calculate any discrepancies: If there are differences between the amounts reported and what has been paid, make the necessary adjustments.

- Review for accuracy: Double-check all entries to ensure there are no errors before submission.

- Submit the form: File the completed Form WR with the Oregon Department of Revenue by the specified deadline.

Legal use of the Form WR, Oregon Annual WH Tax Reconciliation Report, 150 Oregon

The Form WR is legally binding and must be completed in accordance with Oregon state tax laws. Employers are required to file this form annually, ensuring that all withheld taxes are reported accurately. Failure to comply with these regulations can result in penalties, including fines or interest on unpaid taxes. It is important for employers to understand their legal obligations regarding this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form WR. Typically, the form is due by January 31 of the following year after the tax year ends. It is essential to submit the form on time to avoid late fees and ensure compliance with state regulations. Keeping track of these important dates helps maintain an organized approach to tax reporting.

Form Submission Methods (Online / Mail / In-Person)

The Form WR can be submitted through various methods, providing flexibility for employers. Options include:

- Online submission: Employers can file the form electronically through the Oregon Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via postal service to the appropriate address provided by the Oregon Department of Revenue.

- In-person: Employers may also choose to deliver the form in person at designated tax offices.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form WR can lead to significant penalties. Employers may face fines for late submissions or inaccuracies in reporting. Additionally, interest may accrue on any unpaid taxes, increasing the overall liability. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete form wr

Effortlessly Prepare form wr on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage 150 206 012 on any device using the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The easiest way to edit and eSign form wr effortlessly

- Find form or wr and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign 150 206 012 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form or wr

Create this form in 5 minutes!

How to create an eSignature for the 150 206 012

How to generate an electronic signature for the 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon online

How to generate an eSignature for your 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon in Chrome

How to make an eSignature for signing the 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon in Gmail

How to make an electronic signature for the 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon right from your mobile device

How to make an electronic signature for the 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon on iOS devices

How to create an electronic signature for the 2006 Form Wr Oregon Annual Wh Tax Reconciliation Report 150 Oregon on Android devices

People also ask form or wr

-

What is the primary benefit of using airSlate SignNow for sending forms or wr?

The primary benefit of using airSlate SignNow for sending forms or wr is its user-friendly interface that simplifies the document signing process. Businesses can quickly prepare, send, and eSign documents without any hassle, leading to improved productivity and faster transactions.

-

Are there any pricing plans for airSlate SignNow that cater to small businesses needing form or wr solutions?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses looking for effective form or wr solutions. Our competitive pricing ensures that you only pay for the features you need, making it a cost-effective option for businesses of all sizes.

-

What features does airSlate SignNow offer for creating and managing form or wr?

airSlate SignNow provides an array of features for creating and managing form or wr, including customizable templates, secure eSignatures, and document tracking. These tools enable users to streamline their document workflows effortlessly.

-

Can airSlate SignNow integrate with other applications for enhanced form or wr management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications to enhance form or wr management. You can connect it with popular platforms like Google Drive, Dropbox, and Salesforce for a comprehensive document management solution.

-

Is airSlate SignNow secure for handling sensitive form or wr?

Yes, airSlate SignNow takes security seriously. We implement robust security measures, including encryption and compliance with industry regulations, to ensure that your sensitive form or wr are handled securely and confidentially.

-

How does airSlate SignNow facilitate collaboration on form or wr?

airSlate SignNow facilitates collaboration on form or wr by allowing multiple users to edit and sign documents in real-time. This feature ensures that all stakeholders can contribute to the document, enhancing teamwork and reducing turnaround times.

-

What support options are available for users needing assistance with form or wr on airSlate SignNow?

Users can access various support options for assistance with form or wr on airSlate SignNow, including a comprehensive knowledge base, live chat support, and email assistance. Our dedicated support team is always ready to help you resolve any issues.

Get more for 150 206 012

Find out other form wr

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast