This Form Upon Its Completion

What is the 2020 MOAA?

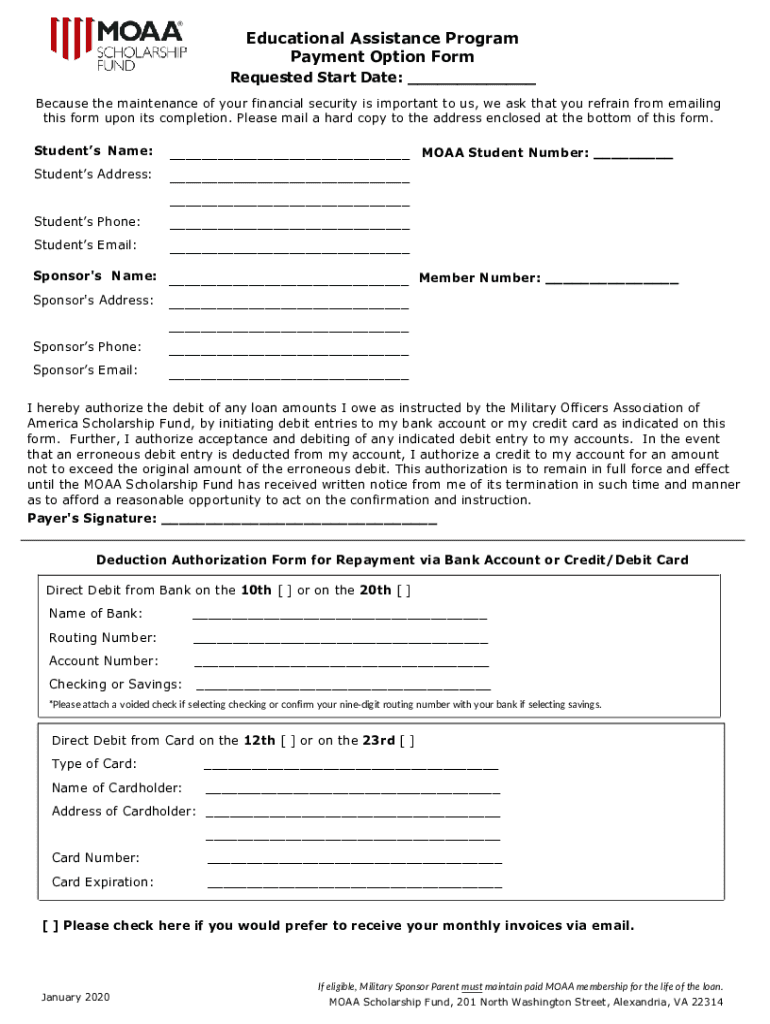

The 2020 MOAA, or Military Officers Association of America form, is a document used primarily for reporting income and expenses related to military benefits and compensation. This form plays a crucial role in ensuring that military officers accurately report their financial information to the IRS. It is essential for maintaining compliance with tax regulations and can affect eligibility for various benefits and programs.

How to use the 2020 MOAA

Using the 2020 MOAA involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts. Next, fill out the form with precise information regarding your income, deductions, and credits. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the 2020 MOAA

Completing the 2020 MOAA requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Fill in personal identification information, including your Social Security number.

- Report all sources of income, including military pay and any additional earnings.

- List applicable deductions, such as expenses related to military service.

- Review the form for completeness and accuracy.

- Submit the form by the designated deadline.

Legal use of the 2020 MOAA

The 2020 MOAA is legally binding when filled out and submitted according to IRS guidelines. To ensure its validity, it must be signed and dated by the individual completing the form. Compliance with tax laws is essential to avoid penalties and ensure eligibility for military benefits. Additionally, maintaining accurate records of the information reported on the form is important for future reference and audits.

Filing Deadlines / Important Dates

Filing deadlines for the 2020 MOAA are critical to avoid penalties. Typically, the form must be submitted by April 15 of the following tax year. However, it is advisable to check for any extensions or changes to the deadline that may apply. Keeping track of these dates helps ensure timely compliance with tax obligations.

Required Documents

To successfully complete the 2020 MOAA, certain documents are required. These include:

- W-2 forms for military pay.

- 1099 forms for any additional income.

- Receipts for deductible expenses related to military service.

- Previous year's tax return for reference.

Who Issues the Form

The 2020 MOAA is issued by the Military Officers Association of America, an organization dedicated to supporting military officers and their families. This form is specifically designed to assist members in accurately reporting their financial information to the IRS, ensuring compliance with tax laws and regulations.

Quick guide on how to complete this form upon its completion

Effortlessly Complete This Form Upon Its Completion on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It provides an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without any delays. Manage This Form Upon Its Completion on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign This Form Upon Its Completion with Ease

- Acquire This Form Upon Its Completion and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign This Form Upon Its Completion and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this form upon its completion

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is MOAA payment and how does it relate to airSlate SignNow?

MOAA payment refers to the payment options available through the airSlate SignNow platform. It allows users to manage payments efficiently while facilitating electronic signatures and document management. With airSlate SignNow, you can streamline your MOAA payment processes seamlessly.

-

How much does airSlate SignNow cost in relation to MOAA payment?

airSlate SignNow offers various pricing plans that cater to different business needs, ensuring an affordable solution for managing MOAA payments. The plans typically range from basic to premium options, allowing you to choose one that fits your budget while benefiting from the full suite of features.

-

What features does airSlate SignNow offer for MOAA payment processing?

airSlate SignNow provides robust features for efficient MOAA payment processing, including customizable workflows, secure document storage, and real-time tracking. These features help ensure your payment processes are organized and easily accessible, improving overall operational efficiency.

-

Are there any benefits to using airSlate SignNow for MOAA payment?

Yes, using airSlate SignNow for MOAA payment offers numerous benefits such as enhanced security, ease of use, and integration capabilities. By choosing this solution, businesses can ensure compliance, reduce paperwork, and improve turnaround times for payment processing.

-

Is it easy to integrate airSlate SignNow with existing MOAA payment systems?

Absolutely! airSlate SignNow is designed for easy integration with various MOAA payment systems. Its API allows businesses to connect their current financial systems seamlessly, ensuring a smooth transition and enhanced functionality.

-

Can I track my MOAA payment status using airSlate SignNow?

Yes, airSlate SignNow provides users with the ability to track the status of their MOAA payment in real-time. This feature ensures that you are always informed about your payment processes and can take action if necessary.

-

What industries benefit the most from using airSlate SignNow for MOAA payment?

Many industries, including healthcare, real estate, and finance, benefit signNowly from using airSlate SignNow for MOAA payment. The platform’s versatility in managing documents and payment processes makes it suitable for any industry looking to streamline operations and enhance productivity.

Get more for This Form Upon Its Completion

- Inground order form garrett liners

- Sf 1449 example form

- Form 8822 b fax number

- Diet history example form

- Texas mortgage company disclosure form

- Images for is it realhttpswww readyforlife nets form

- Voluntary statement form 361549457

- California request for a certified copy of a filed declaration of form

Find out other This Form Upon Its Completion

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile