Irs Form 14335

What is the IRS Form 14335

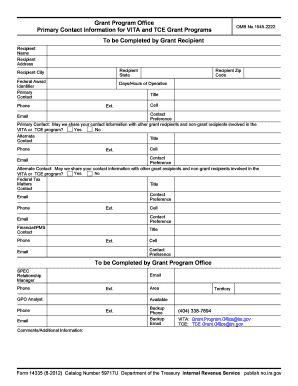

The IRS Form 14335 is a document used by taxpayers in the United States to provide specific information related to their tax obligations. This form is particularly relevant for those who need to report certain types of income or claim specific deductions. Understanding the purpose of Form 14335 is essential for ensuring compliance with tax laws and accurately reporting financial information to the IRS.

How to Obtain the IRS Form 14335

To obtain the IRS Form 14335, taxpayers can visit the official IRS website, where forms are available for download in PDF format. Additionally, individuals can request a paper copy of the form by calling the IRS directly or visiting a local IRS office. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the IRS Form 14335

Completing the IRS Form 14335 involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements and deduction records.

- Fill out the form: Carefully enter the required information in each section, ensuring accuracy.

- Review the form: Double-check all entries for errors or omissions before submission.

- Sign and date: Ensure that the form is signed and dated appropriately to validate it.

Legal Use of the IRS Form 14335

The IRS Form 14335 is legally binding when completed correctly and submitted according to IRS guidelines. It is crucial to adhere to all legal requirements, including accurate reporting of income and deductions. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable eSignature solution can enhance the legitimacy of the form by ensuring that all signatures are verified and compliant with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 14335 may vary depending on the specific tax year and the taxpayer's circumstances. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for most individuals. It is advisable to check the IRS website for any updates or changes to deadlines, as well as for information on extensions that may apply.

Form Submission Methods

Taxpayers can submit the IRS Form 14335 through various methods:

- Online: Many taxpayers choose to file electronically using tax software that supports the form.

- Mail: Completed forms can be mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Individuals may also submit the form in person at local IRS offices, where assistance may be available.

Quick guide on how to complete irs form 14335

Complete Irs Form 14335 effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 14335 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Irs Form 14335 without breaking a sweat

- Find Irs Form 14335 and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Modify and eSign Irs Form 14335 and guarantee seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 14335

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14335?

Form 14335 is a document used for specific legal and administrative purposes. In the context of e-signatures, airSlate SignNow allows you to create, manage, and sign form 14335 electronically, streamlining your workflow and ensuring compliance.

-

How can I use form 14335 with airSlate SignNow?

Using form 14335 with airSlate SignNow is straightforward. You can upload the document, add required fields for e-signatures, and send it out for signing. This ensures a smooth process for all parties involved, enhancing efficiency.

-

Is there a cost associated with using form 14335 on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow to manage form 14335. We offer multiple plans to cater to different business sizes and needs, allowing you to choose a cost-effective solution that fits your budget.

-

What features does airSlate SignNow offer for managing form 14335?

airSlate SignNow provides various features for managing form 14335, including customizable templates, real-time tracking, and automated reminders. These features ensure that the signing process is efficient and that documents are securely handled.

-

What are the benefits of using airSlate SignNow for form 14335?

The primary benefits of using airSlate SignNow for form 14335 include increased speed, reduced paperwork, and enhanced collaboration. With our platform, businesses can complete the signing process faster and reduce the risk of errors or lost documents.

-

Can I integrate other applications with airSlate SignNow for handling form 14335?

Absolutely! airSlate SignNow allows for seamless integrations with various applications such as CRM systems and document management tools, enabling you to efficiently manage form 14335 alongside your other business processes.

-

Is airSlate SignNow compliant with legal regulations for form 14335?

Yes, airSlate SignNow complies with the necessary legal regulations for e-signatures, ensuring that your form 14335 is legally binding. Our platform adheres to industry standards to maintain the integrity and security of your documents.

Get more for Irs Form 14335

- Certificate of survival form

- Discover student loans deferment form

- Transamerica surrender form

- T rowe price hardship withdrawal form

- Gurnick academy of medical arts transcript request form gurnick

- Eacvi tee certification list of 125 procedures form escardio

- Subcontractor verification form

- Authorization to release confidential information cobb county cobbk12

Find out other Irs Form 14335

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form