Pdftax Form

What is the Pdftax

The pdftax form is a crucial document used for various tax-related purposes in the United States. It serves as a means for individuals and businesses to report income, claim deductions, and fulfill other tax obligations. Understanding the pdftax form is essential for ensuring compliance with federal tax regulations and for accurately reporting financial information to the Internal Revenue Service (IRS).

How to use the Pdftax

Using the pdftax form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, download the pdftax form from a reliable source. Fill out the form carefully, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it to the IRS either electronically or via mail.

Steps to complete the Pdftax

Completing the pdftax form requires attention to detail. Follow these steps for successful completion:

- Gather all required documents, including W-2s, 1099s, and any relevant tax records.

- Download the pdftax form and open it using compatible software.

- Fill in personal information, including name, address, and Social Security number.

- Report income accurately and claim any deductions or credits applicable to your situation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Pdftax

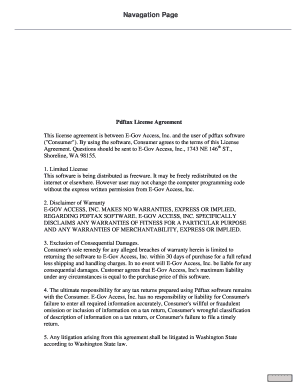

The pdftax form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The use of electronic signatures on the pdftax form is permissible under the ESIGN Act, provided that the signature meets specific legal criteria.

Filing Deadlines / Important Dates

Filing deadlines for the pdftax form vary depending on the type of taxpayer and the specific tax year. Generally, individual taxpayers must file their forms by April 15. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines, as the IRS may adjust them due to various factors, including natural disasters or public health emergencies.

Required Documents

To successfully complete the pdftax form, several documents are typically required. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year's tax return for reference

- Any additional documentation relevant to specific deductions or credits

Quick guide on how to complete pdftax

Easily prepare Pdftax on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Pdftax on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Edit and electronically sign Pdftax effortlessly

- Locate Pdftax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or by downloading it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Pdftax and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdftax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pdftax, and how does it relate to airSlate SignNow?

Pdftax is an innovative solution that streamlines the process of managing tax documents electronically. With airSlate SignNow, you can easily eSign and send your pdftax documents, ensuring a seamless transaction experience for both individuals and businesses.

-

How much does airSlate SignNow cost for pdftax processing?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, including pdftax processing. Whether you are a small business or a large enterprise, you can find a plan that suits your budget and allows for efficient document management.

-

What features does airSlate SignNow offer for pdftax documents?

AirSlate SignNow includes a range of features such as electronic signatures, customizable templates, and secure document storage that enhance your pdftax handling. These features enable users to efficiently manage their tax-related documents while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other tools for managing pdftax?

Yes, airSlate SignNow offers integrations with several popular tools that can help you manage pdftax documents effectively. Whether you use CRM systems, cloud storage, or accounting software, our seamless integrations enhance your workflow and productivity.

-

How does airSlate SignNow improve the pdftax document signing process?

AirSlate SignNow simplifies the pdftax document signing process by providing a user-friendly platform that supports quick and secure electronic signatures. This ensures that your tax documents are signed promptly and without the hassle of printing or mailing.

-

Is airSlate SignNow secure for handling sensitive pdftax information?

Absolutely! AirSlate SignNow prioritizes the security of your pdftax information with robust encryption and continuous data protection. You can be confident that your sensitive tax documents are handled securely throughout the signing process.

-

What are the benefits of using airSlate SignNow for pdftax?

Using airSlate SignNow for pdftax offers numerous benefits, including saving time, reducing paper waste, and enhancing document accuracy. By utilizing our eSigning solution, businesses can streamline their tax document processes and focus on their core activities.

Get more for Pdftax

Find out other Pdftax

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP