Form 8825

What is the Form 8825

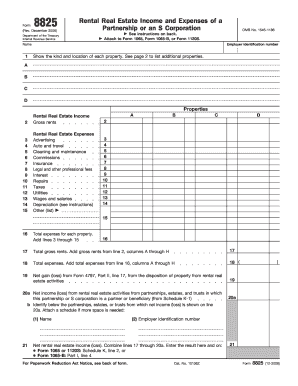

The IRS Form 8825 is used to report income and expenses from rental real estate activities. This form is specifically designed for partnerships and S corporations that own rental properties. It allows these entities to detail their rental income, expenses, and depreciation deductions, which are essential for accurate tax reporting. Understanding the purpose of Form 8825 is crucial for ensuring compliance with IRS regulations and for maximizing potential tax benefits.

How to use the Form 8825

Using Form 8825 involves a few key steps. First, gather all necessary information regarding your rental properties, including income received and expenses incurred. Next, accurately complete the form by entering the details of each property in the designated sections. It is important to categorize expenses correctly, as this can impact your overall tax liability. Finally, ensure that the form is signed by an authorized representative of the partnership or S corporation before submission.

Steps to complete the Form 8825

Completing Form 8825 requires attention to detail. Follow these steps for accurate submission:

- Begin by entering the name and address of the partnership or S corporation.

- List each rental property separately, providing a description and the address.

- Report the total rental income received for each property.

- Detail all expenses related to each property, including repairs, maintenance, and management fees.

- Calculate depreciation for each property, which can significantly affect taxable income.

- Review the completed form for accuracy and ensure all necessary signatures are included.

Legal use of the Form 8825

Form 8825 is legally binding when accurately completed and submitted in accordance with IRS guidelines. It is essential to maintain thorough records of all income and expenses reported on the form. The IRS may audit these forms, so ensuring compliance with tax laws is vital. Using a reliable eSignature platform can enhance the legal validity of your submission by providing a secure method for signing and storing documents.

Filing Deadlines / Important Dates

Form 8825 must be filed along with the entity's tax return. For most partnerships and S corporations, the deadline is March 15 of each year. If additional time is needed, a six-month extension can be requested. It is important to adhere to these deadlines to avoid penalties and interest on any unpaid taxes. Keeping a calendar of important dates can help ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 8825 can be submitted in several ways. The preferred method is electronic filing, which can expedite processing and reduce the risk of errors. Alternatively, you can mail the completed form to the appropriate IRS address based on your location. In-person submission is generally not available for Form 8825, as the IRS does not accept walk-in forms for this specific filing. Always check the IRS website for the latest submission guidelines and addresses.

Quick guide on how to complete form 8825

Complete Form 8825 effortlessly on any gadget

Web-based document management has become widely adopted by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8825 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign Form 8825 with ease

- Obtain Form 8825 and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8825 and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8825

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8825 and how is it used?

Form 8825 is a tax form used by partnerships and S corporations to report income and expenses from rental real estate. With airSlate SignNow, you can easily create, send, and eSign Form 8825, ensuring compliance and accuracy in your financial reporting.

-

How can airSlate SignNow help with Form 8825?

airSlate SignNow streamlines the process of managing Form 8825 by allowing you to create and eSign documents quickly. This ensures that all your taxpayer-related forms, including Form 8825, are handled efficiently and securely.

-

Is airSlate SignNow affordable for small businesses needing Form 8825?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses, making it an affordable choice for managing Form 8825. Our cost-effective solution allows you to save on resources while ensuring compliance with your rental income reporting.

-

What features does airSlate SignNow offer for handling Form 8825?

airSlate SignNow provides a user-friendly interface, customizable templates, and electronic signature capabilities for efficient handling of Form 8825. These features help simplify the preparation and submission process while enhancing productivity.

-

Can I integrate airSlate SignNow with other software for Form 8825?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software that can help you manage Form 8825 seamlessly. This integration allows for better data flow and reduces the likelihood of errors.

-

How secure is airSlate SignNow when handling Form 8825?

Security is a top priority at airSlate SignNow. When handling Form 8825, we utilize advanced encryption methods and secure servers, ensuring that your sensitive information is protected during the eSigning process.

-

What are the benefits of using airSlate SignNow for eSigning Form 8825?

Utilizing airSlate SignNow for eSigning Form 8825 offers numerous benefits, including improved efficiency, reduced turnaround time, and enhanced compliance. Our platform simplifies the signing process, allowing you to focus on your business growth.

Get more for Form 8825

- The undersigned hereby certifyies that heshethey have been informed that

- The remaining amount owed under the contract is form

- Fillable online iowa buyers home inspection checklist fax email print pdffiller form

- Provide appraisal to name and address of lender if selling form

- Prenup templates mt fill online printable fillable blank form

- Except as otherwise provided in this agreement the premarital agreement referenced form

- Creating a prenuptial agreementwoodmen financial form

- Open source framework v 3 software repository linux form

Find out other Form 8825

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF