F 1120a Form

What is the F 1120A

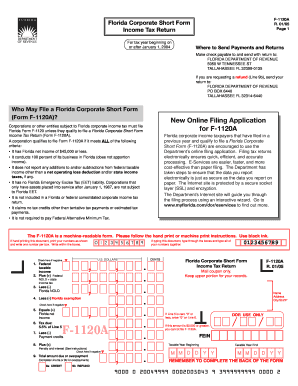

The F 1120A form is a simplified version of the standard corporate tax return used by certain corporations in the United States. This form is specifically designed for small corporations that meet specific criteria, allowing them to report their income, gains, losses, deductions, and credits. The F 1120A form streamlines the filing process, making it easier for eligible corporations to comply with federal tax regulations.

How to use the F 1120A

Using the F 1120A form involves several steps to ensure accurate reporting of a corporation's financial information. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax documents. Next, complete the form by entering the required information in the designated fields. Be sure to double-check all entries for accuracy. After completing the form, it must be signed by an authorized officer of the corporation before submission.

Steps to complete the F 1120A

Completing the F 1120A form requires careful attention to detail. Follow these steps:

- Gather financial records, including income and expenses.

- Fill out the form, starting with basic information about the corporation.

- Report total income, including sales and other revenue sources.

- Detail allowable deductions to reduce taxable income.

- Calculate the tax liability based on the reported income.

- Review the completed form for accuracy and completeness.

- Sign the form and prepare it for submission.

Legal use of the F 1120A

The F 1120A form is legally recognized for tax reporting purposes when completed accurately and submitted on time. To ensure the form's legal validity, it must comply with IRS regulations, including proper signatures and accurate financial reporting. Corporations must retain copies of the filed form and supporting documents for their records, as they may be required during audits or other inquiries by the IRS.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines associated with the F 1120A form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. It is important to file on time to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the F 1120A form, several documents are required. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing the corporation's assets, liabilities, and equity.

- Previous tax returns, if applicable, for reference.

- Any supporting documentation for deductions and credits claimed.

Quick guide on how to complete f 1120a

Prepare F 1120a effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the needed form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Manage F 1120a on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign F 1120a with ease

- Find F 1120a and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight relevant sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign F 1120a and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f 1120a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f 1120a form used for?

The f 1120a form is a simplified tax form for corporations in the United States. It is typically used by businesses to report income and calculate taxes owed. Completing the f 1120a accurately is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist with completing the f 1120a?

airSlate SignNow provides an easy-to-use platform that allows users to eSign and send documents securely, including the f 1120a form. With customizable templates, you can simplify the paperwork process and ensure all necessary signatures are obtained efficiently.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Whether you are filing the f 1120a for a small company or a large corporation, there is a plan that balances affordability with essential features like eSigning and document management.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features like document automation, templates, and comprehensive signing workflows that streamline processes such as filing the f 1120a. These tools help improve efficiency and ensure your documents are handled with precision and security.

-

Can airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow offers integrations with various popular software applications, including CRM and accounting tools. This means you can easily incorporate your workflow, particularly for managing forms like the f 1120a, into your existing tech stack.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides a fast, secure, and legally binding way to sign documents, including the f 1120a. This not only saves time but also reduces the risk of errors, allowing your business to stay compliant and organized.

-

Is airSlate SignNow safe and compliant for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, employing advanced encryption and compliance with industry standards to protect sensitive information. This ensures that your f 1120a and other important forms are handled with the utmost care and security.

Get more for F 1120a

- Uncontrolled when printed document to be superseded as of 07122013 to be superseded by form rt3187 12 13 published on 07092013

- Thurston county confidential sexually transmitted disease case report form and fax prescription for std treatment packs

- For the purposes of registry background clearance i the listed applicant hereby request that the arkansas child maltreatment form

- Directions at the end of each timed interval fill in the square indicating the the intensity of behavior observed during the form

- Fin 357 request to close provincial sales tax account use this form if you are requesting to close your provincial sales tax

- Employment 2016 use the sa1022016 supplementary pages to record your employment details when filing a tax return for the tax form

- Direct payment schemes for inheritance tax iht423 use this form to pay the inheritance tax due by transferring money from the

- Tax information for tsp participants receiving installment payments tax information for participants who are withdrawing their

Find out other F 1120a

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template