Income Tax Forms Department of Taxation and Finance NY Gov

What is the Income Tax Forms Department of Taxation and Finance NY gov

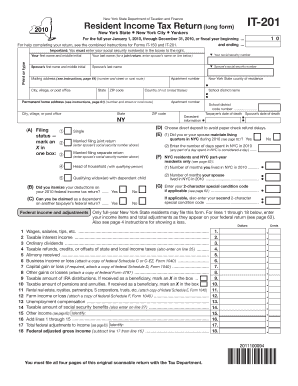

The Income Tax Forms Department of Taxation and Finance in New York is responsible for the administration and collection of state income taxes. This department provides various forms necessary for individuals and businesses to report their income, calculate tax obligations, and claim deductions or credits. These forms are essential for compliance with state tax laws and ensure that taxpayers fulfill their legal obligations.

How to use the Income Tax Forms Department of Taxation and Finance NY gov

Using the Income Tax Forms from the Department of Taxation and Finance involves several steps. First, identify the specific form required for your tax situation, such as the IT-201 for residents or IT-203 for non-residents. Next, download the form from the official website or access it through authorized tax software. After obtaining the form, carefully read the instructions provided to ensure accurate completion. Finally, submit the form electronically or via mail, depending on the submission options available for your chosen form.

Steps to complete the Income Tax Forms Department of Taxation and Finance NY gov

Completing the Income Tax Forms requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the correct form based on your residency status and income type.

- Fill out the form accurately, providing all required information such as personal details, income, and deductions.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring all required signatures are included.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Income Tax Forms Department of Taxation and Finance NY gov

The Income Tax Forms are legally binding documents that must be completed and submitted in accordance with state tax laws. To ensure legal validity, it is crucial to provide accurate information and comply with all filing requirements. Electronic submissions are considered valid as long as they meet the legal standards set forth by the state, including proper eSignature protocols. Failure to comply with these regulations can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Forms are critical for taxpayers to observe. Typically, individual income tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any specific deadlines for extensions or estimated tax payments. Staying informed about these dates helps avoid late fees and ensures compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their Income Tax Forms to the Department of Taxation and Finance. Forms can be submitted online through the state’s e-filing system, which is often faster and more secure. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address listed on the form instructions. In some cases, in-person submissions may be accepted at designated tax offices. It is important to verify the submission method for each specific form to ensure timely processing.

Quick guide on how to complete income tax forms department of taxation and finance ny gov

Complete Income Tax Forms Department Of Taxation And Finance NY gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly solution to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, edit, and eSign your documents swiftly without delays. Manage Income Tax Forms Department Of Taxation And Finance NY gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Income Tax Forms Department Of Taxation And Finance NY gov with ease

- Obtain Income Tax Forms Department Of Taxation And Finance NY gov and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax Forms Department Of Taxation And Finance NY gov and ensure outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax forms department of taxation and finance ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can I access my Income Tax Forms from the Department Of Taxation And Finance NY gov?

You can access your Income Tax Forms from the Department Of Taxation And Finance NY gov by visiting their official website. Ensure you have your personal information ready for verification. Once logged in, you can download the necessary forms directly.

-

What features does airSlate SignNow offer for handling Income Tax Forms?

airSlate SignNow offers various features to simplify the management of Income Tax Forms. Our platform allows for easy document creation, electronic signatures, and secure file sharing, making it ideal for handling forms related to the Department Of Taxation And Finance NY gov.

-

Is airSlate SignNow cost-effective for small businesses managing Income Tax Forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Income Tax Forms. Our pricing plans are designed to fit any budget, ensuring that you can get the necessary tools to handle your forms from the Department Of Taxation And Finance NY gov without overspending.

-

Can airSlate SignNow integrate with other software for filing Income Tax Forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software. This makes it easier to file your Income Tax Forms directly through tools that connect with the Department Of Taxation And Finance NY gov, streamlining your workflow.

-

What benefits does eSigning Income Tax Forms offer through airSlate SignNow?

eSigning your Income Tax Forms through airSlate SignNow offers numerous benefits. It enhances security, speeds up the signing process, and allows for tracking changes. Plus, it ensures compliance with e-signature laws, making it a reliable option for documents for the Department Of Taxation And Finance NY gov.

-

Are there any templates for Income Tax Forms available in airSlate SignNow?

Yes, airSlate SignNow provides pre-built templates for various Income Tax Forms. These templates are customizable and help streamline the process for users, ensuring that you can efficiently complete and submit the necessary paperwork to the Department Of Taxation And Finance NY gov.

-

How secure is my information when using airSlate SignNow for Income Tax Forms?

Security is a top priority at airSlate SignNow. When using our platform for Income Tax Forms, your information is encrypted and securely stored. We adhere to strict security standards to protect your sensitive data, especially regarding documents sent to the Department Of Taxation And Finance NY gov.

Get more for Income Tax Forms Department Of Taxation And Finance NY gov

Find out other Income Tax Forms Department Of Taxation And Finance NY gov

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document