Pp11 Form

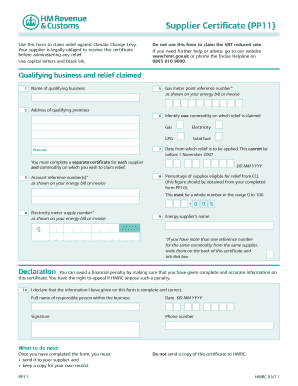

What is the Pp11 Form

The Pp11 form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for individuals or entities to report certain financial details to the relevant authorities. Understanding the purpose and requirements of the Pp11 form is essential for compliance with tax regulations. This form can be crucial for ensuring that all necessary information is accurately recorded and submitted, thereby avoiding potential penalties.

How to use the Pp11 Form

Using the Pp11 form involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal identification details and financial records relevant to the reporting period. Next, carefully fill out each section of the form, ensuring accuracy and completeness. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific guidelines provided by the issuing authority. It is important to retain a copy of the completed form for your records.

Steps to complete the Pp11 Form

Completing the Pp11 form requires attention to detail. Follow these steps:

- Review the form instructions thoroughly to understand the requirements.

- Collect all necessary documents, such as previous tax returns and income statements.

- Fill in your personal information, ensuring accuracy in names, addresses, and identification numbers.

- Provide the required financial information, ensuring that all figures are correct.

- Double-check the form for any errors or omissions before submitting.

Legal use of the Pp11 Form

The Pp11 form is legally binding when completed and submitted according to the guidelines set forth by the relevant authorities. To ensure its legal validity, the form must be filled out accurately, and all necessary signatures must be included. Compliance with applicable laws and regulations, such as the Internal Revenue Code, is essential for the form to be accepted. Additionally, utilizing a reliable electronic signature solution can enhance the legal standing of the submitted document.

Required Documents

When preparing to complete the Pp11 form, certain documents are typically required. These may include:

- Previous tax returns for reference.

- W-2 forms or 1099 statements to report income.

- Receipts or documentation for any deductions claimed.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The Pp11 form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission through the official tax authority website.

- Mailing a physical copy to the designated address.

- In-person submission at local tax offices, if available.

Quick guide on how to complete pp11 form 14933052

Effortlessly Prepare Pp11 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle Pp11 Form on any device with the airSlate SignNow Android or iOS applications and improve your document-centric processes today.

The Easiest Way to Modify and eSign Pp11 Form with Ease

- Obtain Pp11 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Pp11 Form to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pp11 form 14933052

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pp11 form and why is it important?

The pp11 form is a specific document used for various financial and tax reporting purposes. Understanding its importance helps businesses ensure compliance and avoid potential penalties. Properly managing pp11 forms is essential for accurate record-keeping and financial audits.

-

How can airSlate SignNow help with managing pp11 forms?

airSlate SignNow streamlines the process of filling out and signing pp11 forms digitally. With features like templates and automated workflows, it simplifies document management and ensures that your pp11 forms are completed efficiently. This solution saves time and reduces the hassle of paperwork.

-

Is airSlate SignNow cost-effective for managing pp11 forms?

Yes, airSlate SignNow is a cost-effective solution for handling pp11 forms. Its pricing plans are designed to accommodate businesses of all sizes, ensuring that you only pay for the features you need. This affordability helps businesses manage their documents without breaking the bank.

-

What features does airSlate SignNow offer for pp11 form integration?

airSlate SignNow offers robust features for integrating pp11 forms with other platforms. You can easily connect it with popular software like CRMs and document management systems. This integration capability enhances productivity by allowing seamless data flow between applications.

-

Can I customize the pp11 form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their pp11 forms to fit specific business needs. With the drag-and-drop editor, you can easily add fields, change layouts, and incorporate branding elements, ensuring your pp11 forms reflect your company's identity.

-

What security measures does airSlate SignNow provide for pp11 forms?

airSlate SignNow prioritizes the security of your pp11 forms with advanced encryption and compliance with industry standards. All documents are securely stored and transmitted, reducing the risk of unauthorized access. You can trust that your sensitive information is protected.

-

How does airSlate SignNow improve collaboration on pp11 forms?

Collaboration on pp11 forms is made easy with airSlate SignNow's shared access features. Multiple stakeholders can review, comment, and sign the documents in real-time, ensuring everyone stays on the same page. This collaborative approach enhances communication and speeds up the signing process.

Get more for Pp11 Form

- The due date will result in cessation of program payments form

- Il 482 0651 form

- Application for medical staff appointment indian health service ihs form

- Ihcp provider enrollment recertification of licenses and form

- Nj snap interim reporting form

- Ks fcl family form

- Fcl 401 application kansas department for children and families dcf ks form

- Kansas paternity form

Find out other Pp11 Form

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself