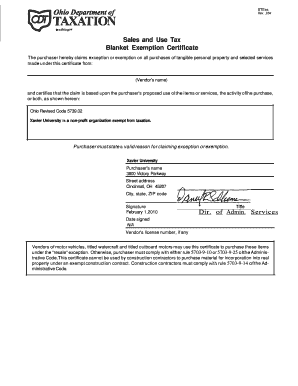

Ohio Farming Blanket Exapmtion Certificate Form

What is the Ohio Farming Blanket Exemption Certificate

The Ohio Farming Blanket Exemption Certificate is a crucial document that allows farmers to make tax-exempt purchases of items used in their agricultural operations. This certificate simplifies the purchasing process by enabling farmers to buy multiple items without needing to complete a separate exemption certificate for each transaction. It is essential for farmers to understand the specific criteria that qualify them for this exemption, as misuse can lead to penalties.

How to Obtain the Ohio Farming Blanket Exemption Certificate

Obtaining the Ohio Farming Blanket Exemption Certificate involves a straightforward process. Farmers must first ensure they meet the eligibility criteria, which typically include being actively engaged in farming and using the purchased items directly in agricultural production. To apply, farmers can download the certificate form from the Ohio Department of Taxation's website or request it from their local tax office. Once completed, the form should be submitted to the appropriate tax authority for approval.

Steps to Complete the Ohio Farming Blanket Exemption Certificate

Completing the Ohio Farming Blanket Exemption Certificate requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business name, address, and tax identification number.

- Clearly describe the items you intend to purchase tax-exempt.

- Sign and date the form to certify that the information provided is accurate and that the purchases will be used for qualified agricultural purposes.

- Keep a copy of the completed form for your records and provide the original to the seller at the time of purchase.

Legal Use of the Ohio Farming Blanket Exemption Certificate

The legal use of the Ohio Farming Blanket Exemption Certificate is governed by state tax laws. Farmers must ensure that the items purchased with this certificate are directly related to their farming operations. Common eligible items include seeds, fertilizers, and equipment. Misuse of the certificate, such as purchasing non-qualifying items, can result in penalties and back taxes. It is advisable for farmers to maintain accurate records of all transactions made under this exemption.

Eligibility Criteria for the Ohio Farming Blanket Exemption Certificate

To qualify for the Ohio Farming Blanket Exemption Certificate, applicants must meet specific eligibility criteria. These typically include:

- Being an active farmer engaged in agricultural production.

- Using the purchased items directly in farming activities.

- Possessing a valid tax identification number.

Farmers should review these criteria carefully to ensure compliance and avoid potential issues with tax authorities.

Examples of Using the Ohio Farming Blanket Exemption Certificate

Farmers can use the Ohio Farming Blanket Exemption Certificate in various scenarios. For example:

- Purchasing seeds and fertilizers from agricultural supply stores without paying sales tax.

- Acquiring farming equipment such as tractors and plows that are essential for agricultural production.

- Buying livestock feed and other necessary supplies that contribute to farm operations.

These examples illustrate how the exemption certificate can facilitate cost savings for farmers while ensuring compliance with state tax regulations.

Quick guide on how to complete ohio farming blanket exapmtion certificate

Easily prepare Ohio Farming Blanket Exapmtion Certificate on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without any delays. Manage Ohio Farming Blanket Exapmtion Certificate on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Ohio Farming Blanket Exapmtion Certificate effortlessly

- Locate Ohio Farming Blanket Exapmtion Certificate and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to finalize your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or errors that require new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your device of choice. Modify and eSign Ohio Farming Blanket Exapmtion Certificate and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio farming blanket exapmtion certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio agriculture tax exemption form?

The Ohio agriculture tax exemption form is a document that allows qualified farmers to purchase certain items without paying sales tax. It is crucial for managing costs effectively in the agricultural sector. By using this form, farmers can save money on necessary equipment and supplies, thereby benefiting their operations.

-

How can I obtain the Ohio agriculture tax exemption form?

You can obtain the Ohio agriculture tax exemption form from the Ohio Department of Taxation website or by contacting your local county auditor's office. Once you have the form, it’s essential to fill it out accurately to avoid any issues during the application process. Having this form is vital for farmers looking to exploit tax benefits.

-

Are there any fees associated with the Ohio agriculture tax exemption form?

No, there are no fees charged for obtaining or submitting the Ohio agriculture tax exemption form. The form is designed to support farmers financially by removing sales tax on eligible purchases. This exemption helps in reducing operational costs in the farming business.

-

What items can I purchase using the Ohio agriculture tax exemption form?

Farmers can use the Ohio agriculture tax exemption form to purchase supplies necessary for production, including seeds, fertilizer, and farming equipment. However, it's important to check the specific guidelines provided by the Ohio Department of Taxation regarding eligible items. Misuse of the exemption could lead to penalties, so be sure to understand the rules.

-

How does airSlate SignNow facilitate the use of the Ohio agriculture tax exemption form?

airSlate SignNow allows users to electronically sign and send the Ohio agriculture tax exemption form quickly and efficiently. Our platform simplifies the paperwork process, ensuring that your documents are error-free and properly submitted. This creates a smoother experience for farmers who need to secure their tax exemptions.

-

Are the forms electronically compatible with airSlate SignNow?

Yes, the Ohio agriculture tax exemption form is compatible with airSlate SignNow, allowing users to manage their documentation digitally. This feature enhances workflow efficiency and minimizes the need for physical paperwork. By integrating your agricultural forms with our platform, you can streamline the signing process signNowly.

-

Can I track the status of my Ohio agriculture tax exemption form submission?

With airSlate SignNow, you can easily track the status of your Ohio agriculture tax exemption form submission. Our tracking features ensure that you are notified of any updates or changes regarding your document's progress. This transparency helps you stay informed and organized during the application process.

Get more for Ohio Farming Blanket Exapmtion Certificate

- Small business management clark college form

- University rule 41 academicaffairs tamucc form

- Benilde reconsideration form

- 4drama medievalquest blm14tableauassessmentrubricdoc form

- Maryland dream act application form

- Special risk accident claim form

- Purchasing services independent contracts and agreements form

- Fillable online bar surg eval pre interview questionnaire form

Find out other Ohio Farming Blanket Exapmtion Certificate

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement