Instructions for Nyc 3l Form

What is the Instructions For Nyc 3l Form

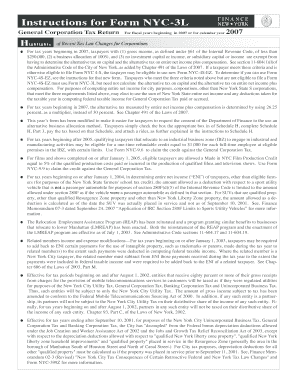

The Instructions for NYC 3L Form is a crucial document used by businesses and individuals in New York City for tax purposes. This form provides guidelines on how to report specific income and deductions accurately. It is essential for ensuring compliance with local tax regulations and helps taxpayers understand their obligations. The form is typically associated with the New York City Department of Finance and is used to calculate various tax liabilities, including the Unincorporated Business Tax (UBT).

Steps to complete the Instructions For Nyc 3l Form

Completing the Instructions for NYC 3L Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and prior tax returns. Next, carefully read through the instructions provided with the form to understand the specific requirements for your situation. Fill out the form methodically, ensuring that all sections are completed accurately. After filling out the form, review it for any errors or omissions before submission. Finally, retain a copy for your records.

Legal use of the Instructions For Nyc 3l Form

The legal use of the Instructions for NYC 3L Form is vital for maintaining compliance with New York City tax laws. This form must be completed truthfully and submitted by the designated deadlines to avoid penalties. The information provided on this form is subject to verification by tax authorities, and any discrepancies can lead to audits or fines. Understanding the legal implications of the form ensures that taxpayers fulfill their obligations and avoid potential legal issues.

Required Documents

To complete the Instructions for NYC 3L Form, certain documents are essential. These typically include:

- Income statements from all sources

- Receipts for deductible expenses

- Prior year tax returns for reference

- Any relevant financial statements

Having these documents on hand will facilitate a smoother completion process and help ensure that all information reported is accurate and complete.

Form Submission Methods

The Instructions for NYC 3L Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online through the New York City Department of Finance website, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for NYC 3L Form are critical to avoid penalties. Typically, the form must be submitted by the due date specified by the New York City Department of Finance, which may vary based on the taxpayer's fiscal year. It is essential to stay informed about these deadlines and any changes that may occur annually. Marking these dates on your calendar can help ensure timely submission and compliance.

Quick guide on how to complete instructions for nyc 3l form

Easily Prepare [SKS] on Any Device

Digital document management has become a favored choice among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to missing or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Nyc 3l Form

Create this form in 5 minutes!

How to create an eSignature for the instructions for nyc 3l form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Nyc 3l Form?

The Instructions For Nyc 3l Form provide detailed guidance for completing this specific tax form mandated by New York City. This form is essential for certain taxpayers and includes information on deductions, taxable income, and filing methods. Ensuring you follow these instructions closely can help avoid delays and errors in your filing.

-

How can airSlate SignNow assist with the Instructions For Nyc 3l Form?

airSlate SignNow offers features that simplify the process of signing and submitting the Instructions For Nyc 3l Form electronically. With intuitive tools, you can easily fill out the form, gather signatures, and send it securely, ensuring compliance with all requirements. This digital solution saves time and enhances document management.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Nyc 3l Form?

airSlate SignNow provides a range of pricing plans to suit various business needs when working with the Instructions For Nyc 3l Form. You can choose a plan that aligns with your budget, and options often include features for adding additional users and documents. Exploring our pricing page will give you more details on the most suitable option.

-

What features does airSlate SignNow offer for the Instructions For Nyc 3l Form?

airSlate SignNow includes several features that are beneficial for handling the Instructions For Nyc 3l Form, such as customizable templates, automated workflows, and real-time collaboration tools. These features make it easier to complete forms accurately and efficiently, reducing the risk of errors during the submission process.

-

Can I integrate airSlate SignNow with other applications for my Instructions For Nyc 3l Form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your workflow when handling the Instructions For Nyc 3l Form. Integrations with popular platforms like Google Drive, Dropbox, and CRM systems allow for smoother document management and easy retrieval of signed forms. This interoperability provides a more comprehensive document solution.

-

What are the benefits of using airSlate SignNow for the Instructions For Nyc 3l Form?

Using airSlate SignNow for the Instructions For Nyc 3l Form offers signNow benefits, including improved efficiency, enhanced security, and ease of access. Digital signing reduces the turnaround time for documents while maintaining compliance with regulations. Additionally, your documents are safely stored and can be easily retrieved anytime.

-

Is airSlate SignNow legally compliant for submitting the Instructions For Nyc 3l Form?

Yes, airSlate SignNow is designed to be legally compliant with electronic signature laws, making it suitable for submitting the Instructions For Nyc 3l Form. It adheres to industry standards for security and authentication, ensuring that your electronic submissions are valid and recognized by the New York City Department of Finance. This compliance gives users peace of mind when filing important documents.

Get more for Instructions For Nyc 3l Form

- Framing contract for contractor connecticut form

- Security contract for contractor connecticut form

- Insulation contract for contractor connecticut form

- Paving contract for contractor connecticut form

- Siding contract for contractor connecticut form

- Refrigeration contract for contractor connecticut form

- Drainage contract for contractor connecticut form

- Foundation contract for contractor connecticut form

Find out other Instructions For Nyc 3l Form

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online