Multiple Tax Rate Schedule L City of Port Huron Porthuron Form

What is the Multiple Tax Rate Schedule L City Of Port Huron Porthuron

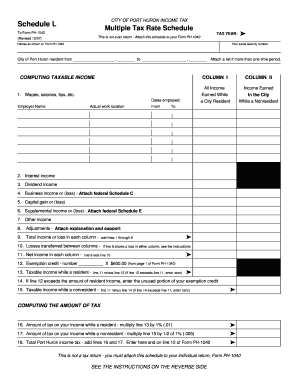

The Multiple Tax Rate Schedule L City Of Port Huron Porthuron is a specific tax form used by residents and businesses within the City of Port Huron, Michigan. This form is designed to help taxpayers report their income and calculate the appropriate tax rates applicable to their situation. The schedule outlines various tax rates based on income levels, ensuring compliance with local tax regulations. Understanding this form is essential for accurate tax reporting and fulfilling local tax obligations.

How to use the Multiple Tax Rate Schedule L City Of Port Huron Porthuron

Using the Multiple Tax Rate Schedule L involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by entering your income details in the designated sections. It is important to refer to the tax rate table provided within the form to determine the correct tax rate applicable to your income bracket. Finally, review all entries for accuracy before submitting the form to the appropriate tax authority.

Steps to complete the Multiple Tax Rate Schedule L City Of Port Huron Porthuron

Completing the Multiple Tax Rate Schedule L requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as W-2s or 1099 forms.

- Begin filling out the form with your personal information, including your name and address.

- Input your total income in the specified section.

- Consult the tax rate schedule to find the applicable rate based on your income level.

- Calculate the total tax owed and ensure all figures are accurate.

- Sign and date the form before submission.

Legal use of the Multiple Tax Rate Schedule L City Of Port Huron Porthuron

The legal use of the Multiple Tax Rate Schedule L is governed by local tax laws and regulations. This form must be filled out accurately to ensure compliance with tax obligations. Electronic signatures are accepted, provided they meet the legal standards set by the ESIGN Act and other relevant laws. It is essential to keep a copy of the completed form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Multiple Tax Rate Schedule L are crucial for compliance. Typically, local tax forms must be submitted by April fifteenth each year. However, it is advisable to check with the City of Port Huron for any specific deadlines or extensions that may apply. Staying informed about these dates helps avoid penalties and ensures timely processing of your tax return.

Required Documents

To complete the Multiple Tax Rate Schedule L, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Previous year’s tax return for reference.

- Any additional income documentation, such as rental income or investment earnings.

Quick guide on how to complete multiple tax rate schedule l city of port huron porthuron

Effortlessly Complete Multiple Tax Rate Schedule L City Of Port Huron Porthuron on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and efficiently. Manage Multiple Tax Rate Schedule L City Of Port Huron Porthuron from any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Multiple Tax Rate Schedule L City Of Port Huron Porthuron with Ease

- Locate Multiple Tax Rate Schedule L City Of Port Huron Porthuron and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Multiple Tax Rate Schedule L City Of Port Huron Porthuron to ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the multiple tax rate schedule l city of port huron porthuron

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Multiple Tax Rate Schedule L for the City of Port Huron?

The Multiple Tax Rate Schedule L for the City of Port Huron is a detailed framework outlining varying tax rates applicable to different property classifications. It helps residents and businesses understand their tax obligations more clearly. By utilizing airSlate SignNow, you can easily manage and sign documents related to the tax schedule.

-

How can airSlate SignNow assist with the Multiple Tax Rate Schedule L documentation?

airSlate SignNow simplifies the process of managing documents related to the Multiple Tax Rate Schedule L for the City of Port Huron. With our platform, you can eSign, send, and store important tax documents securely and efficiently. This ensures that you stay organized and compliant with local tax regulations.

-

What are the key features of airSlate SignNow that support tax document management?

Key features of airSlate SignNow include easy-to-use eSigning tools, customizable templates for tax documents, and secure cloud storage. These features allow users to create, send, and manage forms related to the Multiple Tax Rate Schedule L for the City of Port Huron efficiently. By streamlining these processes, we save you time and reduce the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, there are various pricing plans available to suit different business needs. airSlate SignNow offers a cost-effective solution for managing documents related to the Multiple Tax Rate Schedule L for the City of Port Huron. You can choose a plan that best fits your budget and usage requirements.

-

Can I integrate other tools with airSlate SignNow for managing tax documents?

Absolutely! airSlate SignNow offers integrations with popular business applications such as Google Drive, Salesforce, and Microsoft Office. This ensures that your workflow for handling documents related to the Multiple Tax Rate Schedule L for the City of Port Huron is seamless and efficient, enhancing overall productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with tax filings?

By utilizing airSlate SignNow, businesses can enjoy benefits like improved compliance, reduced turnaround times for documents, and enhanced security for sensitive tax information. Our platform is designed to support users dealing with the Multiple Tax Rate Schedule L for the City of Port Huron, ensuring that you can focus on running your business rather than getting bogged down by paperwork.

-

How can I ensure my tax documents comply with the Multiple Tax Rate Schedule L requirements?

With airSlate SignNow, you can access customizable templates that adhere to the requirements of the Multiple Tax Rate Schedule L for the City of Port Huron. Our platform also allows you to collaborate with team members to ensure all necessary information is included before submission. This helps ensure that your documents are compliant and accurate.

Get more for Multiple Tax Rate Schedule L City Of Port Huron Porthuron

- Training contract sunborn stables form

- Free pdf ebooks and manuals freebookeenet form

- Business shipping services ampampamp direct mail optionsuspscom form

- To aslessee form

- Persons to use this account are form

- Comes now defendant and hereby propounds the following form

- Sample interrogatories and admissions to send to ca form

- Arkansas limited liability company operating agreement form

Find out other Multiple Tax Rate Schedule L City Of Port Huron Porthuron

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free