Rev 276 Extension Form

What is the Rev 276 Extension

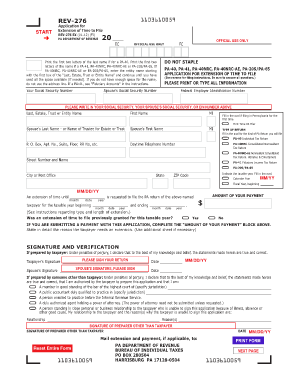

The Rev 276 extension is a specific form used in the United States for requesting an extension of time to file certain tax returns. It is crucial for individuals and businesses who need additional time beyond the standard deadline to prepare their tax documents accurately. This extension form allows taxpayers to avoid penalties for late filing while ensuring compliance with IRS regulations.

How to use the Rev 276 Extension

Using the Rev 276 extension involves a few straightforward steps. First, obtain the form from the IRS website or through authorized tax software. Fill out the required information, including your name, address, and the type of return for which you are requesting an extension. Ensure that all details are accurate to avoid processing delays. Once completed, submit the form either electronically or by mail, depending on your preference and the specific guidelines provided by the IRS.

Steps to complete the Rev 276 Extension

Completing the Rev 276 extension requires careful attention to detail. Follow these steps for successful submission:

- Gather all necessary personal and financial information.

- Download the Rev 276 extension form from the IRS website.

- Fill in your personal details, including your Social Security number or Employer Identification Number.

- Indicate the type of tax return for which you are requesting an extension.

- Review the form for accuracy and completeness.

- Submit the form electronically via approved tax software or mail it to the appropriate IRS address.

Legal use of the Rev 276 Extension

The Rev 276 extension is legally recognized by the IRS, provided it is filled out correctly and submitted on time. It grants taxpayers additional time to file their returns without incurring penalties for late submission. However, it is important to note that this extension does not extend the time to pay any taxes owed. Taxpayers must ensure that any payments are made by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Rev 276 extension are critical to avoid penalties. Typically, the extension request must be submitted by the original due date of the tax return. For individual taxpayers, this is usually April 15. If that date falls on a weekend or holiday, the deadline may be adjusted. It is essential to stay informed about any changes in deadlines to ensure compliance.

Required Documents

When completing the Rev 276 extension, certain documents may be necessary to support your request. These can include:

- Previous year’s tax return for reference.

- Any relevant income statements, such as W-2s or 1099s.

- Documentation of deductions or credits you plan to claim.

Having these documents on hand can streamline the completion process and ensure accuracy.

Quick guide on how to complete rev 276 extension

Complete Rev 276 Extension effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without holdups. Manage Rev 276 Extension on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Rev 276 Extension effortlessly

- Find Rev 276 Extension and click Get Form to get started.

- Use the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Rev 276 Extension to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 276 extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rev 276 extension and how does it work?

The rev 276 extension is a powerful tool designed to enhance document management and eSigning processes. It integrates seamlessly with airSlate SignNow, allowing users to send, receive, and sign documents efficiently. This extension streamlines workflow and enhances collaboration among team members.

-

How much does the rev 276 extension cost?

Pricing for the rev 276 extension is competitive and varies based on the subscription plan chosen for airSlate SignNow. Typically, it offers flexible payment options that cater to businesses of all sizes. For detailed pricing information, visit the pricing page on our website.

-

What features are included with the rev 276 extension?

The rev 276 extension includes features like customizable templates, real-time tracking, and advanced security options. Users can enjoy improved document management with easy access to eSigning features and status updates. This combination makes managing contracts and agreements easier and more efficient.

-

Can I integrate the rev 276 extension with other applications?

Yes, the rev 276 extension is designed to integrate seamlessly with various apps and platforms, enhancing your workflow. This capability allows for automatic synchronization of documents and eSignatures across your favorite software. Popular integrations include CRM systems and project management tools.

-

What are the benefits of using the rev 276 extension for my business?

Using the rev 276 extension can greatly increase productivity through its streamlined eSigning and document management features. This extension reduces turnaround time for contract approvals and provides a secure environment for handling sensitive documents. Overall, it's a cost-effective solution for improving business efficiency.

-

Is the rev 276 extension secure for handling sensitive documents?

Absolutely! The rev 276 extension offers robust security features such as encryption and secure cloud storage. Compliance with industry standards also ensures that your sensitive documents are protected throughout the signing process. Trust is paramount, and we prioritize the safety of your data.

-

How can I get support for the rev 276 extension?

Support for the rev 276 extension is readily available through our dedicated customer service team. Users can signNow out via email, chat, or through our comprehensive help center filled with guides and FAQs. Our goal is to ensure you maximize the benefits of the airSlate SignNow platform.

Get more for Rev 276 Extension

- Dr 308 hybrid custody calculation form

- How to fill out the child support guidelines affidavit form dr

- Fillable online dr 314 information sheet 1006 fax email

- Faqdivision of child support servicesgeorgia department form

- Dr 316 information about cssd 714 state of alaska

- Motion and affidavit to modify custody visitation andor child form

- Dr 322 order re motion to continue support for 18 year old form

- Dr 361 motion to modify another states child support order form

Find out other Rev 276 Extension

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney