Form 571 L

What is the Form 571 L

The Form 571 L is a document utilized in Santa Barbara County for property tax assessment purposes. It serves as a declaration for personal property owned by businesses and individuals. This form is essential for reporting the value of personal property to the county tax assessor, ensuring that property taxes are accurately assessed and collected. The information provided on the form helps the county determine the taxable value of the property, which is critical for local funding and services.

How to use the Form 571 L

Using the Form 571 L involves accurately reporting all personal property owned as of January first of each year. This includes items such as machinery, equipment, and furnishings. The form must be completed with precise details regarding the type, quantity, and value of the property. Once filled out, it should be submitted to the Santa Barbara County Assessor's Office by the specified deadline to ensure compliance with local tax regulations.

Steps to complete the Form 571 L

Completing the Form 571 L requires several key steps:

- Gather all necessary information regarding personal property owned as of January first.

- Accurately fill out each section of the form, providing details about the type and value of the property.

- Review the completed form for accuracy and completeness to avoid potential penalties.

- Submit the form to the Santa Barbara County Assessor's Office by the deadline, either online or via mail.

Legal use of the Form 571 L

The legal use of the Form 571 L is governed by California property tax laws. It is crucial that the information provided is truthful and complete, as inaccuracies can lead to penalties or legal repercussions. The form must be filed annually, and failure to do so can result in the assessment of penalties or additional taxes. Compliance with the legal requirements ensures that property taxes are calculated fairly and accurately.

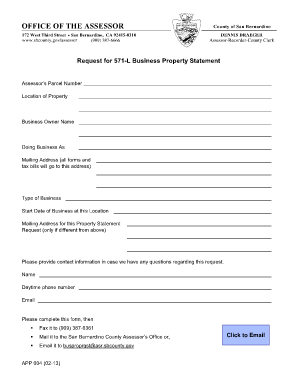

Key elements of the Form 571 L

Key elements of the Form 571 L include:

- Identification of the property owner and their contact information.

- A detailed list of personal property, including descriptions and estimated values.

- Certification statement affirming the truthfulness of the information provided.

- Signature of the property owner or authorized representative.

Form Submission Methods

The Form 571 L can be submitted through various methods to accommodate the needs of property owners:

- Online: Many counties offer electronic submission options through their official websites.

- Mail: The completed form can be mailed directly to the Santa Barbara County Assessor's Office.

- In-Person: Property owners may also choose to deliver the form in person at the Assessor's Office.

Quick guide on how to complete form 571 l 100115296

Prepare Form 571 L effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 571 L on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Form 571 L with ease

- Locate Form 571 L and click Get Form to begin.

- Use our provided tools to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 571 L and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 571 l 100115296

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 571l Santa Barbara form used for?

The 571l Santa Barbara form is primarily used for property tax assessments in Santa Barbara County. It helps property owners report the sale or transfer of property, ensuring accurate tax calculations. Understanding how to fill out this form can signNowly benefit homeowners and real estate agents in the area.

-

How does airSlate SignNow streamline the 571l Santa Barbara eSigning process?

airSlate SignNow simplifies the eSigning process for the 571l Santa Barbara form by providing a user-friendly platform for document management. Users can easily upload, sign, and send documents securely online. This saves time and increases the efficiency of handling essential paperwork.

-

What are the pricing options for using airSlate SignNow for 571l Santa Barbara forms?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses dealing with 571l Santa Barbara forms. Pricing is competitive and varies depending on the features you require. Investing in this solution can help streamline your document processes cost-effectively.

-

Can I integrate airSlate SignNow with other tools for managing 571l Santa Barbara documents?

Yes, airSlate SignNow allows seamless integration with various applications used in managing 571l Santa Barbara documents. These integrations include CRM systems and cloud storage services, which enhance document workflow efficiency. This flexibility can signNowly improve your overall document handling process.

-

What are the benefits of using airSlate SignNow for handling the 571l Santa Barbara form?

Using airSlate SignNow for the 571l Santa Barbara form provides numerous benefits, including enhanced security, ease of access, and real-time tracking of document status. Users can save time and eliminate paper-based processes, making their operations more environmentally friendly. Additionally, the platform is accessible from anywhere, ensuring convenience.

-

Is airSlate SignNow mobile-friendly for completing the 571l Santa Barbara form?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to complete the 571l Santa Barbara form anytime and anywhere. This flexibility ensures that you can manage your important documents on the go, keeping your workflow uninterrupted.

-

What security measures does airSlate SignNow implement for 571l Santa Barbara documents?

airSlate SignNow prioritizes security with advanced encryption, ensuring that all your 571l Santa Barbara documents are protected. Compliance with industry standards and regular security audits guarantees that your data remains safe from unauthorized access. Trusting this platform means you can focus on your business without worrying about security.

Get more for Form 571 L

- Grantors do hereby convey and warrant unto a corporation form

- Husband and wife and husband and wife form

- Control number az 053 77 form

- Control number az 053 78 form

- Eight individuals to two individuals form

- Husband and wife two 2 individuals form

- Beneficiary or t form

- Mortgage help forum loansafeorg form

Find out other Form 571 L

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF