D 1040r Instructions Form

What is the D 1040r Instructions Form

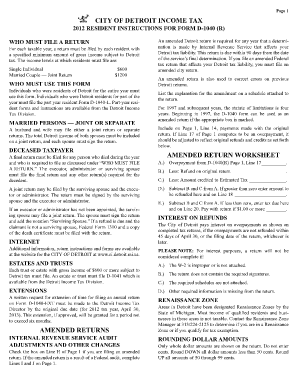

The D 1040r Instructions Form is a tax document used by individuals in the United States to provide guidance on completing the D 1040r form. This form is specifically designed for reporting certain tax information and ensuring compliance with federal tax regulations. It outlines the necessary steps, requirements, and important details that taxpayers need to consider while filling out their tax returns. Understanding this form is essential for accurate tax reporting and avoiding potential penalties.

How to use the D 1040r Instructions Form

Using the D 1040r Instructions Form involves carefully following the guidelines outlined within it. Taxpayers should begin by reading the instructions thoroughly to understand the information required. The form typically includes sections for personal information, income reporting, deductions, and credits. It is important to gather all necessary documentation, such as W-2s and 1099s, before starting the form. Once completed, the form can be submitted electronically or via mail, depending on individual preferences and requirements.

Steps to complete the D 1040r Instructions Form

Completing the D 1040r Instructions Form involves several key steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Read the instructions carefully to understand the requirements for each section.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Report all sources of income, ensuring that all figures are accurate and match your documentation.

- Detail any deductions or credits you are eligible for, following the guidelines provided.

- Review the completed form for accuracy and completeness before submission.

- Submit the form electronically or by mail, ensuring to keep a copy for your records.

Legal use of the D 1040r Instructions Form

The D 1040r Instructions Form is legally binding when completed and submitted in accordance with IRS regulations. It is crucial that taxpayers provide accurate and truthful information, as any discrepancies can lead to penalties or audits. The form must be signed and dated, affirming that the information provided is correct to the best of the taxpayer's knowledge. Compliance with all relevant tax laws ensures that the form is legally valid and protects against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the D 1040r Instructions Form are critical for taxpayers to observe. Typically, the deadline for submitting tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which can provide additional time to file. It is important to mark these dates on your calendar to avoid late penalties.

Required Documents

To successfully complete the D 1040r Instructions Form, several documents are required. These typically include:

- W-2 forms from employers, which report annual wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as interest or dividends.

- Receipts or records for deductions, such as medical expenses or charitable contributions.

- Previous tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The D 1040r Instructions Form can be submitted through various methods, providing flexibility for taxpayers. The primary submission options include:

- Online: Many taxpayers choose to file electronically using tax software, which often simplifies the process and ensures accuracy.

- Mail: Taxpayers can print and send the completed form via postal service. It is advisable to use certified mail for tracking purposes.

- In-Person: Some individuals may opt to file their taxes in person at designated IRS offices or through tax preparation services.

Quick guide on how to complete d 1040r instructions form

Effortlessly Prepare D 1040r Instructions Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and without delays. Manage D 1040r Instructions Form on any platform with airSlate SignNow's apps for Android or iOS and streamline your document-related tasks today.

The easiest way to adjust and eSign D 1040r Instructions Form with ease

- Find D 1040r Instructions Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight crucial sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign D 1040r Instructions Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 1040r instructions form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 1040r Instructions Form?

The D 1040r Instructions Form provides detailed guidance on how to complete your D 1040r tax return. It outlines the necessary steps, required documents, and important deadlines, ensuring you file correctly. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow assist with the D 1040r Instructions Form?

airSlate SignNow simplifies the eSigning process for your D 1040r Instructions Form. Our platform allows you to upload, sign, and send your tax documents securely, ensuring your forms are handled efficiently. This helps you meet deadlines without stress.

-

Are there any costs associated with using airSlate SignNow for D 1040r Instructions Form?

airSlate SignNow offers cost-effective pricing plans tailored for individuals and businesses needing to handle documents like the D 1040r Instructions Form. You can choose from various options to find a plan that suits your budget and document management needs. Additionally, many features come at no extra charge.

-

What features does airSlate SignNow provide for managing the D 1040r Instructions Form?

With airSlate SignNow, you get features like document templates, automatic reminders, and secure cloud storage for your D 1040r Instructions Form. These tools enhance your workflow, making it easier to manage your tax documents efficiently. Our intuitive interface ensures quick access to all necessary forms and functions.

-

Can I integrate airSlate SignNow with other software for the D 1040r Instructions Form?

Yes, airSlate SignNow integrates seamlessly with various software platforms, allowing you to manage your D 1040r Instructions Form alongside other tools you use. This includes CRM systems, accounting software, and more, streamlining your document processes. Integrations enhance efficiency and keep all your important documents connected.

-

What are the benefits of using airSlate SignNow for the D 1040r Instructions Form?

Using airSlate SignNow for your D 1040r Instructions Form means increased efficiency, enhanced security, and reduced turnaround time on document approvals. Our platform is user-friendly, making it easy for anyone to create, sign, and deliver tax documents promptly. Plus, you can access your documents anytime, anywhere.

-

Is airSlate SignNow user-friendly for the D 1040r Instructions Form?

Absolutely! airSlate SignNow is designed with user experience in mind, which means anyone can easily navigate the platform to manage their D 1040r Instructions Form. From uploading documents to obtaining signatures, the intuitive interface simplifies each step, even for those unfamiliar with digital document tools.

Get more for D 1040r Instructions Form

Find out other D 1040r Instructions Form

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple