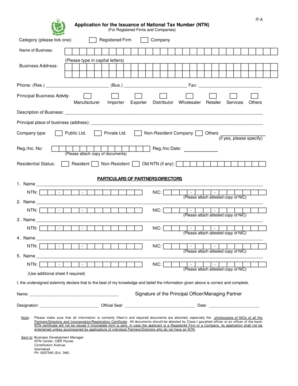

BApplicationb for the Issuance of National Tax Number NTN Bb Form

What is the BApplicationb For The Issuance Of National Tax Number NTN Bb

The BApplicationb for the issuance of national tax number NTN Bb is a formal document required for individuals and businesses to obtain a National Tax Number (NTN) from the Internal Revenue Service (IRS). This number is essential for tax identification purposes, allowing taxpayers to file their taxes accurately and comply with federal regulations. The NTN is particularly important for businesses, as it enables them to conduct transactions legally and ensures they meet their tax obligations.

Steps to complete the BApplicationb For The Issuance Of National Tax Number NTN Bb

Completing the BApplicationb for the issuance of national tax number NTN Bb involves several key steps:

- Gather necessary personal and business information, including Social Security numbers and business structure details.

- Access the application form through the IRS website or other authorized platforms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application electronically or via mail, depending on the chosen method.

Legal use of the BApplicationb For The Issuance Of National Tax Number NTN Bb

The BApplicationb for the issuance of national tax number NTN Bb must be used in accordance with IRS guidelines to ensure its legal validity. This includes providing accurate information and adhering to submission deadlines. Failure to comply with these regulations can result in penalties or delays in receiving the NTN. It is crucial for applicants to understand the legal implications of the information they provide on the form.

Required Documents

When applying for the BApplicationb for the issuance of national tax number NTN Bb, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport.

- Social Security number or Employer Identification Number (EIN) for businesses.

- Business registration documents, if applicable.

Having these documents ready can streamline the application process and help ensure that the form is completed accurately.

Application Process & Approval Time

The application process for the BApplicationb for the issuance of national tax number NTN Bb generally involves submitting the completed form along with any required documents. Once submitted, applicants can expect a processing time of approximately four to six weeks, although this may vary based on the volume of applications received by the IRS. It is advisable to apply well in advance of any tax deadlines to avoid potential delays.

Form Submission Methods (Online / Mail / In-Person)

The BApplicationb for the issuance of national tax number NTN Bb can be submitted through various methods:

- Online: Many applicants prefer to submit the form electronically via the IRS website for faster processing.

- Mail: The form can also be printed and sent to the appropriate IRS address, which is specified on the form itself.

- In-Person: In some cases, applicants may choose to visit a local IRS office to submit their application directly.

Choosing the right submission method can impact the speed and efficiency of the application process.

Quick guide on how to complete bapplicationb for the issuance of national tax number ntn bb

Effortlessly Prepare BApplicationb For The Issuance Of National Tax Number NTN Bb on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage BApplicationb For The Issuance Of National Tax Number NTN Bb on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign BApplicationb For The Issuance Of National Tax Number NTN Bb effortlessly

- Obtain BApplicationb For The Issuance Of National Tax Number NTN Bb and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and electronically sign BApplicationb For The Issuance Of National Tax Number NTN Bb and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bapplicationb for the issuance of national tax number ntn bb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BApplicationb For The Issuance Of National Tax Number NTN Bb?

The BApplicationb For The Issuance Of National Tax Number NTN Bb is a formal request submitted to acquire a National Tax Number, which is essential for tax compliance. It provides businesses with a unique identifier for tax purposes and is required for filing taxes and conducting various business transactions.

-

How can airSlate SignNow assist in the BApplicationb For The Issuance Of National Tax Number NTN Bb?

airSlate SignNow streamlines the process of submitting your BApplicationb For The Issuance Of National Tax Number NTN Bb by allowing you to create, sign, and send documents electronically. This reduces paperwork and simplifies compliance, making it easy to focus on your business.

-

Are there any costs associated with using airSlate SignNow for the BApplicationb For The Issuance Of National Tax Number NTN Bb?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and designed to provide excellent value by optimizing the BApplicationb For The Issuance Of National Tax Number NTN Bb process while enhancing overall efficiency.

-

What features does airSlate SignNow offer for the BApplicationb For The Issuance Of National Tax Number NTN Bb?

airSlate SignNow provides features like electronic signatures, document templates, and automated workflows that cater specifically to the BApplicationb For The Issuance Of National Tax Number NTN Bb. These tools help you save time and reduce errors, ensuring a smooth application process.

-

Can I integrate airSlate SignNow with other tools for the BApplicationb For The Issuance Of National Tax Number NTN Bb?

Absolutely! airSlate SignNow supports numerous integrations with popular business applications. This ensures that your BApplicationb For The Issuance Of National Tax Number NTN Bb fits seamlessly into your existing workflow, enhancing productivity.

-

What are the benefits of using airSlate SignNow for my BApplicationb For The Issuance Of National Tax Number NTN Bb?

Using airSlate SignNow for your BApplicationb For The Issuance Of National Tax Number NTN Bb offers you the benefits of speed, security, and ease of use. You can complete applications faster than traditional methods while ensuring that your data remains secure and organized.

-

How secure is airSlate SignNow when dealing with the BApplicationb For The Issuance Of National Tax Number NTN Bb?

Security is a top priority at airSlate SignNow. The platform utilizes industry-standard encryption and security protocols to protect your documents related to the BApplicationb For The Issuance Of National Tax Number NTN Bb, ensuring your sensitive information remains confidential.

Get more for BApplicationb For The Issuance Of National Tax Number NTN Bb

- Sold horse disclaimer studylib form

- Control number fl 03 82 form

- This form should be used when a husband and wife are filing for a simplified dissolution of marriage

- This will acknowledge your request for the forms and instructions to form a florida limited liability company

- Control number fl 031 77 form

- Eight 8 individuals to one 1 individual form

- That i an adult resident citizen of form

- Florida advance health care directive form 1 pdf formate

Find out other BApplicationb For The Issuance Of National Tax Number NTN Bb

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter