Rtf 8 New Jersey Form

What is the Rtf 8 New Jersey Form

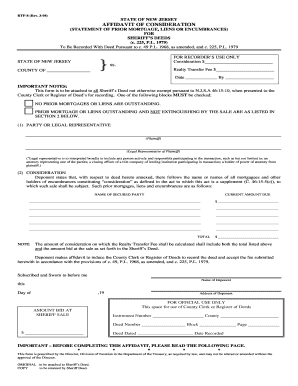

The Rtf 8 New Jersey Form is a specific document used primarily for tax-related purposes in the state of New Jersey. It serves as a declaration or report that individuals or businesses must complete to comply with state tax regulations. This form is essential for ensuring accurate reporting of income and tax obligations, and it is often required for various tax filings, including income tax returns.

How to use the Rtf 8 New Jersey Form

Using the Rtf 8 New Jersey Form involves several key steps. First, gather all necessary financial information, including income statements and deductions. Next, fill out the form accurately, ensuring that all sections are completed as required. After completing the form, review it for any errors or omissions before submission. Finally, submit the form according to the specified guidelines, which may include electronic filing or mailing it to the appropriate tax office.

Steps to complete the Rtf 8 New Jersey Form

Completing the Rtf 8 New Jersey Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with personal identification information.

- Input your income details accurately, ensuring that all figures are correct.

- Complete any additional sections that pertain to deductions or credits you are claiming.

- Review the entire form for accuracy and completeness before signing it.

Legal use of the Rtf 8 New Jersey Form

The Rtf 8 New Jersey Form is legally binding when completed and submitted according to state laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form must be signed by the individual or authorized representative to validate its authenticity. Compliance with all state regulations is crucial for the form to be considered valid.

Who Issues the Form

The Rtf 8 New Jersey Form is issued by the New Jersey Division of Taxation. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. The form can typically be obtained from their official website or through designated tax offices throughout the state.

Form Submission Methods

There are multiple methods for submitting the Rtf 8 New Jersey Form. Taxpayers can choose to file the form electronically through the New Jersey Division of Taxation's online portal, which is often the fastest method. Alternatively, the form can be printed and mailed to the appropriate tax office. In some cases, in-person submission may also be available at designated tax offices, providing another option for taxpayers who prefer direct interaction.

Quick guide on how to complete rtf 8 new jersey form

Complete Rtf 8 New Jersey Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Rtf 8 New Jersey Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Rtf 8 New Jersey Form with ease

- Find Rtf 8 New Jersey Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Rtf 8 New Jersey Form while ensuring effective communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rtf 8 new jersey form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rtf 8 New Jersey Form and how can it be used?

The Rtf 8 New Jersey Form is a standardized document utilized for various legal and administrative purposes within New Jersey. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your paperwork process and ensuring compliance with local regulations.

-

How much does it cost to use airSlate SignNow for managing the Rtf 8 New Jersey Form?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Users can benefit from a cost-effective solution to manage documents like the Rtf 8 New Jersey Form, with plans that often include features like unlimited templates and integrations.

-

What features does airSlate SignNow provide for the Rtf 8 New Jersey Form?

airSlate SignNow provides a host of features for the Rtf 8 New Jersey Form, including customizable templates, automated workflows, and electronic signatures. These features enhance efficiency and help ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software while using the Rtf 8 New Jersey Form?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing the overall functionality while handling the Rtf 8 New Jersey Form. This integration capability allows you to connect your existing tools, such as CRMs and cloud storage platforms, improving workflow efficiency.

-

What are the benefits of using airSlate SignNow for eSigning the Rtf 8 New Jersey Form?

Using airSlate SignNow for eSigning the Rtf 8 New Jersey Form offers numerous benefits, such as faster turnaround times and reduced paperwork. The platform’s user-friendly interface ensures that signing is quick and easy for all parties involved, boosting productivity.

-

Is airSlate SignNow compliant with New Jersey eSignature laws for the Rtf 8 New Jersey Form?

Absolutely! airSlate SignNow complies with New Jersey's electronic signature laws, ensuring that the Rtf 8 New Jersey Form signed through our platform holds legal validity. This compliance gives you peace of mind that your electronic documents can stand up in court.

-

How secure is airSlate SignNow when handling the Rtf 8 New Jersey Form?

Security is a top priority for airSlate SignNow. When managing the Rtf 8 New Jersey Form, your documents are protected with advanced encryption and rigorous security measures, ensuring that your sensitive information remains safe throughout the signing process.

Get more for Rtf 8 New Jersey Form

- Last party to sign below is between having an address at form

- Sinks toilets water cylinders boilers heaters and pipe lining and fabrication and form

- Contractor shall form

- Last party to sign below is between form

- Shingles material form

- Panel box manufacturer amp size form

- Areas to receive form

- Home repair know your consumer rights village of mount form

Find out other Rtf 8 New Jersey Form

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free