What is a Reaffirmation Agreement? United States Bankruptcy Form

What is a reaffirmation agreement in United States bankruptcy?

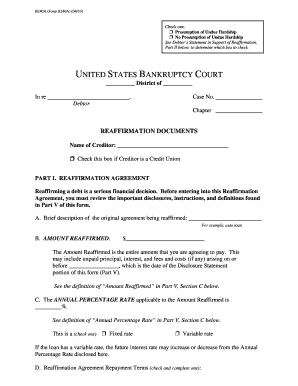

A reaffirmation agreement is a legal document that allows a debtor to reaffirm their obligation to repay a specific debt despite filing for bankruptcy. This agreement is particularly relevant in Chapter Seven bankruptcy cases, where certain debts can be discharged. By entering into a reaffirmation agreement, the debtor agrees to continue making payments on the debt, which can help retain valuable assets, such as a car or home. It is essential for debtors to understand that reaffirming a debt means they remain liable for it, even after bankruptcy proceedings are completed.

Key elements of a reaffirmation agreement

Several key elements define a reaffirmation agreement. These include:

- Identification of the debt: The agreement must clearly specify the debt being reaffirmed, including the creditor's name and the amount owed.

- Debtor's consent: The debtor must voluntarily agree to reaffirm the debt, which means they understand the implications of continuing to owe the money.

- Creditor's acceptance: The creditor must also accept the reaffirmation agreement, indicating they are willing to continue the relationship.

- Filing with the court: The reaffirmation agreement must be filed with the bankruptcy court, typically within a specific time frame after the bankruptcy filing.

Steps to complete a reaffirmation agreement

Completing a reaffirmation agreement involves several steps:

- Review your debts: Assess which debts you want to reaffirm and ensure they are necessary for your financial situation.

- Consult with your attorney: It is advisable to discuss your decision with a bankruptcy attorney to understand the legal implications.

- Obtain the agreement form: Acquire the necessary reaffirmation agreement form, which can often be provided by your attorney or the creditor.

- Complete the form: Fill out the form with accurate information regarding the debt and your agreement to reaffirm it.

- Sign and file: Sign the completed agreement and file it with the bankruptcy court, ensuring it is submitted within the required timeframe.

Legal use of a reaffirmation agreement

The legal use of a reaffirmation agreement is governed by bankruptcy law. It is crucial that the agreement complies with the requirements set forth by the U.S. Bankruptcy Code. This includes the need for the debtor to be fully informed about the consequences of reaffirming the debt. Courts often require a hearing to ensure that the debtor is not being coerced into reaffirming a debt and that it is in their best interest. If the agreement is approved, it becomes legally binding, and the debtor must adhere to the payment terms outlined in the document.

How to obtain a reaffirmation agreement

To obtain a reaffirmation agreement, you can follow these steps:

- Contact your creditor: Reach out to the creditor associated with the debt you wish to reaffirm. They can provide you with the necessary forms and information.

- Consult your attorney: If you have legal representation, your attorney can assist you in obtaining and completing the reaffirmation agreement.

- Access online resources: Some legal websites and bankruptcy resources may offer templates or guidance on how to create a reaffirmation agreement.

Examples of using a reaffirmation agreement

Reaffirmation agreements are commonly used in various scenarios, including:

- Automobile loans: A debtor may choose to reaffirm an auto loan to keep their vehicle, allowing them to continue making payments and avoid repossession.

- Mortgage loans: Homeowners may reaffirm their mortgage to retain their home, ensuring they continue to make monthly payments.

- Personal loans: Debtors may reaffirm personal loans to maintain their credit relationship with the lender, which can be beneficial for future borrowing.

Quick guide on how to complete what is a reaffirmation agreement united states bankruptcy

Complete What Is A Reaffirmation Agreement? United States Bankruptcy effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle What Is A Reaffirmation Agreement? United States Bankruptcy on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign What Is A Reaffirmation Agreement? United States Bankruptcy with ease

- Obtain What Is A Reaffirmation Agreement? United States Bankruptcy and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using the specific tools that airSlate SignNow provides.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from your chosen device. Modify and eSign What Is A Reaffirmation Agreement? United States Bankruptcy and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is a reaffirmation agreement united states bankruptcy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a reaffirmation agreement in the context of United States Bankruptcy?

A reaffirmation agreement is a legal document that allows a debtor to retain certain assets while reaffirming their debt obligations under United States Bankruptcy laws. By signing this agreement, debtors reaffirm their commitment to pay back a specific debt, typically related to secured loans like mortgages or car loans.

-

How does a reaffirmation agreement impact credit after bankruptcy?

Signing a reaffirmation agreement can impact your credit score positively if you maintain timely payments, as it shows lenders your commitment to repay certain debts. However, failure to comply with the terms may have negative repercussions on your credit history under United States Bankruptcy.

-

Is there a fee associated with creating a reaffirmation agreement?

While airSlate SignNow provides an easy and cost-effective solution for creating eSigned documents, specific fees for reaffirmation agreements may vary based on legal advice and the complexity of your case. It's advisable to consult your bankruptcy attorney for precise costs related to using reaffirmation agreements in the United States Bankruptcy system.

-

What are the benefits of using airSlate SignNow for reaffirmation agreements?

Using airSlate SignNow, you can quickly create, send, and eSign reaffirmation agreements, streamlining the process during your United States Bankruptcy proceedings. The platform's easy-to-use interface and secure electronic signature capabilities ensure that you can manage your documents efficiently and securely.

-

Can a reaffirmation agreement be revoked after it’s signed?

Yes, a reaffirmation agreement can be revoked under certain conditions, even after being signed. In the context of United States Bankruptcy, debtors typically have a limited period after signing to change their minds, which highlights the importance of understanding the agreement thoroughly before committing.

-

What types of debts can be included in a reaffirmation agreement?

In the United States Bankruptcy context, reaffirmation agreements commonly cover secured debts like mortgages and auto loans. Unsecured debts, such as credit card debts, cannot be reaffirmed under these agreements, allowing consumers to relieve themselves from these financial obligations.

-

How can I ensure my reaffirmation agreement is legally compliant?

To ensure your reaffirmation agreement complies with United States Bankruptcy laws, it's advisable to consult a qualified bankruptcy attorney who can guide you through the legal nuances. Additionally, using tools like airSlate SignNow can help you streamline the creation and signing process, enhancing compliance with required regulations.

Get more for What Is A Reaffirmation Agreement? United States Bankruptcy

Find out other What Is A Reaffirmation Agreement? United States Bankruptcy

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile