Oregon Fuels Tax Refund Claim Form Fillable

What is the Oregon Fuels Tax Refund Claim Form Fillable

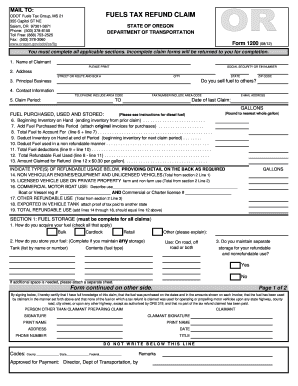

The Oregon Fuels Tax Refund Claim Form Fillable is a specific document used by individuals and businesses in Oregon to request a refund for certain fuel taxes paid. This form is essential for those who have incurred fuel costs in specific situations, such as agricultural use, off-road vehicle use, or other exempt purposes. The fillable version allows users to complete the form electronically, making the process more efficient and accessible.

How to use the Oregon Fuels Tax Refund Claim Form Fillable

Using the Oregon Fuels Tax Refund Claim Form Fillable involves several straightforward steps. First, download the form from a reliable source. Next, open the document in a PDF reader that supports fillable forms. Enter the required information, including personal details, fuel purchase information, and the reason for the refund claim. After completing the form, review it for accuracy, then save it for submission.

Steps to complete the Oregon Fuels Tax Refund Claim Form Fillable

Completing the Oregon Fuels Tax Refund Claim Form Fillable requires careful attention to detail. Follow these steps:

- Download the form and open it in a compatible PDF reader.

- Fill in your personal information, including name, address, and contact details.

- Provide details about the fuel purchased, including type, quantity, and purchase date.

- Indicate the specific reason for the refund request, ensuring it aligns with eligible categories.

- Review all entries for accuracy and completeness.

- Save the completed form to your device.

Legal use of the Oregon Fuels Tax Refund Claim Form Fillable

The Oregon Fuels Tax Refund Claim Form Fillable is legally binding when completed and submitted according to state regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the refund claim. The form must be signed digitally or physically, depending on the submission method chosen.

Eligibility Criteria

To qualify for a refund using the Oregon Fuels Tax Refund Claim Form Fillable, applicants must meet specific eligibility criteria. Generally, the fuel must have been purchased for exempt purposes, such as agricultural use, off-road activities, or certain government operations. Additionally, applicants must retain all relevant receipts and documentation to support their claims.

Form Submission Methods

The Oregon Fuels Tax Refund Claim Form Fillable can be submitted through various methods. Users may choose to file online through the appropriate state portal, mail the completed form to the designated tax office, or deliver it in person. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete oregon fuels tax refund claim form fillable

Effortlessly prepare Oregon Fuels Tax Refund Claim Form Fillable on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Oregon Fuels Tax Refund Claim Form Fillable on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

A seamless method to modify and eSign Oregon Fuels Tax Refund Claim Form Fillable

- Locate Oregon Fuels Tax Refund Claim Form Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Oregon Fuels Tax Refund Claim Form Fillable and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon fuels tax refund claim form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Fuels Tax Refund Claim Form Fillable?

The Oregon Fuels Tax Refund Claim Form Fillable is a digital document designed to help users easily submit their claims for fuel tax refunds in Oregon. By utilizing this fillable form, claimants can streamline the process without dealing with unnecessary paperwork, ensuring a quicker refund experience.

-

How can I access the Oregon Fuels Tax Refund Claim Form Fillable?

You can access the Oregon Fuels Tax Refund Claim Form Fillable directly from the airSlate SignNow platform. Simply visit the landing page, and you’ll find the form ready for download and electronic completion, ensuring a hassle-free experience.

-

Is the Oregon Fuels Tax Refund Claim Form Fillable free to use?

Yes, the Oregon Fuels Tax Refund Claim Form Fillable is available for free on our platform. Users can fill out and eSign the form without any subscription or hidden fees, making it a cost-effective solution for managing tax refund claims.

-

What features does the Oregon Fuels Tax Refund Claim Form Fillable offer?

The Oregon Fuels Tax Refund Claim Form Fillable features an intuitive design, enabling users to easily input their information and digitally sign the document. Additionally, it offers cloud storage and secure sharing options, ensuring your data remains protected throughout the process.

-

Can I save my progress while filling out the Oregon Fuels Tax Refund Claim Form Fillable?

Absolutely! The Oregon Fuels Tax Refund Claim Form Fillable allows users to save their progress at any point. This feature ensures you can return to complete the form at your convenience without losing any previously entered information.

-

How does the Oregon Fuels Tax Refund Claim Form Fillable benefit businesses?

Businesses benefit from the Oregon Fuels Tax Refund Claim Form Fillable by reducing the time and effort spent on tax refund processes. This streamlined approach enhances productivity, allowing businesses to focus on core operations while efficiently managing tax claims.

-

Is the Oregon Fuels Tax Refund Claim Form Fillable compatible with other software?

Yes, the Oregon Fuels Tax Refund Claim Form Fillable is compatible with various document management systems and can be easily integrated into your existing software. This compatibility facilitates seamless workflows and enhances overall operational efficiency.

Get more for Oregon Fuels Tax Refund Claim Form Fillable

- Get the district of columbia letter from tenant to landlord form

- Notice of dismissal pursuant to rule 41a1i form

- Roommates subletting and assignment landlord and tenant form

- Notice of discovery form

- What tenants need to know about subleases and justia form

- Campbell v general motors corp 19 f supp 2d 1260 nd form

- Plaintiffs united states of americas and state of michigans form

- Your refusal to allow my recently requested sub lease was unreasonable and without any rational form

Find out other Oregon Fuels Tax Refund Claim Form Fillable

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast