Newark City Tax Forms

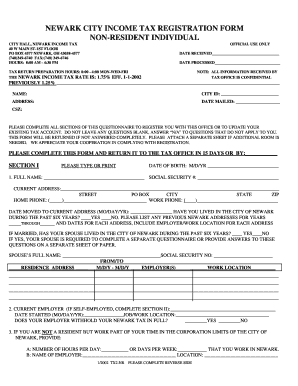

What are the Newark City Tax Forms?

The Newark City Tax Forms are official documents required for filing income taxes within the city of Newark, Ohio. These forms facilitate the reporting of income earned by residents and businesses, ensuring compliance with local tax regulations. The forms may vary depending on the taxpayer's status, such as individual, business, or self-employed. Understanding the specific forms applicable to your situation is essential for accurate tax reporting.

Steps to Complete the Newark City Tax Forms

Completing the Newark City Tax Forms involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including W-2s, 1099s, and any other relevant income statements. Next, select the appropriate tax form based on your filing status. Carefully fill out the form, ensuring all income, deductions, and credits are accurately reported. After completing the form, review it for errors before submission. Finally, choose your submission method, whether online, by mail, or in person.

How to Obtain the Newark City Tax Forms

Newark City Tax Forms can be obtained through multiple channels. The most efficient way is to visit the official website of the City of Newark, where forms are typically available for download. Additionally, forms can be requested directly from the Newark City Tax Department. For those who prefer physical copies, forms may also be available at local government offices or tax preparation services within Newark.

Legal Use of the Newark City Tax Forms

Utilizing the Newark City Tax Forms legally requires adherence to specific guidelines. The forms must be filled out truthfully and accurately to reflect your financial situation. Misrepresentation or failure to file can result in penalties. When submitting forms electronically, ensure you use a compliant eSignature solution that meets legal standards, such as ESIGN and UETA. This ensures that your electronic submissions are legally binding and secure.

Filing Deadlines / Important Dates

Filing deadlines for the Newark City Tax Forms are crucial for compliance. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to deadlines or additional extensions that may be offered by the Newark City Tax Department. Mark these dates on your calendar to avoid late penalties.

Required Documents

When preparing to complete the Newark City Tax Forms, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help ensure accuracy in your tax submissions.

Quick guide on how to complete newark city tax forms

Effortlessly Prepare Newark City Tax Forms on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Newark City Tax Forms on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Newark City Tax Forms with Ease

- Locate Newark City Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that task.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Newark City Tax Forms to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the newark city tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Newark city tax forms and why do I need them?

Newark city tax forms are essential for individuals and businesses to report their income and calculate tax liabilities to the city. Completing these forms accurately helps ensure compliance with local regulations and avoids potential penalties. Using airSlate SignNow, you can easily eSign and submit your Newark city tax forms hassle-free.

-

How can airSlate SignNow help with Newark city tax forms?

airSlate SignNow simplifies the process of preparing and submitting your Newark city tax forms by offering a user-friendly interface for eSigning and managing documents. Our platform allows you to organize your forms digitally, making it easy to access and share them as needed. This efficient approach can save you time and reduce the risk of errors.

-

What features does airSlate SignNow offer for managing Newark city tax forms?

With airSlate SignNow, you enjoy features like customizable templates for Newark city tax forms, cloud storage, and real-time collaboration tools. These features facilitate quick edits, secure storage, and seamless sharing of documents with your accountant or tax preparer. Streamlining the document management process enhances productivity and accuracy.

-

Is airSlate SignNow affordable for individuals needing Newark city tax forms?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses needing to manage Newark city tax forms. We offer various subscription plans to suit different budgets and needs, ensuring that everyone can access our powerful eSigning tools without breaking the bank. Check our pricing page for details.

-

Can I integrate airSlate SignNow with other software for Newark city tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and productivity software. This compatibility allows you to streamline your workflow, making it easier to fill out and submit your Newark city tax forms directly from your preferred applications.

-

What are the benefits of using airSlate SignNow for Newark city tax forms?

Using airSlate SignNow for your Newark city tax forms offers convenience, enhanced security, and improved efficiency. You can eSign documents from anywhere using any device, ensuring that deadlines are met without hassle. Additionally, all your documents are stored securely, giving you peace of mind.

-

How secure is my information when using airSlate SignNow for Newark city tax forms?

Security is a top priority at airSlate SignNow. We utilize state-of-the-art encryption and security protocols to protect your personal and tax information when completing Newark city tax forms. Our platform ensures that your data remains confidential and safely stored.

Get more for Newark City Tax Forms

Find out other Newark City Tax Forms

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe