New India Flexi Floater Group Mediclaim Policy PDF Form

What is the New India Flexi Floater Group Mediclaim Policy PDF?

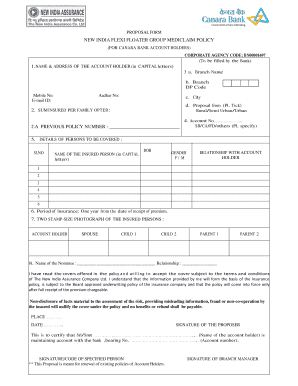

The New India Flexi Floater Group Mediclaim Policy is a comprehensive health insurance plan designed for groups, such as families or organizations. This policy provides coverage for a variety of medical expenses, including hospitalization, surgeries, and other healthcare services. The PDF version of this policy contains all the essential details, including terms, conditions, and coverage limits. It serves as a formal document that outlines the rights and responsibilities of both the insurer and the insured, ensuring clarity and transparency in the agreement.

Key elements of the New India Flexi Floater Group Mediclaim Policy PDF

Understanding the key elements of the New India Flexi Floater Group Mediclaim Policy is crucial for policyholders. Important components include:

- Coverage Amount: The total sum insured under the policy, which can be utilized for medical expenses.

- Eligibility Criteria: Specific requirements that must be met for individuals or groups to qualify for the policy.

- Inclusions and Exclusions: A clear list of what is covered under the policy and what is not, helping to avoid misunderstandings.

- Renewal Terms: Information regarding the renewal process and any associated fees or conditions.

Steps to complete the New India Flexi Floater Group Mediclaim Policy PDF

Filling out the New India Flexi Floater Group Mediclaim Policy PDF involves several steps. Begin by gathering necessary information such as personal details, group information, and medical history. Next, follow these steps:

- Download the PDF from a reliable source.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the document for completeness and correctness.

- Sign the document electronically or manually as per requirements.

Legal use of the New India Flexi Floater Group Mediclaim Policy PDF

The legal validity of the New India Flexi Floater Group Mediclaim Policy PDF is upheld under various regulations. For the document to be considered legally binding, it must comply with eSignature laws, such as the ESIGN Act and UETA in the United States. This ensures that electronic signatures are recognized in legal contexts. Additionally, the policy must be executed in a manner that meets the requirements set forth by the issuing authority, ensuring that all parties are protected under the law.

How to obtain the New India Flexi Floater Group Mediclaim Policy PDF

Obtaining the New India Flexi Floater Group Mediclaim Policy PDF is a straightforward process. Interested parties can typically acquire the document through the following methods:

- Visiting the official website of the insurance provider.

- Contacting customer service for assistance in obtaining the PDF.

- Requesting the document through email or physical mail if necessary.

Eligibility Criteria

Eligibility for the New India Flexi Floater Group Mediclaim Policy is determined by several factors. Generally, the policy is available to:

- Individuals who are part of a registered group or organization.

- Family members of the primary policyholder, depending on the specific terms.

- Individuals meeting the age and health requirements set by the insurer.

Quick guide on how to complete new india flexi floater group mediclaim policy pdf

Handle New India Flexi Floater Group Mediclaim Policy Pdf effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Manage New India Flexi Floater Group Mediclaim Policy Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign New India Flexi Floater Group Mediclaim Policy Pdf with ease

- Obtain New India Flexi Floater Group Mediclaim Policy Pdf and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your liking. Alter and eSign New India Flexi Floater Group Mediclaim Policy Pdf and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new india flexi floater group mediclaim policy pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new India flexi floater group mediclaim policy?

The new India flexi floater group mediclaim policy is a comprehensive health insurance plan designed for groups, offering flexible coverage options. It allows organizations to provide their employees with essential medical benefits while ensuring affordability and convenience.

-

How does the pricing work for the new India flexi floater group mediclaim policy?

Pricing for the new India flexi floater group mediclaim policy varies based on the number of insured members and selected coverage limits. Typically, larger groups may benefit from lower per-member costs, making this policy a cost-effective solution for companies.

-

What are the key features of the new India flexi floater group mediclaim policy?

The new India flexi floater group mediclaim policy includes features such as cashless hospitalization, pre and post-hospitalization coverage, and coverage for daycare procedures. These features make it a robust option for organizations looking to provide comprehensive health benefits.

-

What benefits does the new India flexi floater group mediclaim policy offer?

The main benefits of the new India flexi floater group mediclaim policy include financial protection against high medical costs, customizable coverage options, and an efficient claims process. These advantages help organizations ensure the health and well-being of their employees.

-

Can I customize the new India flexi floater group mediclaim policy?

Yes, the new India flexi floater group mediclaim policy is designed to be adaptable. Employers can choose specific coverage limits and add additional riders to tailor the policy to meet their group's unique health needs.

-

How can organizations integrate the new India flexi floater group mediclaim policy with existing employee benefits?

Organizations can easily integrate the new India flexi floater group mediclaim policy into their existing employee benefits package by coordinating with the insurance provider. The policy can complement other benefits like life insurance and pension plans, creating a holistic benefits program.

-

What documents are required to apply for the new India flexi floater group mediclaim policy?

To apply for the new India flexi floater group mediclaim policy, organizations typically need to provide details such as the company registration document, a list of employees, and their medical histories. These documents help facilitate a smoother application process.

Get more for New India Flexi Floater Group Mediclaim Policy Pdf

- Control number ca p010 pkg form

- Divorce package form

- Control number il p001 pkg form

- Copyright u 481367094 form

- North carolina landlord tenant package form

- Us legals survivors guide to a death in the familyus legal inc 2009 form

- Preparado por registro solicitado por y form

- Free new jersey last will and testament templates pdf ampamp docx form

Find out other New India Flexi Floater Group Mediclaim Policy Pdf

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document