Filing Out E500 Form

What is the Filing Out E500 Form

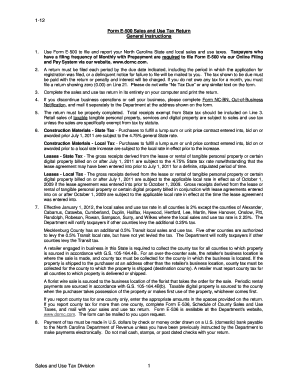

The Filing Out E500 Form is a specific document used for various purposes, often related to tax reporting or compliance within businesses. It serves as a formal request or declaration that must be completed accurately to ensure adherence to legal standards. The form may be required by state or federal agencies, depending on the context in which it is used. Understanding its purpose and requirements is crucial for individuals and businesses alike.

How to use the Filing Out E500 Form

To effectively use the Filing Out E500 Form, begin by gathering all necessary information and documentation required for completion. This may include personal identification details, financial records, or other relevant data. Carefully follow the instructions provided with the form, ensuring each section is filled out accurately. Once completed, review the form for any errors or omissions before submission to avoid delays or complications.

Steps to complete the Filing Out E500 Form

Completing the Filing Out E500 Form involves several key steps:

- Obtain the latest version of the form from the appropriate source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal and business information as required.

- Provide any necessary financial details or supporting documentation.

- Review the completed form for accuracy.

- Submit the form according to the specified submission method.

Legal use of the Filing Out E500 Form

The legal use of the Filing Out E500 Form is essential for ensuring compliance with applicable laws and regulations. This form must be filled out with accurate information to maintain its validity. Misrepresentation or errors can lead to legal penalties, including fines or other consequences. It is important to understand the legal implications associated with the form and to ensure it is used in accordance with all relevant guidelines.

Required Documents

When filling out the Filing Out E500 Form, certain documents may be required to support the information provided. Commonly required documents include:

- Identification documents such as a driver's license or Social Security card.

- Financial statements or records relevant to the filing.

- Previous tax returns if applicable.

- Any additional documentation specified in the form instructions.

Form Submission Methods

The Filing Out E500 Form can typically be submitted through various methods, depending on the requirements set by the issuing agency. Common submission methods include:

- Online submission via the agency's official website.

- Mailing the completed form to the designated address.

- In-person submission at specified locations.

Quick guide on how to complete filing out e500 form

Effortlessly Prepare Filing Out E500 Form on Any Device

Managing documents online has become increasingly common among businesses and individuals. It presents an excellent eco-friendly option to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Filing Out E500 Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Filing Out E500 Form with Ease

- Obtain Filing Out E500 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Filing Out E500 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filing out e500 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the E500 Form and why do I need it?

The E500 Form is a crucial document for businesses dealing with certain tax obligations. Filing Out E500 Form ensures compliance with the necessary regulations and helps you manage your tax filings more effectively.

-

How do I start Filing Out E500 Form using airSlate SignNow?

To begin Filing Out E500 Form, simply sign up for airSlate SignNow, upload your document, and use our intuitive interface to fill in the required fields. Our platform allows for easy editing and collaboration, making the process seamless.

-

What features does airSlate SignNow offer for Filing Out E500 Form?

airSlate SignNow provides a comprehensive set of features including eSigning, template creation, and document sharing specifically designed for Filing Out E500 Form. These tools enhance document management and streamline your workflow.

-

Is airSlate SignNow cost-effective for businesses?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By simplifying the process of Filing Out E500 Form, you can save both time and money, making it an ideal solution for your business.

-

Can I integrate airSlate SignNow with other software for Filing Out E500 Form?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and accounting software, enhancing your ability to manage documents like the E500 Form. This integration simplifies data transfer and eliminates redundant work.

-

What are the benefits of using airSlate SignNow for Filing Out E500 Form?

Using airSlate SignNow for Filing Out E500 Form provides numerous benefits including enhanced efficiency, secure storage, and easy access from any device. This ensures that your documents are managed efficiently and securely.

-

Is technical support available for issues related to Filing Out E500 Form?

Yes, airSlate SignNow offers dedicated technical support to assist you with any issues related to Filing Out E500 Form. Our support team is available to ensure that your experience is smooth and any concerns are promptly addressed.

Get more for Filing Out E500 Form

- Alaska declare this as a codicil to my will dated form

- Alaska last will and testamentlegal will formsus

- Divorce links precious heart form

- Receive the property form

- By the notary form

- Fields 36 38 form

- Free alaska living will templates pdf ampamp docxformswift

- How to create a living trust in alaska smartasset form

Find out other Filing Out E500 Form

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast