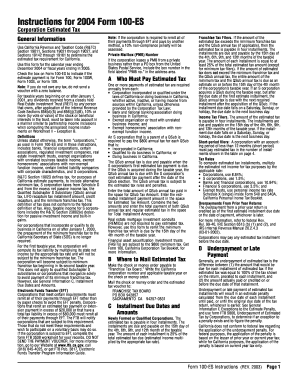

Corporation Estimated Tax 100 Es Form

What is the Corporation Estimated Tax 100 Es Form

The Corporation Estimated Tax 100 Es Form is a crucial document used by corporations in the United States to report and pay estimated tax liabilities. This form is specifically designed for corporations that expect to owe tax of $500 or more when they file their annual return. By submitting this form, corporations can ensure they are meeting their tax obligations throughout the year, rather than facing a large tax bill at the end of the fiscal year.

How to use the Corporation Estimated Tax 100 Es Form

To effectively use the Corporation Estimated Tax 100 Es Form, corporations must first calculate their estimated tax liability based on expected income, deductions, and credits. Once the estimated amount is determined, the corporation can fill out the form, providing necessary details such as the corporation's name, address, and Employer Identification Number (EIN). It is important to keep a copy of the completed form for record-keeping and to ensure compliance with IRS regulations.

Steps to complete the Corporation Estimated Tax 100 Es Form

Completing the Corporation Estimated Tax 100 Es Form involves several key steps:

- Gather financial information: Collect data on expected income, deductions, and credits for the tax year.

- Calculate estimated tax: Use the gathered information to determine the estimated tax liability.

- Fill out the form: Enter the corporation's details and the calculated estimated tax amount on the form.

- Review for accuracy: Double-check all entries for correctness to avoid errors.

- Submit the form: Choose a submission method, such as online, by mail, or in person.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Corporation Estimated Tax 100 Es Form. Generally, estimated tax payments are due quarterly, with deadlines typically falling on the 15th day of April, June, September, and December. It is essential for corporations to mark these dates on their calendars to avoid penalties for late payments.

Penalties for Non-Compliance

Failure to file the Corporation Estimated Tax 100 Es Form or to make the required estimated tax payments can result in significant penalties. The IRS may impose fines based on the amount owed and the duration of non-compliance. Additionally, interest may accrue on any unpaid tax, further increasing the financial burden on the corporation.

Who Issues the Form

The Corporation Estimated Tax 100 Es Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides this form as part of its efforts to ensure that corporations fulfill their tax obligations in a timely manner.

Quick guide on how to complete corporation estimated tax 100 es form

Complete Corporation Estimated Tax 100 Es Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Corporation Estimated Tax 100 Es Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Corporation Estimated Tax 100 Es Form seamlessly

- Find Corporation Estimated Tax 100 Es Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with the tools offered by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searching, or errors that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Corporation Estimated Tax 100 Es Form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporation estimated tax 100 es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Corporation Estimated Tax 100 Es Form?

The Corporation Estimated Tax 100 Es Form is a tax form that corporations in certain jurisdictions use to report and pay estimated income taxes. Using this form, businesses estimate their tax liability for the year and can avoid penalties for underpayment. It's essential for maintaining compliance with tax obligations.

-

How can airSlate SignNow help with the Corporation Estimated Tax 100 Es Form?

airSlate SignNow simplifies the process of preparing and submitting the Corporation Estimated Tax 100 Es Form by enabling users to eSign and send documents securely. With our platform, businesses can enhance workflow efficiency and ensure timely submissions. This can help reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet the needs of businesses of all sizes. Our plans provide access to essential features that can streamline the handling of documents like the Corporation Estimated Tax 100 Es Form. For specific pricing details, please visit our website.

-

Does airSlate SignNow integrate with accounting software?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your Corporation Estimated Tax 100 Es Form and other tax documents. This integration helps ensure that your tax data is synchronized and reduces the chances of errors. Check our integration options to explore compatible applications.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust document management features, including eSignature capabilities, document templates, and real-time collaboration. These features facilitate the efficient handling of crucial documents such as the Corporation Estimated Tax 100 Es Form. Users can track document status and receive notifications for added convenience.

-

Can multiple users collaborate on the Corporation Estimated Tax 100 Es Form in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on documents, including the Corporation Estimated Tax 100 Es Form. This feature promotes teamwork and ensures that all necessary inputs are gathered before submission. It's an ideal solution for teams dealing with complex tax forms.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, employing encryption and secure storage methods for documents like the Corporation Estimated Tax 100 Es Form. Our platform adheres to industry-standard security protocols to protect your sensitive information. You can trust us to keep your tax documents safe.

Get more for Corporation Estimated Tax 100 Es Form

Find out other Corporation Estimated Tax 100 Es Form

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy