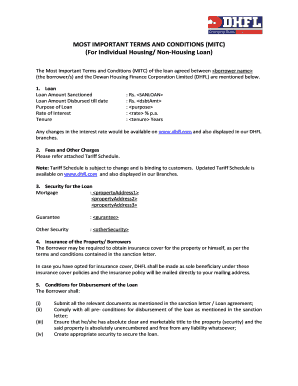

For Individual Housing Non Housing Loan Form

What is the For Individual Housing Non Housing Loan

The For Individual Housing Non Housing Loan form is a crucial document used in the United States for individuals seeking financing for housing-related expenses that do not fall under traditional housing loans. This form outlines the terms and conditions associated with the loan, including the purpose of the funds, repayment terms, and the borrower's obligations. Understanding this form is essential for individuals looking to secure financing for various housing needs, such as renovations, purchasing land, or other related expenses.

How to use the For Individual Housing Non Housing Loan

Using the For Individual Housing Non Housing Loan form involves several steps to ensure proper completion and submission. First, gather all necessary information, including personal identification details and financial information. Next, carefully fill out the form, making sure to provide accurate details regarding the loan amount and intended use of funds. After completing the form, review it for any errors or omissions before submitting it to the relevant financial institution or lender.

Steps to complete the For Individual Housing Non Housing Loan

Completing the For Individual Housing Non Housing Loan form requires attention to detail. Follow these steps:

- Gather required documents, such as proof of income and identification.

- Fill out personal information, including your name, address, and Social Security number.

- Specify the loan amount you are requesting and the purpose of the loan.

- Review all entries for accuracy and completeness.

- Sign and date the form to validate your application.

Legal use of the For Individual Housing Non Housing Loan

The legal use of the For Individual Housing Non Housing Loan form is governed by various regulations that ensure its validity and enforceability. For the form to be legally binding, it must be completed accurately, signed by the borrower, and submitted to a recognized financial institution. Compliance with federal and state laws regarding lending practices is crucial, as any discrepancies may lead to legal challenges or denial of the loan.

Eligibility Criteria

Eligibility for the For Individual Housing Non Housing Loan is typically based on several factors, including:

- Credit score: A higher credit score may improve your chances of approval.

- Income level: Lenders often require proof of stable income to assess repayment ability.

- Debt-to-income ratio: This ratio helps lenders determine your financial health and ability to take on additional debt.

- Purpose of the loan: The intended use of funds must align with the lender's criteria for approval.

Required Documents

To successfully complete the For Individual Housing Non Housing Loan form, you will need to provide several documents, including:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or tax returns to verify income.

- Bank statements to demonstrate financial stability.

- A detailed plan outlining how the loan funds will be used.

Quick guide on how to complete for individual housing non housing loan

Complete For Individual Housing Non Housing Loan effortlessly on any device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without any hold-ups. Handle For Individual Housing Non Housing Loan on any device with the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

How to adjust and eSign For Individual Housing Non Housing Loan with ease

- Locate For Individual Housing Non Housing Loan and then click Get Form to begin.

- Use the tools available to complete your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Dispose of the worry about lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign For Individual Housing Non Housing Loan while ensuring seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for individual housing non housing loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for Individual Housing Non Housing Loan?

The airSlate SignNow platform provides an efficient way to manage documentation for Individual Housing Non Housing Loan applications. It allows users to eSign and send required documents quickly, ensuring a streamlined process. This platform is designed to simplify the complexities typically associated with loan management.

-

How much does airSlate SignNow cost for Individual Housing Non Housing Loan services?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of those managing Individual Housing Non Housing Loan operations. The pricing structures are designed to be cost-effective, ensuring users can access premium features without breaking the bank. For a detailed breakdown of our pricing, you can visit our website.

-

What features does airSlate SignNow offer for Individual Housing Non Housing Loan applications?

Our platform offers features such as eSigning, document templates, secure cloud storage, and automated workflows specifically for Individual Housing Non Housing Loan documents. These features help streamline application processing and improve efficiency. Users can also customize documents to meet specific requirements.

-

How does airSlate SignNow enhance the benefits of Individual Housing Non Housing Loan processing?

By utilizing airSlate SignNow for Individual Housing Non Housing Loan processes, businesses can signNowly reduce paperwork and processing time. The platform increases accuracy, minimizes errors, and accelerates loan approvals. Furthermore, signing documents can be done anywhere, anytime, enhancing user convenience.

-

Can I integrate airSlate SignNow with other software for Individual Housing Non Housing Loan management?

Yes, airSlate SignNow supports integrations with various popular software tools that facilitate Individual Housing Non Housing Loan management. This ensures a smooth exchange of information across platforms, enhancing productivity. You can integrate our solution with CRM systems, document storage solutions, and more.

-

Is airSlate SignNow compliant with regulations for Individual Housing Non Housing Loan documents?

Absolutely, airSlate SignNow complies with all necessary regulations and standards concerning electronic signatures for Individual Housing Non Housing Loan documents. Our platform ensures that all electronic signatures are legally binding and secure. This compliance is vital for maintaining trust and credibility in personal and business transactions.

-

How secure is my data when using airSlate SignNow for Individual Housing Non Housing Loan?

The security of your data is our top priority at airSlate SignNow. We implement advanced encryption measures and secure storage practices to protect your documents related to Individual Housing Non Housing Loan. Regular security audits and compliance checks further enhance the safety of our platform.

Get more for For Individual Housing Non Housing Loan

- Breeding agreement tallin farm form

- Demand for revocation of stop lending notice individual form

- Cre contracts ampampamp regs flashcardsquizlet form

- Form approved omb no 0560 0120 wa 51 2 us department

- Records request form njcourts

- Facilities and equipment use agreement form

- Change o f information minnesota department of health

- Commercial purpose records request form

Find out other For Individual Housing Non Housing Loan

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document