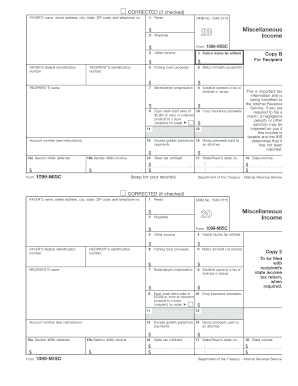

Omb No 1545 0115 Form

What is the OMB No ?

The OMB No is a form issued by the Internal Revenue Service (IRS) that is primarily used for tax-related purposes. This form plays a crucial role in various tax documentation processes, ensuring compliance with federal regulations. It is essential for individuals and businesses to understand the specific requirements associated with this form to avoid complications during tax filing.

How to Use the OMB No

Using the OMB No involves several steps to ensure accurate completion and submission. First, gather all necessary information related to your tax situation, including income details, deductions, and credits. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. This form can be filed electronically or mailed to the appropriate IRS address, depending on your preference and circumstances.

Steps to Complete the OMB No

Completing the OMB No requires a systematic approach:

- Gather required documents, such as W-2s, 1099s, and any other relevant tax forms.

- Fill out the form accurately, ensuring that all personal information is correct.

- Double-check all calculations to ensure accuracy.

- Sign and date the form where required.

- Submit the form electronically or via mail, following the IRS guidelines for your specific situation.

Legal Use of the OMB No

The legal use of the OMB No is governed by IRS regulations. This form must be completed accurately to ensure compliance with federal tax laws. Failure to use the form correctly can result in penalties or delays in processing tax returns. It is crucial to understand the legal implications of submitting this form, as it serves as an official document in the eyes of the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the OMB No are typically aligned with the annual tax filing season. Generally, individual taxpayers must submit their forms by April 15 of each year. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes in deadlines or requirements announced by the IRS to avoid late filing penalties.

Required Documents

To complete the OMB No , several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions and credits

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete omb no 1545 0115 11917509

Effortlessly Complete Omb No 1545 0115 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and eSign your documents without delays. Handle Omb No 1545 0115 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The Simplest Way to Modify and eSign Omb No 1545 0115 with Ease

- Obtain Omb No 1545 0115 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, a process that takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Omb No 1545 0115 to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the omb no 1545 0115 11917509

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is OMB No 1545 0115 and how does it relate to airSlate SignNow?

OMB No 1545 0115 is a unique identifier used by the IRS for certain tax forms and their digital signatures. With airSlate SignNow, you can easily manage these forms and ensure compliance. Our solution makes it simple to eSign and submit documents that require this specific OMB number.

-

How does airSlate SignNow help with eSigning documents related to OMB No 1545 0115?

airSlate SignNow offers a seamless eSigning experience for all documents, including those requiring OMB No 1545 0115. Our platform allows users to sign, send, and track these forms effortlessly, ensuring your submissions are timely and compliant.

-

What pricing options are available for using airSlate SignNow with documents involving OMB No 1545 0115?

We offer competitive pricing plans to meet the needs of businesses using airSlate SignNow for documents tied to OMB No 1545 0115. Each plan is designed to provide features that enhance your document workflow, ensuring cost-effectiveness.

-

Are there any features specific to handling OMB No 1545 0115 with airSlate SignNow?

Yes, airSlate SignNow provides specialized features for handling documents related to OMB No 1545 0115. This includes secure storage, customizable templates, and automated workflows that streamline the eSigning process and maintain compliance.

-

What are the benefits of using airSlate SignNow for OMB No 1545 0115 compliant documents?

Using airSlate SignNow for OMB No 1545 0115 compliant documents offers numerous benefits, including enhanced security, reduced turnaround time, and improved document tracking. Our platform ensures that your forms are managed efficiently while adhering to regulatory standards.

-

Can airSlate SignNow integrate with other tools for managing OMB No 1545 0115 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications and systems to manage OMB No 1545 0115 forms effectively. This feature allows for a cohesive workflow, making it easy to connect with your existing software for enhanced productivity.

-

Is airSlate SignNow user-friendly for managing OMB No 1545 0115 documents?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for individuals and businesses to manage OMB No 1545 0115 documents. Our intuitive interface simplifies the eSigning process, ensuring a straightforward experience for all users.

Get more for Omb No 1545 0115

- Fillable online roll call vote city of grass valley fax form

- Alternative dispute resolution statement to form

- Attorney settlement officer survey form

- Attorney settlement officer form

- Optional form 1012 travel voucher gsagov

- Ao 120 form mailed to us patent and trademark office for

- Ao 121 report on the filing or determination of an action or appeal regarding a copyright pdf conversion 1 march 26 2003 form

- Ao 193 request for personnel action form

Find out other Omb No 1545 0115

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online