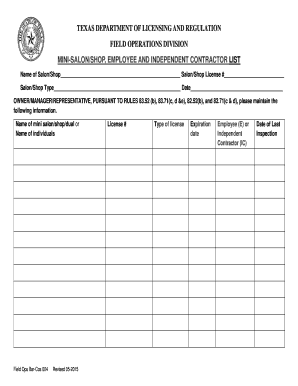

Mini SalonShop, Employee and Independent Contractor List TdLR Form

Key elements of the independent contractor agreement form Texas

The independent contractor agreement form Texas outlines essential components that define the relationship between the contractor and the hiring entity. Understanding these elements is crucial for both parties to ensure clarity and compliance with state laws. Key elements include:

- Parties involved: Clearly identify the contractor and the business, including legal names and contact information.

- Scope of work: Detail the specific services the contractor will provide, including timelines and deliverables.

- Payment terms: Specify the compensation structure, payment schedule, and any reimbursement policies for expenses incurred.

- Confidentiality clauses: Include provisions that protect sensitive information shared during the contract period.

- Termination conditions: Outline the circumstances under which either party can terminate the agreement, including notice periods.

- Liability and indemnification: Define the responsibilities of each party regarding potential legal claims or damages.

Steps to complete the independent contractor agreement form Texas

Completing the independent contractor agreement form Texas involves several straightforward steps. Following these steps ensures that the document is filled out correctly and is legally binding:

- Gather information: Collect all necessary details about the contractor and the business, including names, addresses, and contact information.

- Define the scope of work: Clearly outline the services to be provided, including specific tasks, deadlines, and any milestones.

- Establish payment terms: Decide on the payment amount, method, and schedule. Ensure both parties agree on these terms.

- Include legal provisions: Add any necessary clauses related to confidentiality, liability, and termination to protect both parties.

- Review the document: Both parties should carefully read the agreement to ensure all terms are understood and acceptable.

- Sign the agreement: Both parties should sign the document, either digitally or in person, to make it legally binding.

Legal use of the independent contractor agreement form Texas

The independent contractor agreement form Texas must comply with state laws to be considered legally valid. Understanding the legal framework surrounding this agreement is essential for both contractors and businesses. Key legal aspects include:

- Compliance with state regulations: Ensure that the agreement adheres to Texas labor laws, particularly regarding independent contractor classification.

- ESIGN and UETA compliance: If signed electronically, the agreement must meet the requirements of the Electronic Signatures in Global and National Commerce Act and the Uniform Electronic Transactions Act.

- Clear definitions: Clearly define the relationship as that of an independent contractor to avoid misclassification, which can lead to legal issues.

- Record keeping: Maintain copies of the signed agreement and any related documentation for future reference and compliance verification.

Examples of using the independent contractor agreement form Texas

Understanding how to use the independent contractor agreement form Texas can be enhanced by examining practical examples. Here are a few scenarios where this form is applicable:

- Freelance services: A graphic designer providing services to a marketing agency would use this agreement to outline the project scope and payment terms.

- Consulting work: A business consultant hired by a company to improve operational efficiency would require a contract detailing deliverables and compensation.

- Construction projects: A contractor engaged for a specific construction job would utilize this form to define the work, timeline, and payment structure.

- Event planning: An independent event planner contracted to organize a corporate event would need a detailed agreement to clarify expectations and responsibilities.

IRS Guidelines for independent contractors

When working with independent contractors, it is important to adhere to IRS guidelines to ensure proper classification and tax compliance. Key points include:

- Classification criteria: Understand the IRS guidelines for classifying workers as independent contractors versus employees, focusing on behavioral, financial, and relationship factors.

- Form 1099-MISC: Businesses must issue Form 1099-MISC to independent contractors who earn $600 or more in a tax year, reporting the income to the IRS.

- Self-employment taxes: Independent contractors are responsible for paying self-employment taxes, which cover Social Security and Medicare.

- Record keeping: Maintain accurate records of payments made to independent contractors for tax reporting and compliance purposes.

Eligibility criteria for independent contractors

Understanding the eligibility criteria for independent contractors is essential for both contractors and businesses. Key eligibility factors include:

- Independence: Contractors must operate independently, making their own decisions about how to perform their work.

- Business structure: Contractors may operate as sole proprietors, LLCs, or other business entities, affecting their legal and tax obligations.

- Specialized skills: Many independent contractors possess specialized skills or knowledge that distinguish them from typical employees.

- Client relationships: Contractors often work with multiple clients simultaneously, illustrating their independence and business acumen.

Quick guide on how to complete mini salonshop employee and independent contractor list tdlr

Easily Prepare Mini SalonShop, Employee And Independent Contractor List TdLR on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly, without delays. Manage Mini SalonShop, Employee And Independent Contractor List TdLR on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

Effortlessly Modify and Electronically Sign Mini SalonShop, Employee And Independent Contractor List TdLR

- Locate Mini SalonShop, Employee And Independent Contractor List TdLR and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Mini SalonShop, Employee And Independent Contractor List TdLR to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mini salonshop employee and independent contractor list tdlr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an independent contractor agreement form Texas?

An independent contractor agreement form Texas is a legal document that outlines the terms and conditions between a client and an independent contractor. This form specifies the scope of work, payment terms, and other essential details to protect both parties in Texas.

-

How do I create an independent contractor agreement form Texas?

You can create an independent contractor agreement form Texas using airSlate SignNow’s user-friendly templates. Simply select the independent contractor agreement from our library, fill in the relevant details, and customize it as needed for your specific situation.

-

What are the benefits of using an independent contractor agreement form Texas?

Using an independent contractor agreement form Texas helps clarify expectations, protect both parties, and ensure compliance with Texas state laws. It also minimizes the risk of disputes by providing a clear outline of responsibilities and payment terms.

-

Is the independent contractor agreement form Texas customizable?

Yes, the independent contractor agreement form Texas offered by airSlate SignNow is fully customizable. You can edit sections according to your specific needs, making it easy to tailor the agreement to fit your project's requirements.

-

What features does airSlate SignNow offer for the independent contractor agreement form Texas?

AirSlate SignNow provides features such as eSignature capability, document tracking, and cloud storage for your independent contractor agreement form Texas. These tools help streamline the signing process and keep your documents organized for easy access.

-

Can I integrate the independent contractor agreement form Texas with other software?

Yes, airSlate SignNow allows for seamless integrations with various software solutions, enhancing the functionality of your independent contractor agreement form Texas. This means you can automate your workflows and connect with tools you already use.

-

What is the pricing for using airSlate SignNow's independent contractor agreement form Texas?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, starting with a free trial. Depending on the features you choose to access, you can easily find an affordable plan that includes the independent contractor agreement form Texas.

Get more for Mini SalonShop, Employee And Independent Contractor List TdLR

- Horse leasing agreements fill online printable form

- The term of this lease shall begin insert start date and terminate on insert form

- To be supplemented during the course of this litigation in accordance with law form

- And social security number and if different give the full name as well as the current residence form

- Idaho limited liability company operating agreement form

- Dishonored checks it is the goal of the sherburne form

- Bond renewals surety1 explains friendly service form

- The name and address of each trustee empowered to act under the trust instrument at the form

Find out other Mini SalonShop, Employee And Independent Contractor List TdLR

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template