Nebraska Individual Income Tax Return, Form 1040N

What is the Nebraska Individual Income Tax Return, Form 1040N

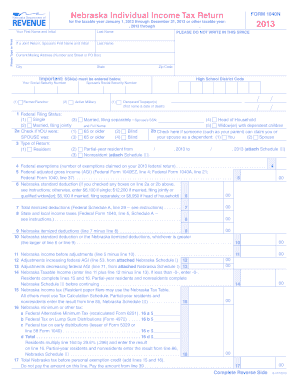

The Nebraska Individual Income Tax Return, Form 1040N, is the official document used by residents of Nebraska to report their annual income and calculate their state tax liability. This form is essential for individuals who earn income within the state, allowing them to fulfill their tax obligations accurately. The 1040N form captures various sources of income, including wages, dividends, and interest, and provides a framework for claiming deductions and credits available to Nebraska taxpayers.

Steps to complete the Nebraska Individual Income Tax Return, Form 1040N

Completing the Nebraska Individual Income Tax Return, Form 1040N, involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Claim deductions and credits that apply to your situation, ensuring you have supporting documentation.

- Calculate your total tax liability and any payments already made.

- Review the completed form for accuracy before submission.

How to obtain the Nebraska Individual Income Tax Return, Form 1040N

The Nebraska Individual Income Tax Return, Form 1040N, can be obtained through several methods. It is available for download on the Nebraska Department of Revenue's official website, where taxpayers can access the most current version of the form. Additionally, physical copies of the form can often be found at public libraries or government offices. For those who prefer digital options, many tax preparation software programs include the 1040N form as part of their offerings.

Legal use of the Nebraska Individual Income Tax Return, Form 1040N

To ensure the legal validity of the Nebraska Individual Income Tax Return, Form 1040N, it must be completed accurately and submitted by the designated deadline. The form must be signed and dated by the taxpayer, affirming that the information provided is true and complete. Electronic submissions are permissible, provided that they comply with state and federal eSignature laws. Utilizing a reliable eSigning platform can enhance the security and legitimacy of your submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Nebraska Individual Income Tax Return, Form 1040N. Typically, the deadline for submitting the form is April 15 of each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any changes or extensions announced by the Nebraska Department of Revenue to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska Individual Income Tax Return, Form 1040N, can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission via the Nebraska Department of Revenue's e-file system, which allows for quick processing.

- Mailing a completed paper form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices, which may offer assistance for those needing help with the filing process.

Quick guide on how to complete nebraska individual income tax return form 1040n 36408630

Manage Nebraska Individual Income Tax Return, Form 1040N effortlessly on any gadget

Digital document handling has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Nebraska Individual Income Tax Return, Form 1040N on any device with airSlate SignNow apps for Android or iOS and improve any document-related procedure today.

How to modify and eSign Nebraska Individual Income Tax Return, Form 1040N with ease

- Obtain Nebraska Individual Income Tax Return, Form 1040N and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important areas of the documents or hide confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Nebraska Individual Income Tax Return, Form 1040N and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska individual income tax return form 1040n 36408630

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Individual Income Tax Return, Form 1040N?

The Nebraska Individual Income Tax Return, Form 1040N, is used by residents of Nebraska to report their income and calculate their state tax liability. It includes sections to list income, exemptions, and deductions that are applicable in Nebraska. Completing this form accurately is essential for compliance with state tax laws.

-

How can airSlate SignNow help with the Nebraska Individual Income Tax Return, Form 1040N?

AirSlate SignNow simplifies the process of preparing and submitting the Nebraska Individual Income Tax Return, Form 1040N by allowing users to easily eSign documents and share them securely online. This minimizes the time spent on paperwork and ensures that all necessary signatures are collected efficiently. Not only is it user-friendly, but it also improves the overall productivity of tax preparation.

-

What features does airSlate SignNow offer for handling the Nebraska Individual Income Tax Return, Form 1040N?

AirSlate SignNow offers features like templates for the Nebraska Individual Income Tax Return, Form 1040N, document management, and automated reminders for signatures. Users can track the status of their documents in real-time and receive notifications once forms are signed, ensuring a smooth filing process. This helps streamline tax preparation, saving time and reducing stress.

-

Is airSlate SignNow cost-effective for filing the Nebraska Individual Income Tax Return, Form 1040N?

Yes, airSlate SignNow provides a cost-effective solution for filing the Nebraska Individual Income Tax Return, Form 1040N. With flexible pricing plans, individuals and businesses can choose an option that fits their budget. This affordability, combined with the time savings from electronic filing, makes it a smart choice for tax season.

-

What are the benefits of using airSlate SignNow for the Nebraska Individual Income Tax Return, Form 1040N?

Using airSlate SignNow for the Nebraska Individual Income Tax Return, Form 1040N offers numerous benefits, including enhanced security, ease of use, and faster processing times. Electronic signing reduces the chances of errors associated with paper documents. Additionally, users can access their forms anytime and anywhere, making tax preparation more convenient.

-

Can airSlate SignNow integrate with other tax software for the Nebraska Individual Income Tax Return, Form 1040N?

Yes, airSlate SignNow can integrate with various tax software platforms ideal for preparing the Nebraska Individual Income Tax Return, Form 1040N. This integration allows users to import necessary data and ensures that all forms can be seamlessly eSigned and shared. This capability enhances the overall efficiency of the tax filing process.

-

How secure is the process of eSigning the Nebraska Individual Income Tax Return, Form 1040N with airSlate SignNow?

AirSlate SignNow prioritizes security, utilizing advanced encryption methods to protect the integrity and confidentiality of the Nebraska Individual Income Tax Return, Form 1040N. Each signed document is securely stored, and access is restricted to authorized users only. This ensures sensitive tax information remains safe during the entire signing process.

Get more for Nebraska Individual Income Tax Return, Form 1040N

- Twostep ppd immunization record bucks form

- April insurance claim form

- Dme proof of delivery form template

- Print shop order form

- Depression self care action form

- Residential category form

- Amvic consignment form

- Random case review form period i january 1 to june 30 period ii july 1 to december 31 reviewing physician aaaasf

Find out other Nebraska Individual Income Tax Return, Form 1040N

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple