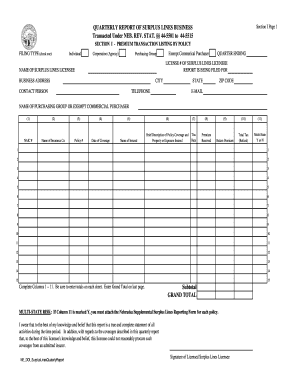

Quarterly Report of Surplus Lines Business Nebraska Form

What is the Quarterly Report Of Surplus Lines Business Nebraska Form

The Quarterly Report Of Surplus Lines Business Nebraska Form is a crucial document for businesses engaged in surplus lines insurance within Nebraska. This form serves to report the volume of surplus lines business conducted during a specific quarter. It is essential for compliance with state regulations and helps ensure that the necessary taxes are calculated and remitted accurately. Understanding the purpose and requirements of this form is vital for any business operating in this sector.

Steps to complete the Quarterly Report Of Surplus Lines Business Nebraska Form

Completing the Quarterly Report Of Surplus Lines Business Nebraska Form involves several key steps:

- Gather relevant financial data from the quarter, including total premiums collected and any applicable deductions.

- Access the official form, which can typically be obtained online or through the appropriate regulatory body.

- Fill out the form accurately, ensuring that all sections are completed, including details about the business and the surplus lines transactions.

- Review the completed form for accuracy, checking calculations and ensuring compliance with state requirements.

- Submit the form by the designated deadline, which may vary based on the reporting period.

Legal use of the Quarterly Report Of Surplus Lines Business Nebraska Form

The legal use of the Quarterly Report Of Surplus Lines Business Nebraska Form is governed by state law. This form must be completed and submitted in accordance with Nebraska statutes to ensure that the reporting of surplus lines business is both accurate and compliant. Failure to adhere to these legal requirements can result in penalties, including fines or other regulatory actions.

Filing Deadlines / Important Dates

Timely filing of the Quarterly Report Of Surplus Lines Business Nebraska Form is essential to avoid penalties. Typically, the form must be submitted within a specific timeframe following the end of each quarter. Important dates to note include:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The Quarterly Report Of Surplus Lines Business Nebraska Form can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission via the state’s designated portal, ensuring quick processing.

- Mailing the completed form to the appropriate regulatory office, which may require additional time for delivery.

- In-person submission at designated locations, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance

Non-compliance with the requirements of the Quarterly Report Of Surplus Lines Business Nebraska Form can lead to significant penalties. These may include:

- Fines imposed for late submission or inaccurate reporting.

- Potential audits by state regulatory agencies, which can result in further scrutiny of business practices.

- Loss of license to operate in the surplus lines market if compliance issues persist.

Quick guide on how to complete quarterly report of surplus lines business nebraska form

Complete Quarterly Report Of Surplus Lines Business Nebraska Form seamlessly on any device

Digital document management has become a favorite among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct format and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Quarterly Report Of Surplus Lines Business Nebraska Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Quarterly Report Of Surplus Lines Business Nebraska Form effortlessly

- Obtain Quarterly Report Of Surplus Lines Business Nebraska Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Quarterly Report Of Surplus Lines Business Nebraska Form while ensuring excellent communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarterly report of surplus lines business nebraska form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska surplus lines tax filing service offered by airSlate SignNow?

The Nebraska surplus lines tax filing service provided by airSlate SignNow simplifies the process of filing surplus lines taxes for businesses. Our platform offers easy document preparation and eSigning capabilities, ensuring compliance with Nebraska's regulations. With airSlate SignNow, you can manage your surplus lines tax filings efficiently and effectively.

-

How can airSlate SignNow benefit my business in Nebraska?

By using airSlate SignNow for your Nebraska surplus lines tax filing service, you gain access to a streamlined process that saves time and reduces the risk of errors. Our user-friendly platform allows you to send and sign documents quickly, enhancing your operational efficiency. Additionally, our solution is cost-effective, allowing you to focus more on your business.

-

Is there a subscription fee for the Nebraska surplus lines tax filing service?

Yes, airSlate SignNow offers competitive subscription plans for our Nebraska surplus lines tax filing service. Pricing can vary based on the features and integrations you choose, but we strive to provide a scalable solution that fits the needs of businesses of all sizes. You can check our website for detailed pricing information.

-

What features does the Nebraska surplus lines tax filing service include?

The Nebraska surplus lines tax filing service includes features such as document templates, electronic signatures, and tracking capabilities. These tools ensure that your tax filings are accurate and submitted on time, streamlining your workflow. Additionally, our features are designed to comply with Nebraska's specific tax regulations.

-

Can I integrate airSlate SignNow with other software for my Nebraska surplus lines tax filing?

Absolutely! airSlate SignNow offers integrations with various accounting and document management software solutions to support your Nebraska surplus lines tax filing service. This allows you to manage your documents seamlessly across platforms and enhances your overall workflow. Check our integrations page for more details.

-

What support is available for Nebraska surplus lines tax filing service users?

We provide comprehensive customer support for users of our Nebraska surplus lines tax filing service. Our team is available via chat, email, and phone to help you with any questions or technical issues you may encounter. Additionally, our resource center contains guides and tutorials to assist you in maximizing your use of our platform.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive tax documents related to our Nebraska surplus lines tax filing service. We implement advanced encryption protocols and secure access controls to protect your information. Our compliance with industry standards ensures that your documents are handled with the utmost care and confidentiality.

Get more for Quarterly Report Of Surplus Lines Business Nebraska Form

- Pylon sign easement and operating agreement hanford ca form

- Free idaho eviction notice formsprocess and laws pdf

- Injured workersif idaho state insurance fund form

- Box 83720 boise idaho 83720 0041 form

- Workers compensationfirst report of injury or illness njcrib form

- Ic52 election of coverage election revocation justia form

- Section 72 212idaho state legislature form

- Id inc cr form

Find out other Quarterly Report Of Surplus Lines Business Nebraska Form

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word