California Quitclaim Deed by Two Individuals to LLC Form

What is the California Quitclaim Deed By Two Individuals To LLC

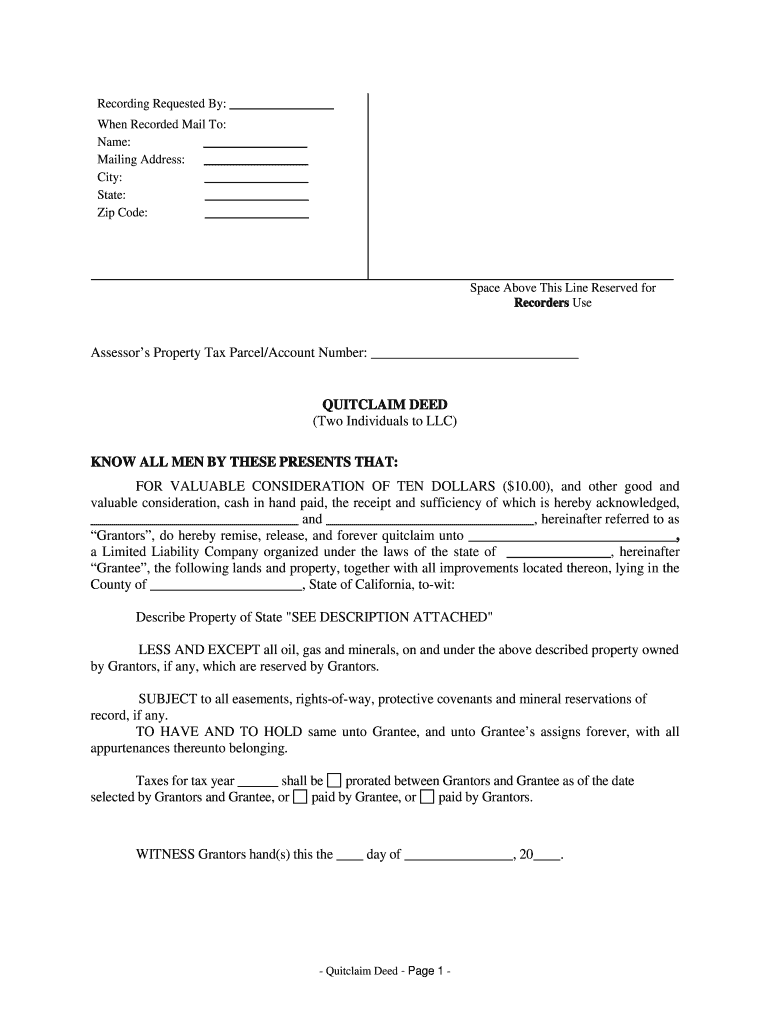

A quitclaim deed in California is a legal document that allows two individuals to transfer their interest in a property to a limited liability company (LLC). This type of deed does not guarantee that the title is free of claims or encumbrances; it merely conveys whatever interest the individuals may have in the property. This is particularly useful for property owners looking to formalize their business structure or protect their personal assets by placing property into an LLC.

Steps to complete the California Quitclaim Deed By Two Individuals To LLC

Completing a quitclaim deed in California involves several important steps:

- Identify the property: Clearly describe the property being transferred, including the address and any relevant legal descriptions.

- Gather necessary information: Collect the full names of the individuals transferring the property and the name of the LLC receiving the property.

- Draft the deed: Use a quitclaim deed form, ensuring all required fields are filled in accurately, including the grantor(s), grantee, and property description.

- Sign the document: All parties involved must sign the deed in the presence of a notary public to ensure its legality.

- File the deed: Submit the completed and notarized deed to the county recorder’s office where the property is located to make the transfer official.

Key elements of the California Quitclaim Deed By Two Individuals To LLC

Several key elements must be included in the quitclaim deed to ensure it is legally binding:

- Grantor(s): The individuals transferring their interest in the property.

- Grantee: The LLC receiving the property.

- Property description: A detailed description of the property being transferred, including the address and legal description.

- Signatures: The signatures of all grantors, along with a notary acknowledgment to validate the document.

- Date: The date the deed is executed.

Legal use of the California Quitclaim Deed By Two Individuals To LLC

The quitclaim deed serves as a legal instrument that facilitates the transfer of property ownership. It is particularly relevant in situations where individuals wish to transfer property to an LLC for reasons such as liability protection, estate planning, or business operations. While the quitclaim deed does not guarantee clear title, it is a valid method of transferring property rights in California, provided all legal requirements are met.

How to obtain the California Quitclaim Deed By Two Individuals To LLC

Obtaining a quitclaim deed form in California is straightforward. Individuals can access a sample quitclaim deed California form through various legal websites or local government offices. Many county recorder’s offices provide templates or forms that can be filled out. It is advisable to ensure that the form complies with California state laws and includes all necessary information to avoid any legal issues during the transfer process.

Examples of using the California Quitclaim Deed By Two Individuals To LLC

There are several scenarios where a California quitclaim deed may be used:

- Two individuals who own a rental property may transfer their ownership to an LLC to limit personal liability.

