Tax Exempt Form Ny

What is the Tax Exempt Form NY

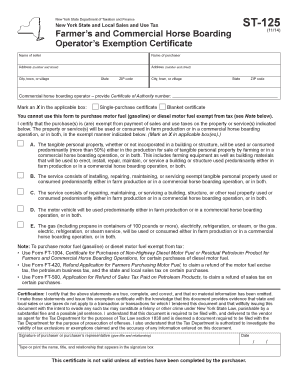

The Tax Exempt Form NY, also known as the ST-125 form, is a crucial document used in New York State for claiming sales tax exemption. This form is typically utilized by organizations that qualify for tax-exempt status, such as nonprofits, educational institutions, and certain government entities. By submitting the ST-125 form, these organizations can purchase goods and services without incurring sales tax, thereby reducing their operational costs. Understanding the purpose and requirements of the ST-125 form is essential for eligible entities to ensure compliance with New York tax regulations.

How to Use the Tax Exempt Form NY

Using the Tax Exempt Form NY involves several straightforward steps. First, eligible organizations must complete the form accurately, providing necessary details such as the organization's name, address, and tax-exempt status. Once the form is filled out, it should be presented to vendors at the time of purchase. Vendors are required to keep a copy of the ST-125 form on file for their records. This process ensures that both the purchaser and the vendor maintain compliance with tax laws. It is important for organizations to ensure that the form is used only for qualifying purchases to avoid potential penalties.

Steps to Complete the Tax Exempt Form NY

Completing the Tax Exempt Form NY requires careful attention to detail. Here are the steps to follow:

- Obtain the form: Download the ST-125 form from the New York State Department of Taxation and Finance website or request a physical copy.

- Fill in organization details: Enter the legal name, address, and tax-exempt status of your organization.

- Specify the purpose: Clearly state the reason for the tax exemption, such as nonprofit activities or educational purposes.

- Sign and date: Ensure that an authorized representative of the organization signs and dates the form to validate it.

- Provide to vendors: Present the completed form to vendors when making tax-exempt purchases.

Legal Use of the Tax Exempt Form NY

The legal use of the Tax Exempt Form NY is governed by New York State tax laws. Organizations must ensure that they meet the eligibility criteria for tax exemption, which typically includes being recognized as a nonprofit or educational institution. Misuse of the ST-125 form, such as using it for personal purchases or for entities that do not qualify, can lead to serious legal consequences, including fines and penalties. It is essential for organizations to maintain accurate records and ensure that the form is used in compliance with the law.

Key Elements of the Tax Exempt Form NY

The ST-125 form contains several key elements that are vital for its validity. These include:

- Organization Information: Name and address of the tax-exempt organization.

- Tax Identification Number: The organization's federal Employer Identification Number (EIN) or Social Security Number (SSN).

- Exemption Reason: A clear statement of the reason for tax exemption.

- Signature: The signature of an authorized representative, confirming the accuracy of the information provided.

Eligibility Criteria

To qualify for using the Tax Exempt Form NY, organizations must meet specific eligibility criteria set forth by New York State. Generally, these criteria include:

- Being a recognized nonprofit organization, educational institution, or government entity.

- Having a valid tax-exempt status as determined by the IRS or New York State.

- Using the form solely for purchases related to the organization's tax-exempt activities.

Quick guide on how to complete tax exempt form ny

Effortlessly Prepare Tax Exempt Form Ny on Any Device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Tax Exempt Form Ny on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Edit and eSign Tax Exempt Form Ny with Ease

- Find Tax Exempt Form Ny and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Tax Exempt Form Ny and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt form ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st 125 and how does it relate to airSlate SignNow?

The st 125 is a document that allows businesses to manage their electronic signatures legally and effectively. airSlate SignNow offers the ability to create, send, and eSign documents such as the st 125, simplifying the signing process for users.

-

What are the pricing options for airSlate SignNow's st 125 services?

airSlate SignNow provides various pricing plans that accommodate businesses of all sizes looking to manage documents like the st 125. You can choose from monthly or annual subscriptions, with options that scale based on your team's needs.

-

What features does airSlate SignNow offer for the st 125 document?

With airSlate SignNow, you can easily upload and customize the st 125 document for electronic signatures. Features include templates, workflow automation, and tracking, ensuring that your document management process is smooth and efficient.

-

How can airSlate SignNow benefit my business with the st 125?

Using airSlate SignNow for the st 125 can signNowly enhance your business's efficiency by reducing the time spent on paper-based processes. Electronic signatures help speed up transactions, improve compliance, and lower operational costs.

-

Can I integrate airSlate SignNow with other applications while using the st 125?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easy to manage the st 125 document alongside your existing business tools. This includes integrations with CRM software, cloud storage, and project management tools to streamline your workflow.

-

Is it secure to use airSlate SignNow for the st 125 document?

Absolutely! airSlate SignNow employs advanced security protocols to protect your st 125 and other sensitive documents. They ensure that all data is encrypted and compliant with industry standards, so you can sign with confidence.

-

Do I need technical skills to eSign the st 125 using airSlate SignNow?

Not at all! airSlate SignNow is designed to be user-friendly, allowing anyone to eSign the st 125 without needing technical skills. The platform guides you through the process, making it simple for both senders and signers.

Get more for Tax Exempt Form Ny

- Jv 571 notice form

- Va form 10 5345a 549402843

- Audit referral form audit referral form

- C 32 i form

- Montgomery al 36131 form

- Prevent problems with your application prevent problems with your illinois secretary of state job application form

- To the respondent a rebuttal of application for reconsiderationfull board review must be filed within 30 calendar form

- Referral system change request form

Find out other Tax Exempt Form Ny

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT