Delaware Form 400 Tax Year

What is the Delaware Form 400 Tax Year

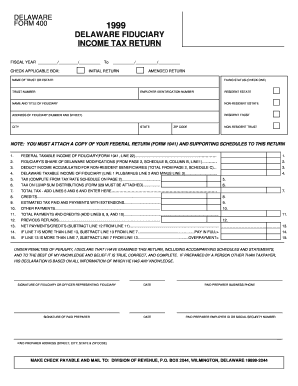

The Delaware Form 400 Tax Year is a crucial document used by businesses operating in Delaware to report their annual corporate income tax. This form is essential for corporations, including C corporations and S corporations, as it provides the state with necessary financial information. The details submitted on this form help determine the tax liability for the business, ensuring compliance with state tax regulations.

How to use the Delaware Form 400 Tax Year

Using the Delaware Form 400 Tax Year involves several steps. First, gather all relevant financial records, including income statements, balance sheets, and any deductions or credits applicable to your business. Next, accurately complete the form by entering the required financial information, ensuring that all calculations are correct. Once completed, the form can be submitted electronically or by mail, depending on your preference and the guidelines provided by the Delaware Division of Revenue.

Steps to complete the Delaware Form 400 Tax Year

Completing the Delaware Form 400 Tax Year requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, including financial statements and prior tax returns.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations for accuracy, including income, deductions, and tax credits.

- Review the form for any missing information or errors.

- Submit the completed form by the deadline, either electronically or via mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Delaware Form 400 Tax Year to avoid penalties. Typically, the form is due on the first day of the fourth month following the end of your fiscal year. For most businesses operating on a calendar year, this means the deadline is April fifteenth. However, if the due date falls on a weekend or holiday, the deadline may be adjusted accordingly. Always check for any updates or changes to the filing schedule.

Required Documents

To complete the Delaware Form 400 Tax Year, certain documents are necessary. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Documentation for any tax credits or deductions claimed.

- Prior year tax returns for reference.

Having these documents organized and accessible will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to file the Delaware Form 400 Tax Year by the deadline can result in significant penalties. Businesses may face late filing fees, which can accumulate over time. Additionally, non-compliance may lead to interest charges on any unpaid taxes. It is crucial to adhere to the filing requirements to avoid these financial repercussions and maintain good standing with the state.

Quick guide on how to complete delaware form 400 tax year

Effortlessly prepare Delaware Form 400 Tax Year on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow equips you with all the necessary tools to efficiently create, edit, and eSign your documents without delays. Manage Delaware Form 400 Tax Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Effortlessly edit and eSign Delaware Form 400 Tax Year

- Obtain Delaware Form 400 Tax Year and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Delaware Form 400 Tax Year to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware form 400 tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware Form 400 Tax Year?

The Delaware Form 400 Tax Year is a tax return form that businesses must file to report their income and calculate their corporate tax liability in Delaware. It is crucial for compliance with state tax laws and helps ensure that businesses meet their tax obligations efficiently.

-

How can airSlate SignNow assist with filing the Delaware Form 400 Tax Year?

airSlate SignNow provides a seamless solution for electronically signing and submitting the Delaware Form 400 Tax Year. With our easy-to-use platform, you can streamline the document signing process, helping you file your taxes accurately and on time without the hassles of paperwork.

-

What are the pricing options for using airSlate SignNow related to the Delaware Form 400 Tax Year?

airSlate SignNow offers a range of pricing plans designed to fit various business needs. Each plan provides access to features that can help you manage electronic signatures and document workflows, specifically for filings like the Delaware Form 400 Tax Year, ensuring you stay compliant at a cost-effective rate.

-

What features does airSlate SignNow offer for the Delaware Form 400 Tax Year?

airSlate SignNow includes powerful features such as customizable templates, secure document storage, and real-time tracking of document statuses. These features enhance the efficiency of filing the Delaware Form 400 Tax Year, allowing businesses to manage their tax documents effortlessly.

-

Are there any benefits to using airSlate SignNow for the Delaware Form 400 Tax Year?

Using airSlate SignNow to handle the Delaware Form 400 Tax Year provides numerous benefits, including faster turnaround times, reduced paper consumption, and enhanced security for sensitive information. This digital solution minimizes errors and improves compliance with state tax regulations.

-

Can airSlate SignNow integrate with other tax software for filing the Delaware Form 400 Tax Year?

Yes, airSlate SignNow can integrate with various accounting and tax software, streamlining the entire process for filing the Delaware Form 400 Tax Year. These integrations allow for easy data transfer and improved workflow, reducing the chances of errors and enhancing productivity.

-

Is eSigning the Delaware Form 400 Tax Year with airSlate SignNow legally binding?

Absolutely! eSigning the Delaware Form 400 Tax Year using airSlate SignNow is legally binding and complies with federal and state e-signature laws. This ensures that your signed documents are fully valid and enforceable in a court of law.

Get more for Delaware Form 400 Tax Year

- Personal information organizer template

- Cover page for grant proposal form

- Nace level 1 study material pdf form

- Mymahbub com pdf form

- Dha application form download

- Echs logo form

- Bradford publishing residential lease form

- Form 2350 sp application for extension of time to file u s income tax return spanish version 793568347

Find out other Delaware Form 400 Tax Year

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract