Iht400 Form

What is the Iht400

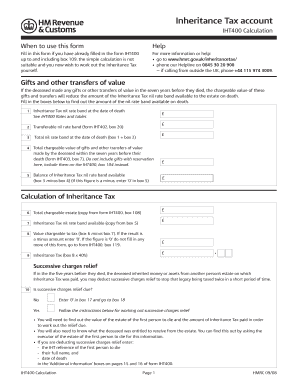

The Iht400 is a crucial form used in the context of inheritance tax in the United States. It is designed to report the value of an estate when someone passes away. This form helps the Internal Revenue Service (IRS) assess whether any inheritance tax is due. The Iht400 requires detailed information about the deceased's assets, liabilities, and other relevant financial information. Proper completion of this form is essential for ensuring compliance with federal tax regulations.

How to use the Iht400

Using the Iht400 involves several steps to ensure accurate reporting of an estate's value. First, gather all necessary documentation related to the deceased's assets, including bank statements, property deeds, and investment records. Next, complete the form by entering the required information in the designated sections, ensuring that all values are accurate and reflect the current market conditions. After completing the form, review it for any errors or omissions before submission. It is advisable to consult with a tax professional if there are uncertainties regarding any aspect of the form.

Steps to complete the Iht400

Completing the Iht400 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, including wills, bank statements, and property valuations.

- Begin filling out the form by entering the decedent's personal information, including their full name, date of birth, and date of death.

- List all assets owned by the decedent at the time of death, including real estate, vehicles, and investments.

- Detail any outstanding debts or liabilities that may affect the estate's value.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Iht400

The legal use of the Iht400 is paramount in ensuring that the estate is properly assessed for inheritance tax. This form must be filed within a specific timeframe following the decedent's death to avoid penalties. The information provided on the Iht400 is subject to review by the IRS, and any inaccuracies can lead to legal repercussions. It is essential to ensure that all information is truthful and complete to maintain compliance with tax laws.

Required Documents

To complete the Iht400, several documents are necessary to provide a comprehensive overview of the estate. These documents typically include:

- Death certificate of the decedent.

- Will or trust documents outlining the distribution of the estate.

- Financial statements from banks and investment accounts.

- Property deeds and valuations for real estate.

- Records of any outstanding debts or liabilities.

Form Submission Methods

The Iht400 can be submitted through various methods, providing flexibility for the filer. The available submission methods include:

- Online submission through the IRS e-filing system, if applicable.

- Mailing a physical copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if required.

Quick guide on how to complete iht400 28465758

Prepare Iht400 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Iht400 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Iht400 with ease

- Locate Iht400 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure confidential information using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Iht400 and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht400 28465758

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht418 and how does it relate to airSlate SignNow?

IHT418 is a key term associated with airSlate SignNow, which is an efficient eSignature platform. This solution allows businesses to send and eSign documents swiftly while ensuring compliance and security. Understanding iht418 can help users leverage specific features tailored to enhance their document management processes.

-

What pricing plans are available for airSlate SignNow?

AirSlate SignNow offers various pricing plans to accommodate different business needs, with options that cater to both small businesses and enterprises. Each plan provides access to features that utilize the power of iht418, ensuring that users can choose the right level of service at a competitive price. For detailed pricing, visit our website.

-

What features does airSlate SignNow offer?

AirSlate SignNow includes a wide range of features designed to simplify document workflows, such as customizable templates, bulk sending, and real-time tracking. The platform's iht418 technology enhances the eSignature process, ensuring efficiency and security. These features make it a top choice for businesses looking to streamline their operations.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on document handling. The platform, powered by iht418, facilitates fast and secure electronic signatures, improves team collaboration, and helps maintain compliance with regulatory standards. This efficiency leads to better customer satisfaction and streamlined operations.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow offers seamless integrations with a variety of popular applications, including CRM systems and cloud storage services. The capability to incorporate iht418 functionality enhances these integrations, making it easy for users to connect their existing tools. This flexibility allows businesses to maximize their workflow efficiency.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow, which employs industry-standard protocols to protect documents during transmission and storage. With iht418 features in place, users can be confident that their sensitive information is safeguarded. The platform also complies with major regulatory requirements to ensure total peace of mind.

-

Can I use airSlate SignNow for international transactions?

Absolutely! AirSlate SignNow is designed to cater to global businesses, allowing users to send and eSign documents internationally. Utilizing the efficiency of iht418, the platform supports multiple languages and provides a user-friendly experience for international clients. This makes it an ideal solution for businesses operating across borders.

Get more for Iht400

- Control number id p006 pkg form

- The power of attorney for custodylegalzoom legal info form

- Internet and online incomepage 46work from home work form

- Control number id p008 pkg form

- Address of declarant form

- Idaho statutory form power of attorney fill online printable

- Of county idaho as my attorney in fact to act as form

- Control number id p011 pkg form

Find out other Iht400

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice