Fillable 760 Form

What is the fillable 760 form

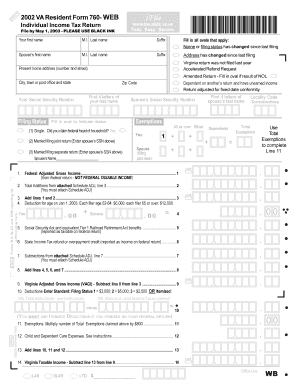

The fillable 760 form is a state income tax return used by residents of Virginia to report their income and calculate their tax liability. This form is essential for individuals and businesses to ensure compliance with state tax laws. It captures various income types, deductions, and credits, allowing taxpayers to accurately assess their financial obligations to the state. The form is designed to be user-friendly, making it easier for taxpayers to complete their returns electronically.

How to use the fillable 760 form

Using the fillable 760 form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, access the fillable form online and input your information directly into the designated fields. Ensure that you follow the instructions provided for each section to avoid errors. After completing the form, review all entries for accuracy before submitting it electronically or printing it for mailing.

Steps to complete the fillable 760 form

Completing the fillable 760 form can be streamlined by following these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Access the fillable 760 form through a trusted online platform.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include wages, interest, and dividends.

- Claim applicable deductions and credits to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it out for mailing, ensuring it is sent by the appropriate deadline.

Legal use of the fillable 760 form

The fillable 760 form is legally binding when completed accurately and submitted in accordance with Virginia state tax laws. To ensure its legal standing, taxpayers must provide truthful information and retain copies of all submitted documents. The form must be filed by the designated deadline to avoid penalties. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for the fillable 760 form are crucial for compliance. Typically, the deadline to submit the form is May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available for filing, which may require additional forms to be submitted. Staying informed about these dates helps avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the fillable 760 form. The most efficient method is online submission through a secure platform that supports electronic filing. This method often results in faster processing times. Alternatively, taxpayers can print the completed form and mail it to the appropriate state tax office. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt. Each method has its advantages, and taxpayers should choose based on their preferences and circumstances.

Quick guide on how to complete fillable 760 form

Effortlessly Prepare Fillable 760 Form on Any Device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents swiftly without delays. Handle Fillable 760 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign Fillable 760 Form With Ease

- Obtain Fillable 760 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Fillable 760 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable 760 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable 760 form?

A fillable 760 form is a digital document used for Virginia state income tax returns. It allows taxpayers to input their financial information easily and efficiently. With airSlate SignNow, you can create and customize your fillable 760 form to streamline your tax preparation process.

-

How does airSlate SignNow help with the fillable 760 form?

airSlate SignNow simplifies the process of completing the fillable 760 form by providing an intuitive interface for editing and signing. You can quickly add data, make changes, and ensure that all necessary information is included. Plus, it allows for easy storage and sharing of your completed forms.

-

Is there a cost associated with using the fillable 760 form on airSlate SignNow?

While airSlate SignNow offers competitive pricing plans, there are typically no hidden fees for creating a fillable 760 form. You can choose a plan that fits your needs, ensuring you can easily manage your documents without breaking your budget. Check the pricing page for the best option for your business.

-

Can I customize the fillable 760 form using airSlate SignNow?

Yes, airSlate SignNow allows full customization of the fillable 760 form. You can add fields, adjust formats, and include various elements according to your requirements. This customization ensures that your form meets your specific needs and complies with all necessary regulations.

-

What are the benefits of using a fillable 760 form?

Using a fillable 760 form offers several benefits, including improved accuracy and efficiency in your tax preparation. Digital forms reduce the likelihood of errors and make it easy to track changes. Additionally, airSlate SignNow ensures your forms are securely stored and easily accessible.

-

Does airSlate SignNow integrate with other software for managing fillable 760 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your workflow efficiency when dealing with fillable 760 forms. Whether you need to connect with accounting software or document management systems, airSlate SignNow has you covered for smooth interoperability.

-

How secure are my fillable 760 forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. Your fillable 760 forms are protected with advanced encryption and compliance protocols, ensuring that your sensitive financial information remains confidential. We take extensive measures to safeguard all your documents during the signing process.

Get more for Fillable 760 Form

- For executors trustees administrators and other form

- Grantor or grantee form

- Control number al sdeed 8 1 form

- How to add a new owner to the title deed to real estate form

- Arkansas quitclaim deed from individual to us legal forms

- California quitclaim deed from individual to us legal forms

- Alabama quitclaim deed from one individual us legal forms

- Alabama warranty deed from husband and wife us legal forms

Find out other Fillable 760 Form

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document