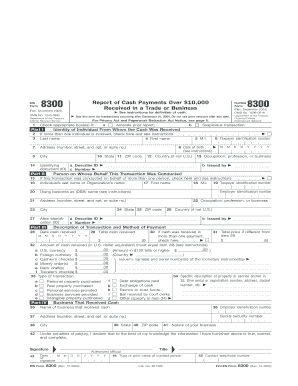

Form 8300

What is the Form 8300

The Form 8300 is a report used by businesses to report cash payments over ten thousand dollars received in a single transaction or related transactions. This form is essential for compliance with the Bank Secrecy Act, which aims to prevent money laundering and other financial crimes. The form requires detailed information about the transaction, including the payer's identity, the amount received, and the nature of the transaction. Businesses must file this form with the Internal Revenue Service (IRS) to ensure transparency and proper reporting of large cash transactions.

How to use the Form 8300

Using the Form 8300 involves several steps to ensure accurate reporting. First, businesses must determine if a transaction qualifies for reporting based on the cash payment threshold. If the payment exceeds ten thousand dollars, the business must complete the form. Next, gather all necessary information, including the payer's name, address, and Social Security number or Employer Identification Number. Once the form is filled out, it should be submitted to the IRS within 15 days of receiving the cash payment. Additionally, a copy of the form must be provided to the payer, ensuring they are aware of the reporting.

Steps to complete the Form 8300

Completing the Form 8300 requires attention to detail. Follow these steps:

- Gather information on the transaction, including the date, amount, and nature of the payment.

- Collect the payer's details: full name, address, and identification number.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS electronically or by mail within the required timeframe.

- Provide a copy of the form to the payer for their records.

Legal use of the Form 8300

The legal use of the Form 8300 is governed by federal regulations aimed at preventing financial crimes. Businesses must file this form to comply with the Bank Secrecy Act. Failure to report qualifying transactions can lead to significant penalties, including fines and legal repercussions. It is crucial for businesses to understand their obligations under this law and ensure that they file the form correctly and on time. Proper use of the form not only helps in legal compliance but also fosters trust and transparency in financial transactions.

Filing Deadlines / Important Dates

Timely filing of the Form 8300 is critical to avoid penalties. The form must be submitted to the IRS within 15 days of receiving a cash payment that meets the reporting threshold. Additionally, businesses should keep in mind that if they receive multiple cash payments that total over ten thousand dollars, they must report these transactions separately, adhering to the same filing deadline. Staying organized and aware of these deadlines can help businesses maintain compliance and avoid unnecessary complications.

Penalties for Non-Compliance

Non-compliance with the Form 8300 filing requirements can result in severe penalties. The IRS may impose fines for failing to file the form or for filing it late. Additionally, if a business knowingly fails to report a cash transaction, it may face criminal charges, including money laundering. It is essential for businesses to understand these risks and take the necessary steps to ensure compliance with reporting requirements. Maintaining accurate records and filing on time can help mitigate these risks and protect the business from potential legal issues.

Quick guide on how to complete form 8300

Finalize Form 8300 effortlessly on any device

Electronic document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents quickly without any holdups. Manage Form 8300 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Form 8300 effortlessly

- Obtain Form 8300 and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and then click on the Done button to retain your changes.

- Choose your preferred method of sending your form, whether by email, SMS, an invitation link, or by downloading it to your computer.

Eliminate worries over lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Adapt and electronically sign Form 8300 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8300

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8300 form and why is it important?

The 8300 form is used to report cash payments over $10,000 received in a trade or business. It's crucial for compliance with IRS regulations to prevent money laundering. Businesses must correctly file this form to avoid potential fines and legal issues.

-

How can airSlate SignNow help with the 8300 form?

airSlate SignNow simplifies the process of completing and submitting the 8300 form by allowing users to eSign and securely share documents online. Our platform ensures that your forms are completed accurately and stored safely. This enhances both compliance and convenience for your business.

-

Is there a cost associated with eSigning the 8300 form using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs, making it a cost-effective solution for eSigning the 8300 form and other documents. You can choose from monthly or annual subscriptions that fit your budget. This investment streamlines your documentation process, saving both time and money.

-

What features does airSlate SignNow offer for managing the 8300 form?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage specifically for managing the 8300 form. These tools ensure that you can easily create, send, and track your forms while maintaining compliance. Plus, our user-friendly interface makes the process straightforward.

-

Can I integrate airSlate SignNow with other software for processing the 8300 form?

Absolutely! airSlate SignNow supports integrations with various third-party applications like Zapier, making it easy to connect with tools you already use for processing the 8300 form. This helps streamline your workflow and enhances productivity by automating data transfer between platforms.

-

How secure is the data when using airSlate SignNow for the 8300 form?

Data security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 8300 form. We employ advanced encryption methods and comply with HIPAA and GDPR regulations to ensure that your information is protected. You can confidently sign and store documents knowing they are secure.

-

Can I access the 8300 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and eSign the 8300 form from any device. Whether you're in the office or on the go, our mobile app enables smooth document management. This flexibility ensures you can stay compliant no matter where you are.

Get more for Form 8300

- Enclosed are documents regarding the estate of name form

- Manual the portal to texas history form

- Name loan no 481375422 form

- This letter is to inform you that the cancellation of the subject deed of trust has been filed of

- County case no form

- Mortgage loan trust form

- City n a m e form

- Judgmentgarnishment form

Find out other Form 8300

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship