City of Philadelphia Deferred Compensation Plan Distribution Form

What is the City of Philadelphia Deferred Compensation Plan Distribution

The City of Philadelphia Deferred Compensation Plan is a retirement savings plan designed for employees of the city. This plan allows participants to defer a portion of their salary into a retirement account, which can grow tax-deferred until withdrawal. The distribution from this plan refers to the process of accessing these funds upon retirement or under specific circumstances, such as financial hardship or separation from service. Understanding the rules and regulations surrounding the distribution is essential for participants to make informed decisions about their retirement funds.

Steps to Complete the City of Philadelphia Deferred Compensation Plan Distribution

Completing the distribution process for the City of Philadelphia Deferred Compensation Plan involves several key steps:

- Review Eligibility: Confirm that you meet the eligibility criteria for distribution, which may include age, years of service, and employment status.

- Gather Required Documents: Collect necessary documentation such as identification, proof of employment, and any forms related to your deferred compensation plan.

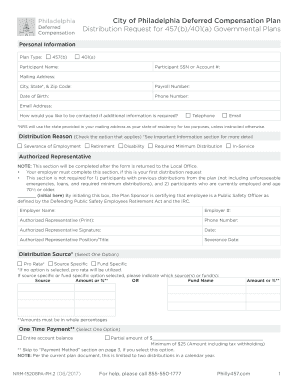

- Complete the Distribution Request Form: Fill out the required distribution request form accurately, ensuring all information is correct.

- Submit Your Request: Send the completed form along with any supporting documents to the appropriate department, either online or via mail.

- Await Confirmation: After submission, wait for confirmation from the plan administrator regarding the status of your distribution request.

Legal Use of the City of Philadelphia Deferred Compensation Plan Distribution

The legal use of the City of Philadelphia Deferred Compensation Plan distribution is governed by federal and state regulations. Participants must adhere to the guidelines set forth by the Internal Revenue Service (IRS) regarding the timing and manner of distributions. This includes understanding tax implications and penalties for early withdrawal. Ensuring compliance with these regulations is crucial to avoid unnecessary financial repercussions and to ensure that distributions are processed smoothly.

Eligibility Criteria for the City of Philadelphia Deferred Compensation Plan Distribution

Eligibility for distribution from the City of Philadelphia Deferred Compensation Plan typically includes factors such as:

- Age: Participants often must reach a certain age, commonly fifty-nine and a half years, to access their funds without penalties.

- Separation from Service: Employees who leave their position, whether through retirement or other means, may qualify for distribution.

- Financial Hardship: In some cases, participants may access their funds earlier if they can demonstrate a significant financial need.

Understanding these criteria helps participants navigate their options effectively and plan for their financial future.

Required Documents for the City of Philadelphia Deferred Compensation Plan Distribution

When requesting a distribution from the City of Philadelphia Deferred Compensation Plan, participants must prepare several key documents:

- Identification: A government-issued ID to verify identity.

- Distribution Request Form: The official form that initiates the distribution process.

- Proof of Employment: Documentation that confirms your employment status with the city.

- Financial Hardship Documentation: If applicable, evidence supporting the claim for early withdrawal due to financial hardship.

Having these documents ready can streamline the distribution process and help ensure compliance with all requirements.

How to Use the City of Philadelphia Deferred Compensation Plan Distribution

Using the City of Philadelphia Deferred Compensation Plan distribution effectively involves understanding how to manage the funds once received. Participants can choose to:

- Reinvest the Funds: Consider investing the distribution into other retirement accounts or investment vehicles to continue growing your savings.

- Withdraw Funds: If immediate cash is needed, participants may withdraw funds, keeping in mind the tax implications and potential penalties.

- Consult a Financial Advisor: Engaging with a financial professional can provide personalized guidance on the best use of distribution funds based on individual circumstances.

Making informed decisions about how to use the distribution can significantly impact long-term financial health.

Quick guide on how to complete city of philadelphia deferred compensation plan distribution

Prepare City Of Philadelphia Deferred Compensation Plan Distribution effortlessly on any gadget

Online document management has become favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, since you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly without delays. Manage City Of Philadelphia Deferred Compensation Plan Distribution on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered task today.

The simplest way to modify and eSign City Of Philadelphia Deferred Compensation Plan Distribution with ease

- Locate City Of Philadelphia Deferred Compensation Plan Distribution and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as an original wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and eSign City Of Philadelphia Deferred Compensation Plan Distribution and ensure excellent communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia deferred compensation plan distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is deferred comp in Philadelphia?

Deferred comp in Philadelphia refers to a retirement savings plan that allows employees to defer a portion of their salary to a later date, often until retirement. This type of plan provides tax advantages and helps individuals save more efficiently for their future.

-

How does airSlate SignNow facilitate deferred comp agreements?

AirSlate SignNow streamlines the process of creating and signing deferred comp agreements in Philadelphia. Our platform allows businesses to easily send, edit, and eSign documents, ensuring that those agreements are securely handled and stored.

-

What are the primary benefits of using airSlate SignNow for deferred comp in Philadelphia?

Using airSlate SignNow for deferred comp in Philadelphia allows businesses to simplify document management, improve workflow efficiency, and reduce paper usage. Additionally, our cost-effective solution helps businesses save time while ensuring compliance and security.

-

Are there any integration options available with airSlate SignNow for deferred comp management?

Yes, airSlate SignNow offers various integration options that can enhance your deferred comp management process in Philadelphia. You can integrate with popular tools like Salesforce, Google Workspace, and others to create a seamless experience for managing documents.

-

What pricing options does airSlate SignNow offer for businesses managing deferred comp in Philadelphia?

AirSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes managing deferred comp in Philadelphia. Our plans are designed to fit different budgets while providing essential features to ensure efficient document signing and management.

-

Is airSlate SignNow user-friendly for employees dealing with deferred comp documents?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for employees in Philadelphia to navigate and handle deferred comp documents. With intuitive interfaces and clear instructions, employees can sign and manage their documents with minimal training.

-

How secure is airSlate SignNow for storing deferred comp documents?

AirSlate SignNow utilizes advanced security measures to ensure your deferred comp documents in Philadelphia are safeguarded. Our platform includes encryption, secure access controls, and regular backups to protect sensitive information and maintain compliance.

Get more for City Of Philadelphia Deferred Compensation Plan Distribution

- 2017msla master securities loan agreement 2017 form

- I hereby consent to evaluation andor treatment of my condition by the licensed physical therapists form

- Nebraska application information veterinary medicine and

- Veterinary technician application dhhs nebraskagov form

- State board of pharmacy 8 00 sw jackson suite 1414 form

- Pharmacy closure notice form

- Pregnant and worried about coronavirus heres what we form

- Advancing your state career calhr state of california form

Find out other City Of Philadelphia Deferred Compensation Plan Distribution

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document