- A couple may decide to transfer their jointly owned home into an LLC for estate planning purposes.

- Business partners may use a quitclaim deed to formalize the ownership of a commercial property under their LLC.

Quick guide on how to complete california quitclaim deed by two individuals to llc

Effortlessly prepare California Quitclaim Deed By Two Individuals To LLC on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle California Quitclaim Deed By Two Individuals To LLC on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign California Quitclaim Deed By Two Individuals To LLC without any effort

- Find California Quitclaim Deed By Two Individuals To LLC and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device of your choosing. Modify and electronically sign California Quitclaim Deed By Two Individuals To LLC and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

How is a single-member LLC owned by a nonresident alien taxed? Should I fill out a W-8 or am I deemed not to have U.S. activities?

Based on the facts as you have presented them:You are selling a product, as I see it, and not a service - although there's something of a gray area here, this is more like an intangible asset than it is providing a personal service for compensation. That product is being offered to US-based customers who are using it in the US - your focus is building up your market in the US, and you are doing that under the auspices of an LLC which is US-based. Looking at all of the facts and circumstances surrounding the conduct of your business, as you have presented them and as the IRS will look at them if asked, I conclude that you are conducting a business in the US and your income from US sources is effectively connected with the conduct of that business in the US, which means that you are subject to US taxes on that income.With that conclusion, Form W-8ECI is the proper form to provide to your US sources if you wish to prevent withholding on the income from your business.I want to add one point, since this seems to be coming up frequently - while an LLC is a disregarded entity for tax purposes, it is still a legal entity in the US - and the fact that you, as a nonresident alien, choose to operate a business under the auspices of a US-based LLC is a piece of evidence that can, under the appropriate set of facts and circumstances, be used by the IRS to support an argument that you are conducting business in the US and that your income from that business that comes from US sources should be taxable in the U.S. You should not assume that as a nonresident alien you have carte blanche to create a US LLC, operate a business under its auspices, and then at tax time argue that the income should not be taxable in the US because the LLC is a disregarded entity. The IRS will look at all of the facts and circumstances surrounding your business, including your choice of a US-based entity as the face of your business, and while that decision alone won't be dispositive, it will certainly be considered.

Create this form in 5 minutes!

How to create an eSignature for the california quitclaim deed by two individuals to llc

How to create an electronic signature for your California Quitclaim Deed By Two Individuals To Llc online

How to make an electronic signature for your California Quitclaim Deed By Two Individuals To Llc in Chrome

How to generate an eSignature for signing the California Quitclaim Deed By Two Individuals To Llc in Gmail

How to create an eSignature for the California Quitclaim Deed By Two Individuals To Llc right from your smartphone

How to create an electronic signature for the California Quitclaim Deed By Two Individuals To Llc on iOS devices

How to make an eSignature for the California Quitclaim Deed By Two Individuals To Llc on Android devices

People also ask

-

What is a quitclaim deed in California?

A quitclaim deed in California is a legal document used to transfer ownership of real estate between parties. This type of deed provides no guarantees regarding the title, making it essential to understand its implications. If you're looking for a sample quitclaim deed California form, airSlate SignNow can help streamline the process.

-

How do I obtain a sample quitclaim deed California form?

You can obtain a sample quitclaim deed California form by visiting the airSlate SignNow website. We provide easy templates that can be customized to fit your needs. With our platform, you can quickly access and eSign your documents online.

-

What are the benefits of using airSlate SignNow for my quitclaim deed?

Using airSlate SignNow for your quitclaim deed simplifies the signing process and ensures compliance with California laws. Our solution offers user-friendly features, allowing you to eSign documents securely and keep all your paperwork organized. By choosing airSlate SignNow, you can save time and reduce stress involved in property transfers.

-

How much does it cost to use airSlate SignNow for a quitclaim deed?

airSlate SignNow offers a cost-effective solution for managing documents like a quitclaim deed. Pricing details can be found on our website, and we provide various plans tailored to your needs. You'll find that our pricing is competitive compared to traditional methods of handling real estate transactions.

-

Can I customize a sample quitclaim deed California on airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize a sample quitclaim deed California according to your specific requirements. Our platform supports various fields and features for personalization, ensuring that your quitclaim deed meets all necessary legal criteria. Start customizing today to fit your property transfer needs.

-

Is airSlate SignNow compliant with California real estate laws?

Absolutely! airSlate SignNow is designed to comply with California real estate laws, ensuring that your quitclaim deed is valid and legally binding. We continuously update our templates to reflect current legal standards. Rest assured, your documentation process will adhere to the requirements set by the state.

-

What integrations does airSlate SignNow offer for handling quitclaim deeds?

airSlate SignNow offers various integrations that enhance your ability to manage quitclaim deeds seamlessly. These include popular platforms like Google Drive and Dropbox, making it easy to access and store your documents. Our integrations help streamline your workflow and keep your files organized.

Get more for California Quitclaim Deed By Two Individuals To LLC

Find out other California Quitclaim Deed By Two Individuals To LLC

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself