TSB M 815 5C1281Information for Fuel Oil Dealers,tsbm8155c Tax Ny

Understanding the TSB M 8155C Information for Fuel Oil Dealers

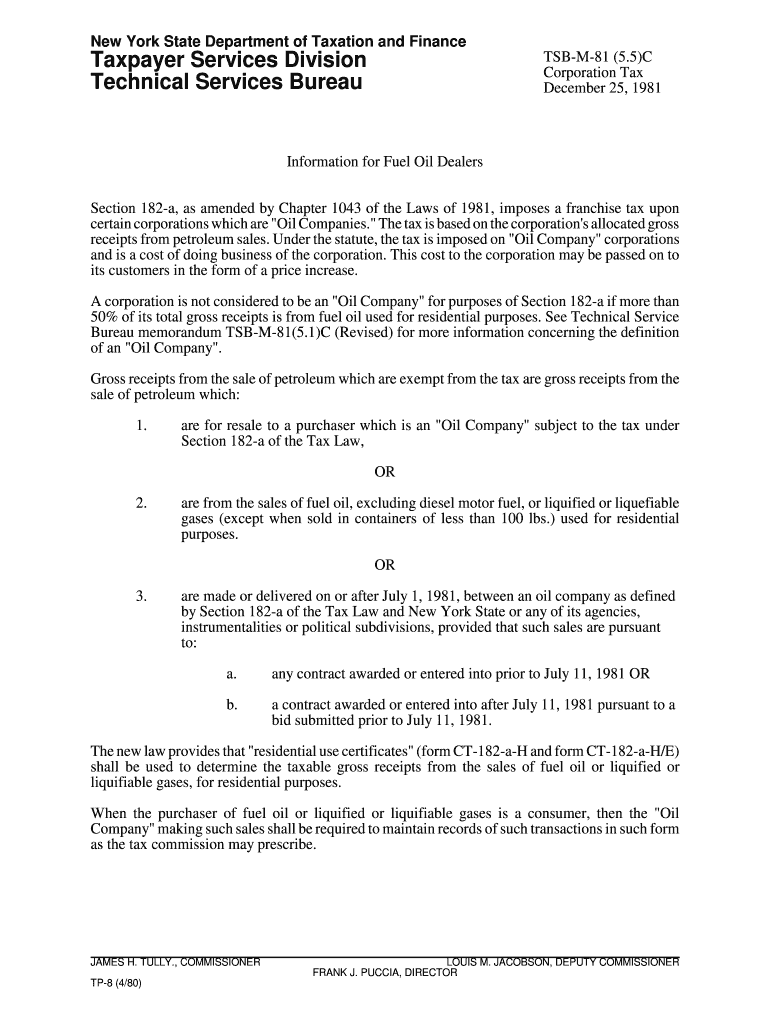

The TSB M 8155C is a specific form required for fuel oil dealers in New York. This document serves as a tax reporting tool, detailing the sales and usage of fuel oil, which is crucial for compliance with state regulations. Understanding this form is essential for businesses in the fuel oil industry to ensure accurate reporting and avoid penalties.

Steps to Complete the TSB M 8155C Information for Fuel Oil Dealers

Completing the TSB M 8155C involves several steps to ensure accuracy and compliance. Begin by gathering all necessary sales records and usage data related to fuel oil. Next, fill out the form with precise information, including your business details and the total amount of fuel oil sold. Ensure that all calculations are correct, as errors can lead to complications with tax authorities. Finally, review the completed form for accuracy before submission.

Legal Use of the TSB M 8155C Information for Fuel Oil Dealers

The TSB M 8155C must be completed in accordance with state laws governing fuel oil sales. This includes adhering to specific reporting requirements and deadlines. The form is legally binding and must be filed accurately to avoid potential legal repercussions. Compliance with the relevant regulations ensures that businesses can operate without interruption and maintain good standing with tax authorities.

Obtaining the TSB M 8155C Information for Fuel Oil Dealers

To obtain the TSB M 8155C, fuel oil dealers can typically download the form from the New York State Department of Taxation and Finance website or request a physical copy from local tax offices. It is important to ensure that you are using the most current version of the form to comply with any recent changes in regulations.

Examples of Using the TSB M 8155C Information for Fuel Oil Dealers

Fuel oil dealers may use the TSB M 8155C to report various transactions, such as bulk sales to commercial clients or residential deliveries. For instance, a dealer who sells heating oil to a local business would need to document the sale on this form. Accurate reporting helps maintain transparency and accountability in the fuel oil market.

Filing Deadlines and Important Dates for the TSB M 8155C

It is crucial for fuel oil dealers to be aware of filing deadlines associated with the TSB M 8155C. Typically, forms must be submitted by the end of the month following the reporting period. Keeping track of these dates helps prevent late submissions and potential penalties. Dealers should maintain a calendar of important tax dates to ensure compliance.

Quick guide on how to complete signtsb co uk

Prepare signtsb co uk effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the capabilities required to generate, modify, and eSign your documents promptly without holdups. Manage signtsb on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign signtsb co uk with ease

- Find tsb m and then click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for those purposes.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign signtsb and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to tsb m

Create this form in 5 minutes!

How to create an eSignature for the signtsb

How to create an eSignature for your Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny online

How to make an electronic signature for your Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny in Google Chrome

How to create an electronic signature for signing the Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny in Gmail

How to make an electronic signature for the Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny right from your mobile device

How to generate an electronic signature for the Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny on iOS devices

How to generate an electronic signature for the Tsb M 8155c1281information For Fuel Oil Dealerstsbm8155c Tax Ny on Android

People also ask tsb m

-

What is signtsb and how can it benefit my business?

Signtsb is a powerful tool offered by airSlate SignNow that enables businesses to send and eSign documents seamlessly. By utilizing signtsb, businesses can streamline their document workflows, reduce turnaround times, and enhance overall efficiency, making it an ideal solution for organizations looking to optimize their operations.

-

How much does it cost to use signtsb?

The pricing for signtsb is highly competitive and varies based on the plan you choose. airSlate SignNow offers flexible pricing tiers that cater to businesses of all sizes, making it a cost-effective solution for both startups and enterprises. You can explore the pricing options on our website to find the best fit for your needs.

-

What are the key features of signtsb?

Signtsb includes a variety of features designed to enhance the eSigning experience, such as templates, in-person signing, and mobile compatibility. Additionally, it offers robust security measures and integration options with other platforms to ensure that the signing process is both safe and efficient. These features make signtsb a versatile choice for any organization.

-

Can signtsb integrate with other software?

Yes, signtsb easily integrates with numerous software applications and services, allowing you to incorporate eSigning into your existing workflows seamlessly. This means you can connect signtsb with CRM systems, document management tools, and more, providing added convenience and efficiency in your business operations.

-

Is signtsb secure for handling sensitive documents?

Absolutely! Signtsb prioritizes security and complies with industry-leading standards to protect your sensitive documents. With advanced encryption, access controls, and audit trails, you can confidently use signtsb for all your eSigning needs while ensuring your data remains safe and secure.

-

How easy is it to get started with signtsb?

Getting started with signtsb is incredibly straightforward. Simply sign up for an account on the airSlate SignNow website, and you’ll be guided through an easy setup process. Whether you're sending your first document or setting up advanced features, our user-friendly interface makes it accessible for everyone.

-

What types of documents can I sign with signtsb?

Signtsb supports a wide range of document types, including contracts, agreements, forms, and more. This versatility allows you to adapt signtsb to suit your specific needs, whether you’re in real estate, legal, HR, or any other industry requiring electronic signatures.

Get more for signtsb

Find out other signtsb co uk

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple