Village of Walbridge Tax Form

What is the Village Of Walbridge Tax Form

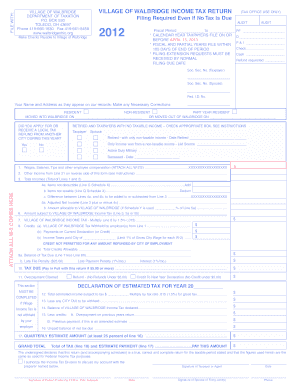

The Village of Walbridge Tax Form is a document used by residents and businesses within the village to report their income and calculate their tax obligations. This form is essential for ensuring compliance with local tax regulations. It typically includes sections for personal information, income details, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose and structure of this form is crucial for accurate completion and submission.

How to obtain the Village Of Walbridge Tax Form

The Village of Walbridge Tax Form can be obtained through several channels. Residents may visit the official village website, where forms are often available for download in PDF format. Additionally, the village office may provide physical copies upon request. It is advisable to check for any updates or changes to the form annually, as tax regulations may evolve.

Steps to complete the Village Of Walbridge Tax Form

Completing the Village of Walbridge Tax Form involves several key steps:

- Gather necessary documents, including income statements, previous tax returns, and any relevant receipts for deductions.

- Fill in personal information, such as your name, address, and Social Security number.

- Report income from all sources, ensuring to include wages, self-employment income, and any other earnings.

- Apply any eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Village Of Walbridge Tax Form

The Village of Walbridge Tax Form serves as a legally binding document once completed and submitted. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. Compliance with local tax laws is essential, and utilizing the form correctly helps maintain transparency with the village's tax authorities.

Form Submission Methods

The Village of Walbridge Tax Form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many municipalities offer an online portal for electronic filing, which is often the fastest method.

- Mail: Completed forms can be mailed to the designated tax office address. Ensure to send it well before the deadline to avoid late penalties.

- In-Person: Residents may also choose to submit the form in person at the village office during business hours.

Filing Deadlines / Important Dates

Filing deadlines for the Village of Walbridge Tax Form typically align with the tax year. It is crucial to be aware of these dates to avoid penalties:

- The annual filing deadline is usually April 15 for individual taxpayers.

- Extensions may be available, but it is important to file for an extension before the original deadline.

Quick guide on how to complete village of walbridge tax form

Finalize Village Of Walbridge Tax Form effortlessly across any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to produce, modify, and electronically sign your documents swiftly without delays. Handle Village Of Walbridge Tax Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign Village Of Walbridge Tax Form with ease

- Find Village Of Walbridge Tax Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you choose. Modify and eSign Village Of Walbridge Tax Form and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the village of walbridge tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Village Of Walbridge Tax Form?

The Village Of Walbridge Tax Form is a specific document required for residents and businesses in Walbridge to report their income and pay local taxes accurately. Using airSlate SignNow, you can easily fill out and eSign this form online, saving you time and ensuring compliance.

-

How can airSlate SignNow help with the Village Of Walbridge Tax Form?

airSlate SignNow simplifies the process of completing the Village Of Walbridge Tax Form by providing a digital platform for filling out, signing, and submitting the document. This tool ensures your tax form is submitted accurately and timely, reducing the risk of penalties.

-

Is there a cost associated with using airSlate SignNow for the Village Of Walbridge Tax Form?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses. The pricing typically includes various features to help manage your documents, such as templates and eSignature options that will streamline your experience with the Village Of Walbridge Tax Form.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow offers a range of features for tax form management, including customizable templates, secure eSignature capabilities, and status tracking for your Village Of Walbridge Tax Form. These features enhance your efficiency and provide a straightforward way to handle your tax filings.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software solutions, enabling you to streamline your workflow. You can easily connect it with accounting software or other applications that may involve the Village Of Walbridge Tax Form, enhancing your overall document management process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow provides numerous benefits, such as a user-friendly interface, enhanced security for your documents, and the ability to eSign from anywhere. This ensures that your Village Of Walbridge Tax Form is handled efficiently and securely, which is essential during tax season.

-

How secure is my information when using airSlate SignNow for the Village Of Walbridge Tax Form?

airSlate SignNow prioritizes the security of your information by employing advanced encryption and security protocols. This ensures that all your data, including the details on your Village Of Walbridge Tax Form, is protected against unauthorized access.

Get more for Village Of Walbridge Tax Form

- College visit evaluation form 12535966

- Southern vermont college transcripts form

- Volunteer community service form

- Uop arc petition form

- Basic orientation plus test answers form

- The university application form

- Athletic physical examination form university of wisconsin platteville uwplatt

- Xula housing application form

Find out other Village Of Walbridge Tax Form

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple