Buy Up Long Term Disability Insurance the Standard Form

Understanding the Buy up Long Term Disability Insurance The Standard

The Buy up Long Term Disability Insurance The Standard is designed to provide financial protection in the event of a long-term disability. This insurance helps replace a portion of your income if you are unable to work due to a covered condition. It is essential for individuals who want to secure their financial future against unforeseen circumstances that may prevent them from earning a living.

Steps to Complete the Buy up Long Term Disability Insurance The Standard

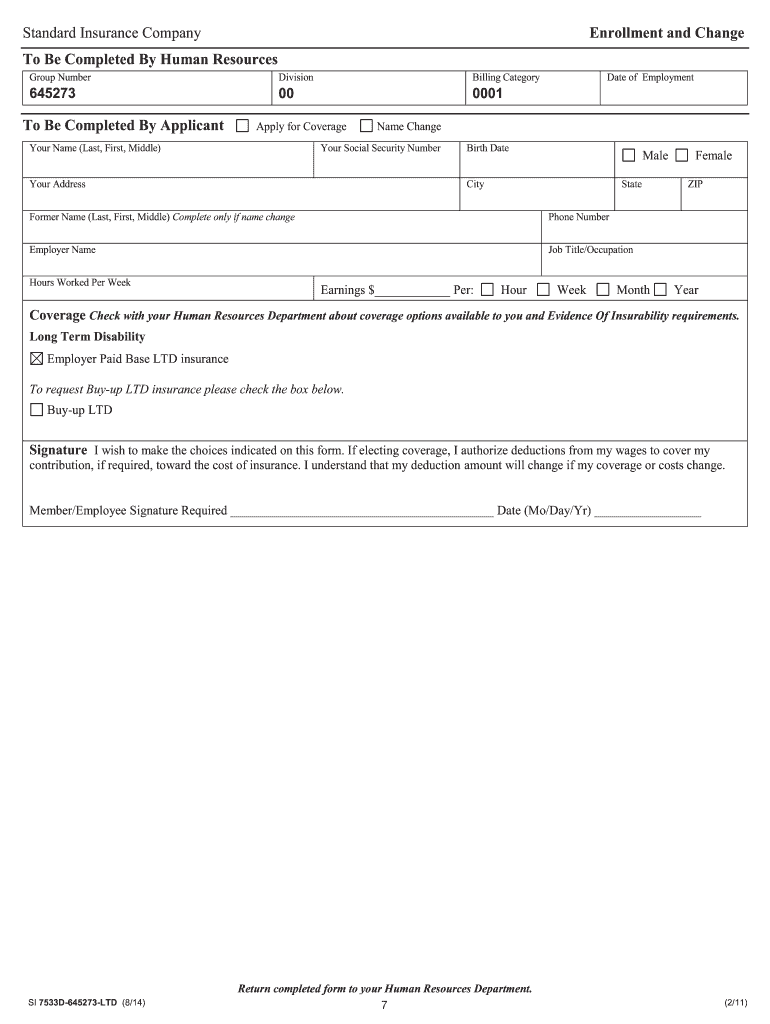

Completing the Buy up Long Term Disability Insurance The Standard involves several key steps:

- Gather necessary personal information, including your employment details and income.

- Review the policy options available to determine the coverage amount that suits your needs.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide any additional documentation requested, such as medical records or proof of income.

- Submit the application electronically or via mail, depending on your preference.

Legal Use of the Buy up Long Term Disability Insurance The Standard

The legal validity of the Buy up Long Term Disability Insurance The Standard is upheld through adherence to specific regulations governing eSignatures and document execution. In the United States, eDocuments are considered legally binding when they meet the requirements set forth by the ESIGN Act and UETA. This ensures that your application and any accompanying documents are recognized by legal authorities and insurance providers.

Key Elements of the Buy up Long Term Disability Insurance The Standard

Several key elements define the Buy up Long Term Disability Insurance The Standard:

- Coverage duration: The length of time benefits will be paid, which can vary based on the policy.

- Elimination period: The waiting period before benefits begin, typically ranging from 30 to 180 days.

- Benefit percentage: The percentage of your income that will be replaced, usually between 50% and 70%.

- Renewability: Terms regarding whether the policy can be renewed and under what conditions.

Eligibility Criteria for the Buy up Long Term Disability Insurance The Standard

To qualify for the Buy up Long Term Disability Insurance The Standard, applicants typically must meet certain eligibility criteria, including:

- Being employed full-time or part-time, as defined by the policy.

- Meeting health requirements, which may involve a medical examination or questionnaire.

- Being within the age limits specified by the insurance provider.

How to Obtain the Buy up Long Term Disability Insurance The Standard

Obtaining the Buy up Long Term Disability Insurance The Standard can be accomplished through several methods:

- Contacting an insurance agent or broker who specializes in disability insurance.

- Visiting the official website of The Standard to access online quotes and applications.

- Requesting information directly from your employer if they offer this insurance as part of employee benefits.

Quick guide on how to complete buy up long term disability insurance the standard

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I get my Instagram account back if I disabled it and now when I try to connect back, it tells me that the account was not found?

You can’t get it back.“If your account was deleted by you or someone with your password, there's no way to restore it. You can create a new account with the same email address you used before, but you may not be able to get the same username.”What can I do if my account has been disabled?If a service said it can, it is a scam, and will steal your info and or charge you money. Can’t be done.

-

Is a Residual Disability and Recovery benefit really worth the extra ~25% cost on long term disability insurance? What are other important things to know when buying long term disability insurance?

I do not have a lot of knowledge about the various disability plans but I can tell you from experience one thing that is absolutely important to consider….I became an RN (registered nurse) and landed my dream job. I loved being a nurse, and I mean LOVE! Sadly, I became disabled at an early age, just shortly after my 25th birthday. I was diagnosed with two rare conditions that I apparently had since birth and struggled with but could never receive an accurate diagnosis. I had signNowed the point where I could no longer work. I was in rough shape! I fought past 5 surgeries, believing each time I could return to work. However in the end it was just not possible and I had to accept what my doctors were telling me.So here's the thing… I receive long-term Disabilty however it does not include any considerations for inflation. This may not seem like a huge deal, but consider this: let's say, for example, (figures are completely fictional) a person is paid $2,000 a month in Disabilty income. Now, consider the fact that in 20 years I will only be 45 years old. Yet inflation will have increased so much that $2,000 may only be “worth” $1,000. How so? Well, a loaf of bread will cost $5.00 instead of $2.50 and a car will cost $40,000 instead of $20,000. I'm scared about my future. I'm saving everything I possibly can right now because I know my future will be strained.I wish I could still work. I miss it every day. EVERY day.So, I'm no expert but that is one thing I would be sure to ask about.

-

How can I cancel the JEE Main 2018 application form? I am in 11th standard and I fill a form up to 'upload image'.

If you have done the payment, its a non refundable amount. So you don't get that back anyway.If the payment hasn't been done, then you may leave that form as it is. But they may have your data in their database. So there may be a chance your attempt is counted. If that's the case, then you may appear in the examination just to have the aroma of the JEE Thing.But keep in mind, FINGERS CROSSED if you have to attempt the paper as a dropper you might not be able to sit if there aee two attempts.If JEE allows three attempts then there's no harm in doing any of the above cases.

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

Related searches to Buy up Long Term Disability Insurance The Standard

Create this form in 5 minutes!

How to create an eSignature for the buy up long term disability insurance the standard

How to make an eSignature for the Buy Up Long Term Disability Insurance The Standard online

How to generate an electronic signature for the Buy Up Long Term Disability Insurance The Standard in Google Chrome

How to make an electronic signature for putting it on the Buy Up Long Term Disability Insurance The Standard in Gmail

How to make an electronic signature for the Buy Up Long Term Disability Insurance The Standard straight from your smartphone

How to make an eSignature for the Buy Up Long Term Disability Insurance The Standard on iOS

How to create an electronic signature for the Buy Up Long Term Disability Insurance The Standard on Android OS

People also ask

-

What does it mean to buy up Long Term Disability Insurance The Standard?

To buy up Long Term Disability Insurance The Standard means increasing your coverage amount to ensure you have adequate financial support if you become unable to work due to illness or injury. This additional coverage helps to fill the income gap and provides peace of mind for you and your family.

-

How much does it cost to buy up Long Term Disability Insurance The Standard?

The cost to buy up Long Term Disability Insurance The Standard varies based on factors such as your age, occupation, and desired coverage amount. Most insurers provide flexible pricing options, allowing you to customize your plan to fit your budget while ensuring comprehensive protection.

-

What benefits are included when I buy up Long Term Disability Insurance The Standard?

When you buy up Long Term Disability Insurance The Standard, you typically receive benefits such as a percentage of your income replaced, coverage for various disabilities, and the option to add riders for additional protection. These features ensure you remain financially secure in the event of a long-term disability.

-

Can I customize my Long Term Disability Insurance coverage with The Standard?

Yes, you can customize your Long Term Disability Insurance coverage with The Standard to fit your specific needs. Options for customization may include the duration of benefits, waiting periods, and additional riders that enhance your coverage for specific situations.

-

Is there a waiting period to access benefits after I buy up Long Term Disability Insurance The Standard?

Yes, typically there is a waiting period, also known as an elimination period, before you can access benefits after you buy up Long Term Disability Insurance The Standard. This period can usually range from 30 to 180 days depending on the policy you choose.

-

What are the integration options for managing my Long Term Disability Insurance The Standard?

When you buy up Long Term Disability Insurance The Standard, integration options are usually available to help you manage your policy efficiently. Many providers offer online portals and apps that allow for easy monitoring and claims submission, making it convenient for policyholders.

-

How do I file a claim for Long Term Disability Insurance with The Standard?

Filing a claim for Long Term Disability Insurance with The Standard involves completing a claims form and providing necessary documentation to support your disability status. It's essential to consult your policy's guidelines to ensure you include all required information for a smooth claims process.

Get more for Buy up Long Term Disability Insurance The Standard

- Letter request for authority to purchase vehicle form

- Jumpstarting the raspberry pi zero w pdf form

- Amazon 61624050 form

- Myplate daily checklist 100713906 form

- Agency representation brochure arkansas real estate commission arec arkansas form

- Overtime register form

- Coshh assessment form

- Blank electron shell diagram form

Find out other Buy up Long Term Disability Insurance The Standard

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter