Form 8233

What is the Form 8233

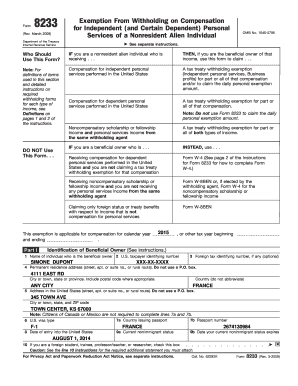

The Form 8233 is a tax document used by non-resident aliens in the United States to claim exemption from withholding on compensation for independent personal services. This form is essential for individuals who qualify for tax treaty benefits, allowing them to avoid excessive taxation on income earned in the U.S. Understanding the purpose of Form 8233 is crucial for non-resident aliens to ensure compliance with U.S. tax laws while maximizing their financial benefits.

How to use the Form 8233

To effectively use Form 8233, individuals must first determine their eligibility for tax treaty benefits. Once eligibility is confirmed, the form should be completed accurately, providing necessary information such as the taxpayer's name, address, and details of the income being claimed. After completing the form, it must be submitted to the payer of the income, who will then use it to determine the appropriate withholding tax rate. It is important to retain a copy of the submitted form for personal records and future reference.

Steps to complete the Form 8233

Completing Form 8233 involves several key steps:

- Gather required information, including personal details and income specifics.

- Fill out the form correctly, ensuring all sections are completed, including the signature and date.

- Submit the form to the income payer before the payment is made to ensure proper withholding.

- Keep a copy of the submitted form for your records.

Following these steps helps ensure that the form is processed efficiently and that tax benefits are received.

Legal use of the Form 8233

The legal use of Form 8233 is governed by U.S. tax laws and regulations. To be considered valid, the form must be completed accurately and submitted in accordance with IRS guidelines. Non-resident aliens must ensure that they meet the eligibility criteria outlined in tax treaties between their home country and the United States. Misuse or incorrect submission of Form 8233 can lead to penalties or denial of tax benefits, making it essential to adhere to legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 8233 are crucial for non-resident aliens to ensure compliance with tax regulations. Generally, the form should be submitted to the income payer before the first payment is made. It is advisable to check specific deadlines related to the tax year, as they may vary. Staying informed about these dates helps prevent potential issues with tax withholding and compliance.

Eligibility Criteria

To qualify for using Form 8233, individuals must meet specific eligibility criteria. These include being a non-resident alien and having income that is subject to U.S. tax withholding. Additionally, individuals must be eligible for benefits under a tax treaty between their country of residence and the United States. It is important to review the details of applicable treaties to confirm eligibility before submitting the form.

Quick guide on how to complete form 8233

Prepare Form 8233 seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without hassle. Manage Form 8233 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 8233 with ease

- Obtain Form 8233 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Annotate essential sections of your documents or mask sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8233 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8233

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8233?

Form 8233 is a tax form used by nonresident aliens in the United States to claim exemption from withholding on certain types of income. It is important for anyone receiving compensation from U.S. sources, as it helps in establishing eligibility for tax treaty benefits.

-

How can airSlate SignNow help with filling out form 8233?

airSlate SignNow offers an intuitive platform for electronic signatures and document management, making it easy to fill out, sign, and share form 8233 securely. With our user-friendly interface, you can streamline the process of completing and submitting this important tax form.

-

What are the costs associated with using airSlate SignNow for form 8233?

airSlate SignNow provides affordable pricing plans that cater to various business sizes and needs. Depending on the features you require, you can choose a plan that offers the best value while ensuring you have the necessary tools to manage form 8233 efficiently.

-

What features does airSlate SignNow offer for managing form 8233?

Our platform includes features such as eSignature capabilities, document routing, customizable templates, and compliance tracking to facilitate the handling of form 8233. These tools simplify the process, ensuring documents are completed accurately and on time.

-

Can I integrate airSlate SignNow with other software for managing form 8233?

Yes, airSlate SignNow seamlessly integrates with various third-party applications and software, allowing you to manage form 8233 alongside your other tools. This means you can synchronize workflows and enhance productivity with minimal disruption.

-

How secure is airSlate SignNow for handling sensitive documents like form 8233?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption methods and conforms to industry standards to ensure that sensitive documents, including form 8233, are protected at all times during transmission and storage.

-

Is it easy to collaborate with others on form 8233 using airSlate SignNow?

Absolutely! airSlate SignNow provides an easy collaboration feature that allows multiple users to work on form 8233 simultaneously. You can invite team members to review, edit, and sign the document, streamlining your workflow.

Get more for Form 8233

- Notice disposal form

- California home care aide form

- In sbi home loan application form

- Fill dirt program form

- How much will a social security disability lawyer or advocate form

- Courts orders and opinions regarding final resolution in form

- Ireland health service executive form

- Claim residence nil rate band form

Find out other Form 8233

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form