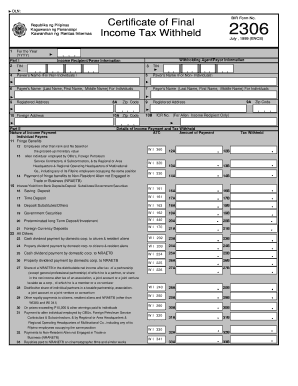

Certificate of Final Income Tax Withheld Lawphil Form

Understanding the Certificate of Final Income Tax Withheld

The Certificate of Final Income Tax Withheld is an essential document that certifies the amount of income tax withheld from an individual's earnings. This certificate serves as proof of tax compliance and is often required when filing tax returns. It is crucial for taxpayers to understand this certificate to ensure accurate reporting of their income and taxes withheld.

Steps to Complete the Certificate of Final Income Tax Withheld

Completing the Certificate of Final Income Tax Withheld involves several key steps:

- Gather necessary information, including your personal details and income sources.

- Accurately input the total income earned during the tax period.

- Calculate the total amount of tax withheld based on applicable rates.

- Review the completed form for accuracy before submission.

IRS Guidelines for Income Tax Withholding

The Internal Revenue Service (IRS) provides specific guidelines regarding income tax withholding. Taxpayers should familiarize themselves with these guidelines to ensure compliance and avoid penalties. Key points include understanding the withholding allowances, updating W-4 forms as needed, and knowing the deadlines for submitting withholding information.

Filing Deadlines and Important Dates

Timely filing is crucial for compliance with income tax regulations. Important dates include:

- January 31: Deadline for employers to provide employees with their Certificates of Final Income Tax Withheld.

- April 15: Deadline for individuals to file their annual tax returns.

- Quarterly deadlines: Dates for estimated tax payments if applicable.

Required Documents for Filing

To file your income tax return accurately, you will need several documents, including:

- The Certificate of Final Income Tax Withheld from your employer.

- W-2 forms detailing your annual earnings.

- Any additional documentation related to income sources.

Penalties for Non-Compliance

Failing to comply with income tax withholding regulations can lead to significant penalties. Common consequences include:

- Fines for late filing or underpayment of taxes.

- Interest charges on unpaid tax amounts.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete certificate of final income tax withheld lawphil

Effortlessly Prepare Certificate Of Final Income Tax Withheld Lawphil on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and without delays. Manage Certificate Of Final Income Tax Withheld Lawphil on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and eSign Certificate Of Final Income Tax Withheld Lawphil with Ease

- Obtain Certificate Of Final Income Tax Withheld Lawphil and then click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your form, either via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Certificate Of Final Income Tax Withheld Lawphil to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of final income tax withheld lawphil

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is income tax withholding?

Income tax withholding is the process by which employers deduct a portion of their employees' earnings to prepay federal and state income taxes. It helps ensure that tax liabilities are paid throughout the year, reducing the chances of underpayment at tax time. Understanding income tax withholding is crucial for both employers and employees to maintain compliance.

-

How does airSlate SignNow help with income tax withholding documentation?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents related to income tax withholding. Our solution ensures that all necessary forms, such as W-4s, are completed and stored securely, simplifying compliance for businesses. By using airSlate SignNow, you can manage these vital documents efficiently.

-

Are there any costs associated with using airSlate SignNow for income tax withholding forms?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes, including options tailored for efficient management of income tax withholding forms. Our competitive pricing model ensures that companies can find a plan that fits their budget while benefiting from an effective document management solution. Check our pricing page for specific details.

-

What features does airSlate SignNow provide for managing income tax withholding?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automatic reminders to streamline the process of managing income tax withholding documents. The user-friendly dashboard allows for easy access to all signed documents, ensuring you stay compliant on all tax-related matters. Improve your workflow and accuracy with our comprehensive features.

-

Can airSlate SignNow integrate with other accounting software for income tax withholding?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions to help manage income tax withholding processes. This integration ensures that all tax documents are updated in real-time, allowing for smoother interactions with payroll systems and accurate record-keeping. You can easily connect your favorite software for a more efficient workflow.

-

What benefits can companies expect from using airSlate SignNow for income tax withholding?

Companies using airSlate SignNow for income tax withholding can expect increased operational efficiency, reduced paperwork, and enhanced compliance. By automating document workflows, businesses can save time and minimize the chances of errors in tax-related documentation. Enjoy the peace of mind that comes with a reliable and secure solution.

-

How secure is airSlate SignNow when handling income tax withholding forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive information related to income tax withholding. We utilize advanced encryption and secure data storage to protect all documents and user information. Our platform is designed to meet industry standards, ensuring that your income tax withholding forms are always safe.

Get more for Certificate Of Final Income Tax Withheld Lawphil

Find out other Certificate Of Final Income Tax Withheld Lawphil

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement