State of Rhode Island Division of Taxation Business Application and Registration Fillable Form

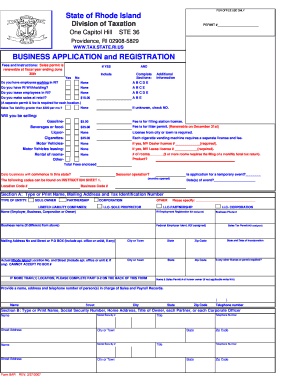

What is the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

The State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form is an essential document for individuals and entities looking to establish a business within Rhode Island. This form serves as a formal request to register a business, ensuring compliance with state regulations. It collects vital information about the business, including its name, structure, and ownership details, which are necessary for tax identification and legal recognition.

How to use the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

Using the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form involves a straightforward process. First, download the form from the official state website or a reliable source. Once you have the form, fill it out electronically or print it for manual completion. Ensure that all required fields are accurately filled, including business name, address, and type of entity. After completing the form, review it for any errors before submission to avoid delays in processing.

Steps to complete the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

Completing the form requires careful attention to detail. Here are the steps to follow:

- Download the fillable form from the official Rhode Island Division of Taxation website.

- Open the form in a compatible PDF reader that supports fillable fields.

- Fill in the business name, address, and type of business entity.

- Provide the names and addresses of the owners or partners involved.

- Include the federal Employer Identification Number (EIN), if applicable.

- Review all entries for accuracy and completeness.

- Save the completed form for your records.

Legal use of the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

The legal use of the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form is crucial for establishing a business entity in compliance with state laws. This form must be filled out accurately and submitted to the appropriate state authorities. Once processed, it provides legal recognition to your business, allowing it to operate within Rhode Island. Proper completion and submission of this form help avoid potential legal issues and ensure that your business meets all regulatory requirements.

Required Documents

When completing the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form, certain documents may be required to support your application. These typically include:

- Proof of identity for the business owner(s), such as a driver's license or passport.

- Federal Employer Identification Number (EIN) documentation, if applicable.

- Any relevant business licenses or permits, depending on the nature of the business.

Form Submission Methods

The completed State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form can be submitted through various methods. These include:

- Online submission via the Rhode Island Division of Taxation's official website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at the local Division of Taxation office.

Quick guide on how to complete state of rhode island division of taxation business application and registration fillable form

Complete State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without interruptions. Manage State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form without any hassle

- Find State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent portions of your documents or conceal sensitive information with utilities specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxation business application and registration fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

The State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form is a document designed for businesses looking to register their operations within Rhode Island. This fillable form allows you to easily input necessary information and submit it electronically, streamlining the registration process. With airSlate SignNow, filling and signing this form becomes a simplified task.

-

How can airSlate SignNow facilitate the completion of the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

airSlate SignNow provides an intuitive platform for creating, filling, and signing the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form. Our user-friendly interface allows you to easily complete the form from any device, ensuring a hassle-free experience. Furthermore, you can store your documents securely within our cloud-based service.

-

Are there any costs associated with using airSlate SignNow for the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

Yes, airSlate SignNow offers various pricing plans suited for different business needs when filling the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form. Each plan is designed to be cost-effective while providing essential features such as eSignature capabilities and document management. You can choose a plan that best fits your requirements.

-

Can the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing the functionality when completing the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form. This allows you to connect with your favorite tools and streamline your overall workflow, making the registration and documentation process even more efficient.

-

What are the benefits of using airSlate SignNow for filling the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

Using airSlate SignNow to fill the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form provides several benefits, including ease of use, cost savings, and time efficiency. The platform allows for quick edits, electronic signatures, and secure storage, ensuring that your registration process is not only fast but also reliable. It simplifies compliance with state regulations.

-

Is it secure to use airSlate SignNow for the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

Yes, security is a top priority at airSlate SignNow. When you fill out the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form, your data is protected with industry-standard encryption and secure access measures. You can confidently complete and submit your documents knowing that they are safe from unauthorized access.

-

What features does airSlate SignNow offer for the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form?

AirSlate SignNow offers a range of features for the State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form, including customizable templates, eSignature capabilities, and document tracking. These features allow you to efficiently manage your form and ensure that you complete the registration process smoothly. Additionally, you can automate reminders for pending signatures.

Get more for State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

- Aka sponsor requirements form

- Boat slip rental agreement florida form

- Certification of trustee under the trust form

- D youville college strongly recommends all students have dyc form

- Smart goal setting worksheet form

- Horse transport contract template form

- Release education form

- Registration form the mechanicsburg area senior high school

Find out other State Of Rhode Island Division Of Taxation Business Application And Registration Fillable Form

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure