Miller Trust Revised with Successor Trustee Arkansas Legal Services Form

Understanding the Miller Trust Revised With Successor Trustee in Arkansas

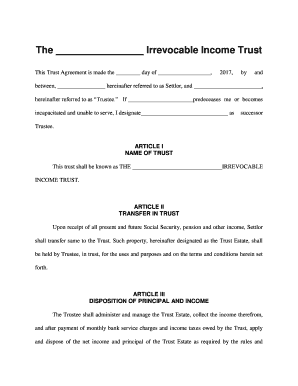

The Miller Trust, also known as a Qualified Income Trust, is a legal instrument designed to help individuals qualify for Medicaid benefits while maintaining a higher income level than typically allowed. In Arkansas, this trust allows individuals to place excess income into a trust, ensuring they meet Medicaid eligibility requirements. The revised version includes provisions for a successor trustee, which ensures that the trust is managed according to the individual's wishes even after their passing or if they become incapacitated.

Steps to Complete the Miller Trust Revised With Successor Trustee in Arkansas

Completing the Miller Trust involves several key steps to ensure its legality and effectiveness. Begin by gathering necessary personal and financial information, including income sources and expenses. Next, draft the trust document, clearly outlining the terms, including the appointment of a successor trustee. It is advisable to consult with a legal professional to ensure compliance with Arkansas laws. Once the document is prepared, sign it in the presence of a notary public to validate its authenticity. Finally, fund the trust by transferring the appropriate income into it, ensuring that it aligns with Medicaid regulations.

Legal Use of the Miller Trust Revised With Successor Trustee in Arkansas

The legal framework surrounding the Miller Trust in Arkansas is designed to protect the assets of individuals while allowing them to qualify for Medicaid. This trust must be established in accordance with state laws to ensure its validity. It is crucial to follow the guidelines set forth by the Arkansas Department of Human Services to avoid complications during Medicaid eligibility determinations. The trust must be irrevocable, meaning that once established, the terms cannot be changed, ensuring that the assets are used solely for the benefit of the beneficiary.

Key Elements of the Miller Trust Revised With Successor Trustee in Arkansas

Several key elements define the Miller Trust in Arkansas. First, the trust must include a clear statement of its purpose, which is to hold excess income for Medicaid eligibility. Second, the designation of a successor trustee is essential; this person or entity will manage the trust if the original trustee is unable to do so. Additionally, the trust must comply with state regulations regarding income limits and allowable expenses. Proper documentation must be maintained to demonstrate compliance with Medicaid requirements, ensuring that the trust serves its intended purpose without legal complications.

Eligibility Criteria for the Miller Trust Revised With Successor Trustee in Arkansas

To establish a Miller Trust in Arkansas, individuals must meet specific eligibility criteria. Primarily, the individual must be applying for Medicaid benefits and have income that exceeds the allowable limit. The trust is particularly beneficial for those who require long-term care services but wish to preserve their assets. It is essential that the trust be irrevocable and that the income placed within it is used solely for the benefit of the individual, aligning with Medicaid regulations. Consulting with a legal expert can help clarify any additional requirements specific to individual circumstances.

Quick guide on how to complete miller trust revised with successor trustee arkansas legal services

Effortlessly Prepare Miller Trust Revised With Successor Trustee Arkansas Legal Services on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any hiccups. Manage Miller Trust Revised With Successor Trustee Arkansas Legal Services on any device through the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Miller Trust Revised With Successor Trustee Arkansas Legal Services with Ease

- Obtain Miller Trust Revised With Successor Trustee Arkansas Legal Services and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Miller Trust Revised With Successor Trustee Arkansas Legal Services and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the miller trust revised with successor trustee arkansas legal services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Miller Trust in Arkansas?

A Miller Trust in Arkansas is a legal tool that helps individuals qualify for Medicaid while protecting their income. This type of trust allows excess income to be set aside, ensuring that applicants can meet the financial eligibility criteria for Medicaid services without losing their assets.

-

How can airSlate SignNow help with creating a Miller Trust in Arkansas?

With airSlate SignNow, you can easily create, manage, and securely sign documents related to setting up a Miller Trust in Arkansas. Our platform simplifies the process by allowing you to eSign essential documents and store them securely, ensuring compliance with legal requirements.

-

What are the benefits of using airSlate SignNow for a Miller Trust in Arkansas?

Using airSlate SignNow for a Miller Trust in Arkansas provides numerous benefits, including time-saving digital workflows, secure document storage, and easy accessibility from any device. Our solution also allows for collaborative editing, making it easier for legal representatives and families to work together.

-

Is airSlate SignNow cost-effective for setting up a Miller Trust in Arkansas?

Yes, airSlate SignNow offers a cost-effective solution for individuals and professionals looking to set up a Miller Trust in Arkansas. Our competitive pricing plans ensure that you can manage your documents affordably without compromising on features and security.

-

What features does airSlate SignNow offer for Miller Trust documentation?

AirSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning that are perfect for managing Miller Trust documentation in Arkansas. These features streamline the process, reduce paperwork, and enhance compliance, making it easier for users.

-

Can airSlate SignNow integrate with other tools for managing a Miller Trust in Arkansas?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can enhance the management of a Miller Trust in Arkansas. This includes compatibility with cloud storage services, CRM systems, and document management software, facilitating a seamless workflow.

-

How secure is the airSlate SignNow platform for Miller Trust documents in Arkansas?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect Miller Trust documents in Arkansas, ensuring that sensitive information remains confidential and is only accessible by authorized users.

Get more for Miller Trust Revised With Successor Trustee Arkansas Legal Services

- Petition of conservator for leave to sell property or rent lease or otherwise dispose of form

- Free 2 petition for temporary letters of administration 1 form

- Temporary legal guardianship form georgia free download

- Free letters legal forms findformscom

- Petition for letters of conservatorship of minor gpcsf 30 form

- Georgia probate court standard form petition for discharge

- Georgia probate court standard form petition of

- Adult conservatorship inventory and asset management plan form

Find out other Miller Trust Revised With Successor Trustee Arkansas Legal Services

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure